Bi-weekly pay is a common payroll practice in the United States, where employees receive their paychecks every two weeks. While this payment frequency has its advantages, it also comes with some challenges. Understanding the pros and cons of bi-weekly pay can help you better manage your finances, especially if you use tools like a free check stub maker to keep track of your income.

In this blog, we’ll explore the benefits and drawbacks of bi-weekly pay, and provide practical tips on how to take care of your money effectively.

What is Bi-Weekly Pay?

Bi-weekly pay means that employees receive their paycheck every two weeks, typically resulting in 26 pay periods per year. This payment schedule is popular among employers because it strikes a balance between weekly and monthly pay periods, offering a convenient way to manage payroll.

Pros of Bi-Weekly Pay

Bi-weekly pay has several advantages that can benefit both employees and employers. Let’s explore some of these benefits:

1. Regular Income Stream

One of the most significant advantages of bi-weekly pay is the regular income stream it provides. With payments coming in every two weeks, you can more easily plan your budget and manage your finances. This consistency is particularly helpful for those who have regular monthly expenses, such as rent, utilities, and groceries.

2. Two Extra Paychecks Per Year

Since there are 26 pay periods in a bi-weekly schedule, employees receive two extra paychecks each year compared to those on a monthly pay schedule. These extra paychecks can be a financial boon, offering an opportunity to save more, pay off debt, or treat yourself to something special.

3. Easier Budgeting

With a bi-weekly pay schedule, it’s easier to align your income with your monthly bills. By breaking down your expenses into bi-weekly amounts, you can allocate funds from each paycheck more effectively, reducing the risk of overspending and helping you stay on top of your financial obligations.

4. Time to Adjust Spending

The frequency of bi-weekly paychecks allows for more flexibility in managing your spending habits. If you overspend during one pay period, you have the opportunity to adjust your budget and spending in the next period, helping you stay on track financially.

5. Consistent Savings Opportunities

Bi-weekly pay can also facilitate consistent savings habits. By setting up automatic transfers to your savings account each payday, you can build up your savings steadily. The regularity of bi-weekly pay helps instill discipline in saving, as it becomes a routine part of your financial management.

Cons of Bi-Weekly Pay

While bi-weekly pay has its advantages, it also comes with some downsides that are important to consider:

1. Budgeting Challenges During Extra Paychecks

Although the extra paychecks in a bi-weekly schedule are a bonus, they can also create budgeting challenges. If you’re not prepared for these additional pay periods, you might struggle to allocate these funds effectively. This can lead to overspending or mismanagement of the extra income.

2. Inconsistent Monthly Income

One of the biggest drawbacks of bi-weekly pay is that your income doesn’t align perfectly with the calendar month. Some months will have two paychecks, while others will have three. This inconsistency can make it difficult to budget for monthly expenses, especially if you’re used to a more predictable income stream.

3. Potential for Overspending

With bi-weekly pay, there’s a risk of overspending when you receive those two extra paychecks each year. If you view these paychecks as “bonus” money rather than part of your regular income, you might be tempted to spend them on non-essential items instead of saving or paying off debt.

4. Timing of Bill Payments

The timing of bill payments can be tricky with a bi-weekly pay schedule. Since not all bills are due on the same day each month, you may find yourself needing to juggle payment dates with your paycheck schedule. This can create stress and confusion, especially if you’re trying to avoid late fees or missed payments.

5. Complex Financial Planning

For those with more complex financial situations, such as multiple income streams or irregular expenses, bi-weekly pay can make financial planning more challenging. The need to reconcile your budget with a non-monthly income schedule requires careful planning and attention to detail.

How to Take Care of Your Money on a Bi-Weekly Pay Schedule

Managing your finances effectively on a bi-weekly pay schedule requires some strategic planning. Here are some practical tips to help you take care of your money:

1. Create a Bi-Weekly Budget

One of the most effective ways to manage your finances on a bi-weekly pay schedule is to create a bi-weekly budget. Instead of planning your expenses on a monthly basis, break them down into two-week periods that align with your paychecks. This approach allows you to allocate your income more effectively and ensures that you have enough money to cover your essential expenses.

Steps to Create a Bi-Weekly Budget:

- List Your Expenses: Start by listing all your monthly expenses, including rent, utilities, groceries, transportation, and entertainment.

- Divide by Two: Divide your monthly expenses by two to determine how much you need to allocate from each paycheck.

- Allocate Funds: Use your bi-weekly budget to allocate funds for each expense category. Make sure to prioritize essential expenses like rent, utilities, and groceries.

- Monitor Spending: Keep track of your spending throughout the pay period to ensure you stay within your budget.

2. Save Your Extra Paychecks

The two extra paychecks you receive each year can be a valuable financial resource. Instead of treating them as bonus money, consider saving these paychecks to build an emergency fund, pay off debt, or invest in your future. By saving these paychecks, you can take advantage of the financial flexibility they provide and make progress toward your financial goals.

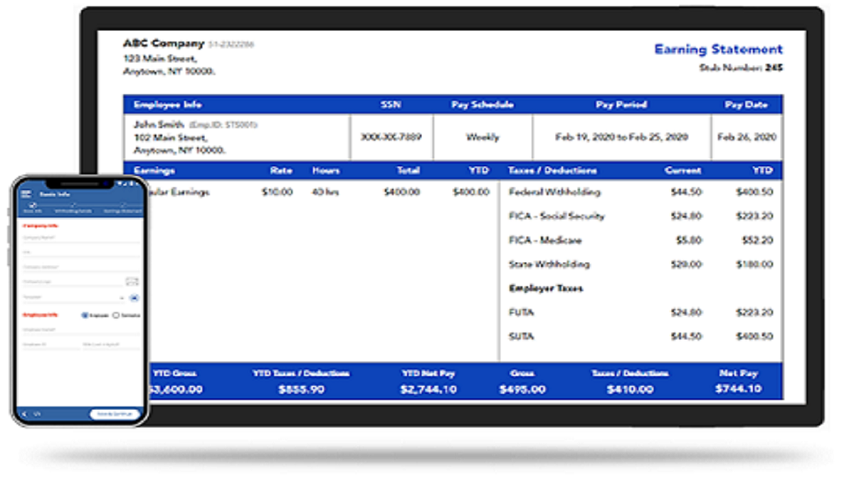

3. Use a Free Check Stub Maker

A free check stub maker is a valuable tool for managing your finances, especially if you’re on a bi-weekly pay schedule. This tool allows you to create accurate and professional pay stubs that reflect your earnings, deductions, and net pay. By keeping detailed records of your income, you can track your financial progress, verify your earnings, and ensure that your budgeting efforts are on track.

Benefits of Using a Free Check Stub Maker:

- Accurate Record-Keeping: A check stub maker helps you keep accurate records of your income, making it easier to track your earnings and budget effectively.

- Income Verification: If you need to verify your income for a loan application, rental agreement, or other financial transaction, a professional pay stub can provide the necessary documentation.

- Tax Reporting: Properly documented pay stubs are essential for accurate tax reporting, ensuring that you report your income correctly and avoid potential issues with the IRS.

4. Automate Your Savings

One of the best ways to take care of your money on a bi-weekly pay schedule is to automate your savings. Set up automatic transfers from your checking account to your savings account on payday. This approach ensures that you’re consistently setting aside money for future financial goals, even if you’re not consciously thinking about it.

Automated Savings Tips:

- Set a Savings Goal: Determine how much you want to save each pay period and set up an automatic transfer to your savings account.

- Prioritize Emergency Savings: Start by building an emergency fund that can cover 3-6 months of living expenses.

- Increase Savings Gradually: As your income increases or your financial situation improves, gradually increase the amount you save each pay period.

5. Align Your Bills with Your Paychecks

To make budgeting easier, consider aligning your bill payments with your bi-weekly pay schedule. Contact your service providers and see if they offer flexible payment dates. By syncing your bill payments with your paychecks, you can reduce the stress of managing due dates and ensure that you always have enough money to cover your expenses.

Tips for Aligning Bills with Paychecks:

- Review Your Bill Due Dates: Make a list of all your bills and their due dates.

- Contact Service Providers: Reach out to your service providers and request to change your payment dates to align with your paychecks.

- Set Up Automatic Payments: To avoid late payments, set up automatic payments for your bills on payday.

6. Plan for Inconsistent Income Months

Since some months will have three paychecks instead of two, it’s essential to plan for these inconsistent income months. Use these months as an opportunity to boost your savings, pay off debt, or make significant purchases. By planning ahead, you can make the most of these extra paychecks and avoid the temptation to overspend.

Planning Tips for Extra Paycheck Months:

- Set a Financial Goal: Determine how you want to use the extra income from your third paycheck.

- Avoid Impulse Spending: Resist the urge to spend the extra paycheck on non-essential items. Instead, focus on long-term financial goals.

- Review Your Budget: Adjust your budget to account for the extra income and ensure that it aligns with your financial priorities.

Conclusion

Bi-weekly pay offers both advantages and challenges, but with the right strategies, you can manage your finances effectively. By understanding the pros and cons of bi-weekly pay, creating a bi-weekly budget, and using tools like a free check stub maker, you can take control of your money and work toward your financial goals. Remember, consistency and planning are key to making the most of your bi-weekly paychecks, so take the time to develop a financial plan that works for you.