A “poverty mindset” refers to a set of beliefs and attitudes about money and resources that perpetuate a state of financial struggle. This mindset can trap individuals in a cycle of financial insecurity, limiting their potential and hindering their ability to improve their economic situation. Understanding what constitutes a poverty mindset and how to overcome it can be the first step toward financial empowerment and success. In this blog, we will explore the concept of a poverty mindset, how it manifests, and actionable strategies to break free from it. Additionally, we’ll discuss how tools like a free paystub generator can play a role in financial management and overcoming this mindset.

What is a Poverty Mindset?

A poverty mindset encompasses a range of limiting beliefs and attitudes about money and resources. These beliefs often stem from personal experiences, societal influences, or cultural narratives that shape an individual’s perception of wealth and financial security. Here are some common characteristics of a poverty mindset:

- Scarcity Mentality: Believing that there is not enough money or resources to go around. This mentality often leads to fear and anxiety about financial stability, resulting in hoarding or an unwillingness to invest in opportunities.

- Fixed Beliefs About Money: Viewing money as something that is either attainable only through luck or reserved for a select few. This belief can create a sense of hopelessness and resignation, making it difficult to pursue financial goals or opportunities.

- Negative Self-Talk: Consistently criticizing oneself for financial shortcomings or mistakes. This negative self-talk reinforces feelings of inadequacy and discourages proactive efforts to improve one’s financial situation.

- Blaming External Factors: Attributing financial struggles to external factors such as the economy, job market, or other people. This mindset can lead to a lack of personal responsibility and hinder efforts to take control of one’s financial future.

- Fear of Taking Risks: Avoiding financial risks or opportunities due to a fear of failure or loss. This reluctance to take risks can prevent individuals from exploring new income streams or investment opportunities that could improve their financial situation.

How a Poverty Mindset Manifests

A poverty mindset can manifest in various ways, impacting both financial behavior and overall quality of life. Here are some common manifestations:

- Living Paycheck to Paycheck: Individuals with a poverty mindset may struggle to manage their finances effectively, resulting in living paycheck to paycheck. This can lead to constant stress and a lack of financial security.

- Avoiding Financial Planning: A reluctance to create and follow a financial plan or budget. This avoidance can result in missed opportunities for saving, investing, and building wealth.

- Underestimating One’s Worth: Not valuing one’s skills, talents, or time appropriately. This can lead to accepting lower wages or undervaluing personal contributions, which perpetuates financial struggle.

- Lack of Investment in Personal Growth: Neglecting opportunities for education, skill development, or career advancement due to the belief that such investments are too costly or unnecessary.

- High Levels of Debt: Accumulating debt due to poor financial habits or a lack of understanding of money management. This debt can exacerbate financial stress and limit future financial opportunities.

How to Get Out of a Poverty Mindset

Breaking free from a poverty mindset requires a shift in beliefs, attitudes, and behaviors related to money and resources. Here are some actionable strategies to help overcome a poverty mindset and work towards financial empowerment:

- Adopt an Abundance Mentality

Transitioning from a scarcity mentality to an abundance mentality involves believing that there are ample opportunities and resources available. This shift in mindset encourages optimism and a proactive approach to financial growth. Focus on the possibilities rather than limitations and seek out opportunities for income and personal development.

- Set Clear Financial Goals

Establishing clear, achievable financial goals provides direction and motivation. Whether it’s saving for a specific purpose, reducing debt, or investing in education, having concrete goals helps to create a sense of purpose and progress. Break down larger goals into smaller, manageable steps to make them more attainable.

- Invest in Financial Education

Educate yourself about money management, investment strategies, and financial planning. Knowledge is a powerful tool in overcoming a poverty mindset. Utilize resources such as books, online courses, and financial advisors to improve your understanding of financial concepts and strategies.

- Practice Positive Self-Talk

Replace negative self-talk with affirmations and positive reinforcement. Acknowledge your strengths and accomplishments, and focus on the progress you’ve made. Positive self-talk can help build confidence and motivation, leading to more proactive financial behavior.

- Take Responsibility for Your Finances

Embrace personal responsibility for your financial situation. Rather than blaming external factors, focus on what you can control and take actionable steps to improve your financial situation. This might include creating a budget, seeking additional income sources, or managing expenses more effectively.

- Embrace Financial Risks Wisely

Taking calculated financial risks can lead to significant rewards. Evaluate opportunities for investment, career advancement, or entrepreneurship with a balanced approach. Conduct thorough research and seek advice from trusted sources to make informed decisions that align with your financial goals.

- Utilize Financial Tools

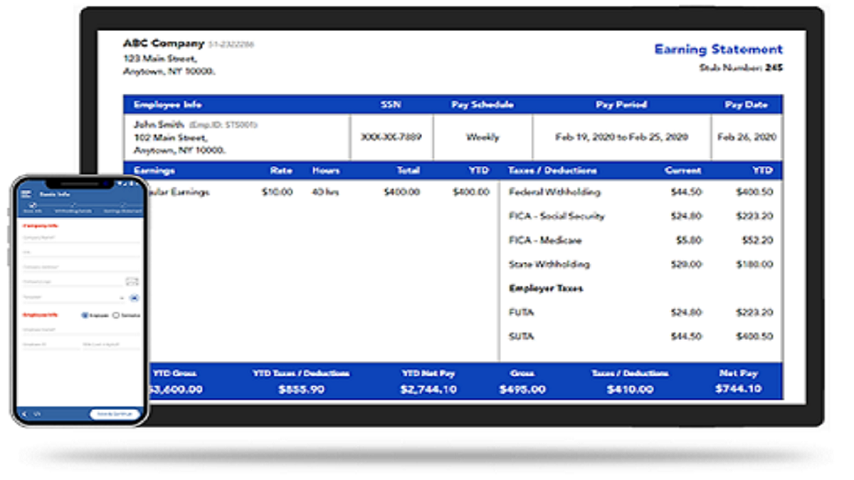

Leverage financial tools to manage your money more effectively. For example, a free paystub generator can help you keep track of your income and deductions, providing a clear picture of your financial situation. Accurate pay stubs can assist in budgeting, tax planning, and financial record-keeping.

- Build an Emergency Fund

Establishing an emergency fund provides a financial safety net in case of unexpected expenses or emergencies. Aim to save a portion of your income regularly to build and maintain this fund. Having an emergency fund reduces financial stress and enhances your overall financial stability.

- Seek Support and Mentorship

Connect with mentors, financial advisors, or support groups that can offer guidance and encouragement. Surrounding yourself with individuals who have successfully overcome financial challenges can provide valuable insights and motivation.

- Celebrate Small Wins

Recognize and celebrate your progress, no matter how small. Acknowledging your achievements helps to build momentum and maintain motivation. Each step forward is a sign of growth and progress in overcoming a poverty mindset.

How a Free Paystub Generator Can Help

A free paystub generator is a practical tool for managing your finances and tracking your income. Here’s how it can be beneficial:

- Accurate Record-Keeping: Generate accurate pay stubs to keep track of your earnings, deductions, and taxes. This helps ensure that your financial records are up-to-date and accurate.

- Budgeting and Planning: Use pay stubs to understand your income patterns and create a more effective budget. Knowing your exact earnings can help you plan and allocate your resources more efficiently.

- Tax Preparation: Accurate pay stubs simplify the process of preparing your tax returns. They provide a clear record of your income and deductions, making it easier to file your taxes correctly.

- Financial Transparency: Pay stubs offer transparency into your financial situation, helping you identify areas for improvement and make informed financial decisions.

- Proof of Income: Pay stubs serve as proof of income for loan applications, rental agreements, or other financial transactions. Having organized and accurate pay stubs can facilitate these processes.

Conclusion

Overcoming a poverty mindset involves shifting your beliefs and attitudes about money and resources. By adopting an abundance mentality, setting clear financial goals, investing in education, and embracing personal responsibility, you can break free from limiting financial behaviors and work towards financial empowerment. Utilizing tools such as a free paystub generator can further support your financial management efforts, providing accurate records and insights into your financial situation. With the right mindset and strategies, you can transform your financial future and achieve your financial goals.