If you’ve just landed your first job or are starting to manage your finances, you might have come across paystubs. Understanding paystub terminology is crucial for keeping track of your earnings, taxes, and deductions. In this guide, we’ll break down everything you need to know about paystubs, making it simple and easy to understand.

What is a Paystub?

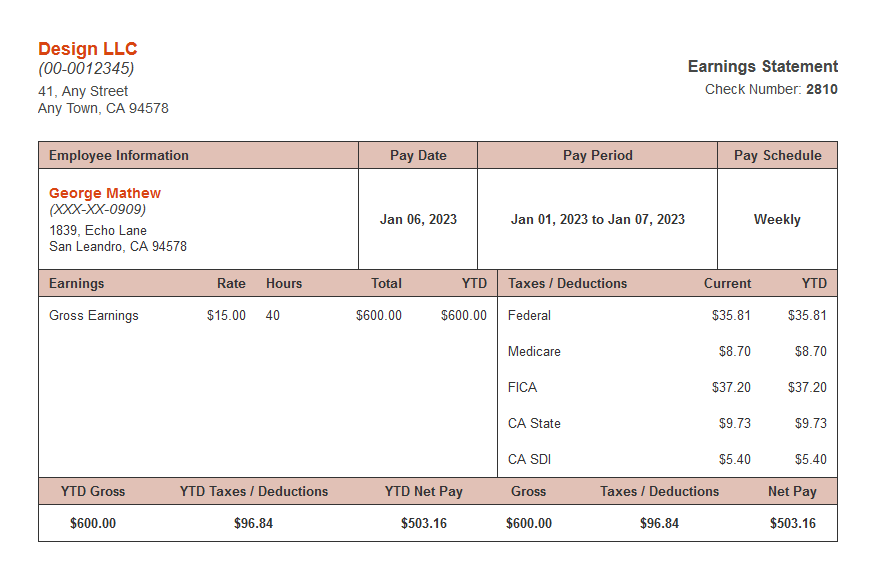

A paystub, also known as a paycheck stub or wage statement, is a document provided by your employer that outlines your earnings for a specific pay period. It typically includes information about your gross pay, deductions, and net pay. Paystubs can be physical documents or digital versions, and they are essential for tracking your income and understanding your financial situation.

Why are Paystubs Important?

Paystubs serve several purposes:

- Proof of Income: If you’re applying for a loan, rental agreement, or government assistance, paystubs can be used to verify your income.

- Tracking Earnings: Regularly reviewing your paystubs helps you keep track of your earnings over time, making it easier to budget and plan for expenses.

- Understanding Deductions: Paystubs provide detailed information on deductions, helping you understand where your money goes each pay period.

- Tax Preparation: Paystubs contain information needed for tax filings, including the total amount of income earned and taxes withheld.

Key Paystub Terminology

Let’s dive into some common terms you’ll find on a paystub:

1. Gross Pay

Gross pay is the total amount you earn before any deductions are taken out. This includes your hourly wage or salary, plus any overtime, bonuses, or commissions you may have earned during the pay period.

2. Net Pay

Net pay is the amount you take home after all deductions are subtracted from your gross pay. This is the amount you’ll actually receive in your bank account or on your paycheck.

3. Deductions

Deductions are amounts subtracted from your gross pay, which can include:

- Taxes: Federal, state, and local taxes are deducted from your earnings. These can include income tax, Social Security tax, and Medicare tax.

- Benefits: Contributions for health insurance, retirement plans, and other employee benefits are also deducted.

- Garnishments: If you have any court-ordered deductions (like child support), these will also appear on your paystub.

4. Federal Tax Withholding

This is the amount of federal income tax your employer withholds from your paycheck to pay to the IRS. The amount withheld is based on your income level and the information you provided on your W-4 form.

5. State Tax Withholding

Similar to federal tax, this is the amount withheld for state income taxes, if applicable. Not all states have income tax, so this deduction may not appear on your paystub.

6. FICA Taxes

FICA stands for the Federal Insurance Contributions Act. It includes Social Security and Medicare taxes. Social Security tax funds your future retirement benefits, while Medicare tax helps pay for medical care for seniors.

7. Year-to-Date (YTD)

YTD refers to the total amount earned or deducted from the start of the calendar year to the current pay period. This figure helps you see your total earnings and total deductions for the year at a glance.

8. Hours Worked

This section shows the number of hours you worked during the pay period, which is especially important for hourly employees. It may also indicate regular hours, overtime hours, and any paid time off (PTO) you took.

9. Leave Balances

For employees with PTO or vacation time, this section shows how much leave you have available. It’s helpful for planning future time off.

10. Employer Contributions

Some paystubs will also list contributions your employer makes on your behalf, such as matching retirement contributions or contributions to health savings accounts (HSAs).

How to Read Your Paystub

Reading a paystub can seem overwhelming at first, but once you understand the terminology, it’s much easier. Here’s a simple way to break it down:

- Start with Gross Pay: Look at your gross pay to see how much you earned before deductions.

- Check Deductions: Review each deduction to understand what’s being taken out. Make sure they align with your expectations.

- Look at Net Pay: This is the amount you’ll take home. Ensure it matches what you expected to receive.

- Review YTD Figures: Compare the year-to-date earnings and deductions with your previous paystubs to track your progress.

- Note Any Changes: If there’s a significant change in your pay or deductions, investigate the reason. It could be due to a tax change, a raise, or new benefits.

Common Paystub Questions

1. What if I don’t understand something on my paystub?

If you come across something confusing, don’t hesitate to ask your employer or HR department. They’re there to help you understand your pay and any deductions.

2. Can I get a copy of my paystub?

Yes! Employers are required to provide you with a paystub for each pay period. If you need a copy, just ask your employer or check your company’s payroll system.

3. What should I do if there’s a mistake on my paystub?

If you notice an error, such as an incorrect deduction or incorrect hours, report it to your HR department as soon as possible. They can help you correct it.

4. How can I create my own paystub?

If you’re self-employed or need to provide proof of income, you can use a free paystub generator. These tools allow you to enter your information and create a paystub that looks official. Just be sure to include accurate details so it reflects your actual earnings and deductions.

Understanding Taxes and Deductions

To effectively manage your finances, it’s essential to have a grasp on how taxes and deductions work. Let’s explore these a bit more:

Understanding Federal and State Taxes

- Federal Taxes: These are mandatory taxes levied by the IRS. Your employer estimates the amount based on your earnings and the information you provided on your W-4.

- State Taxes: Depending on your state, you may have to pay additional income taxes. Each state has its own tax rates and regulations.

Other Deductions

- Health Insurance: If your employer offers health insurance, your contribution will be deducted from your paycheck. This is often one of the largest deductions for many employees.

- Retirement Contributions: If you participate in a retirement plan like a 401(k), your contributions will also come out of your paycheck.

- Other Benefits: Additional deductions may include life insurance, disability insurance, or other voluntary benefits offered by your employer.

Conclusion

Understanding your paystub is essential for managing your finances and making informed decisions about your income. By familiarizing yourself with the terminology and key components, you’ll be better equipped to track your earnings and deductions. Remember, if you ever have questions or concerns, reach out to your employer or HR for clarification. And if you need to create your own paystub, consider using a free paystub generator to get started. With these tools and knowledge, you’ll have a solid grasp on your financial situation and be ready to take control of your future!