In today’s financial world, you might hear the term “voided cheque” thrown around quite a bit. But what exactly is it, and why would you need one? This guide will help you understand when to use a voided cheque, how to get one, and everything else you need to know about this important financial tool.

What is a Voided Cheque?

A voided cheque is a cheque that has been marked “VOID” across the front, rendering it unusable for transactions. This simple act ensures that no one can cash or deposit the cheque. Instead, a voided cheque serves a different purpose, often related to setting up automatic payments or deposits.

Why Use a Voided Cheque?

Voided cheques are commonly used in several situations:

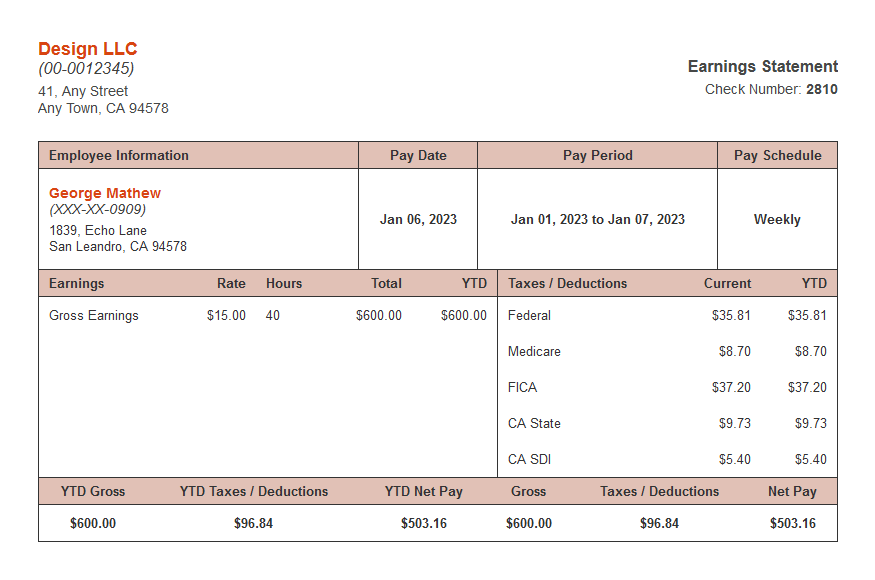

- Setting Up Direct Deposits: Employers often ask for a voided cheque to establish direct deposit for payroll. This allows your salary to be automatically deposited into your bank account, making payday a lot easier.

- Automatic Bill Payments: Utility companies or other service providers may request a voided cheque to set up automatic payments. This helps ensure that your bills are paid on time without any manual effort.

- Banking and Loan Applications: When applying for a loan or certain banking services, you might be asked to provide a voided cheque to verify your banking information.

- Avoiding Errors: Providing a voided cheque reduces the chance of errors in account numbers and routing information since you’re directly supplying the bank’s details.

How to Get a Voided Cheque

Getting a voided cheque is straightforward. Here’s a step-by-step guide on how to create one:

Step 1: Get a Blank Cheque

- Checkbook: If you have a chequebook, pull out a blank cheque. If you don’t, you may need to request a few cheques from your bank.

- Online Banking: Many banks now offer digital banking options. You can check if your bank allows you to create digital cheques.

Step 2: Fill Out the Cheque

- Payee Line: Leave the “Pay to the order of” line blank. This ensures that the cheque can’t be cashed.

- Amount Line: Leave the amount line blank as well.

- Date: You can write today’s date or leave it blank.

- Signature: You can also leave the signature line blank.

Step 3: Mark it as “VOID”

Use a pen to write “VOID” in large letters across the front of the cheque. This makes it clear that the cheque cannot be used for payment. You might also want to write “VOID” in the amount line and on the signature line for extra clarity.

Step 4: Provide it to the Requester

Once you’ve voided the cheque, hand it over to the person or company that requested it. They’ll use the information to set up the necessary banking arrangements.

Important Tips for Handling Voided Cheques

1. Keep it Safe

Treat a voided cheque like any other sensitive financial document. Don’t leave it lying around where someone could find it. Store it securely until you hand it over.

2. Use Only When Necessary

Only provide a voided cheque when it’s specifically requested. If you’re not sure whether it’s needed, ask the requester why they need it.

3. Check Your Bank’s Policies

Different banks have varying policies regarding cheques and direct deposits. Make sure to check with your bank if you have any questions or concerns.

4. Use a Check Stub Maker

If you need to keep track of your payments or are creating a financial record, consider using a check stub maker. This tool can help you generate pay stubs or cheque stubs that keep your financial documentation organized and professional.

Common Questions About Voided Cheques

What If I Don’t Have a Chequebook?

If you don’t have a chequebook, many banks can provide you with a voided cheque upon request. You can also ask for a printed form with your banking information.

Can I Void a Digital Cheque?

Yes, if your bank offers digital banking services, you can often create a digital cheque that includes all the necessary banking details. Just make sure to indicate that it is void.

Is a Voided Cheque Safe?

Yes, a voided cheque is safe as long as you handle it properly. It’s essential to ensure that no sensitive information is misused.

What Should I Do if I Make a Mistake?

If you make a mistake while voiding a cheque, simply discard it and create a new one. It’s crucial to ensure that the voided cheque is clear and legible.

Conclusion

Voided cheques are a useful financial tool that can simplify many banking processes. They make it easy to set up direct deposits, and automatic bill payments, and verify your banking details when applying for loans or services. By following the steps outlined in this guide, you can create a voided cheque quickly and safely.

Remember, always handle your financial documents with care, and don’t hesitate to ask your bank if you have any questions. Whether you’re receiving your paycheck through direct deposit or paying your bills automatically, a voided cheque can make your financial life a little easier.