Accurate and efficient payroll management is essential in the fast-paced and highly regulated healthcare industry. Healthcare organizations, from hospitals to private practices, rely on streamlined payroll processes to ensure timely and precise employee payments. One tool that has emerged as a game-changer in this context is the paystub generator. With its ability to create detailed, customizable paystubs quickly, this tool can help healthcare employers improve payroll accuracy and transparency. Here, we explore the best practices for using a paystub generator in the healthcare industry.

1. Understand the Importance of Accurate Paystubs

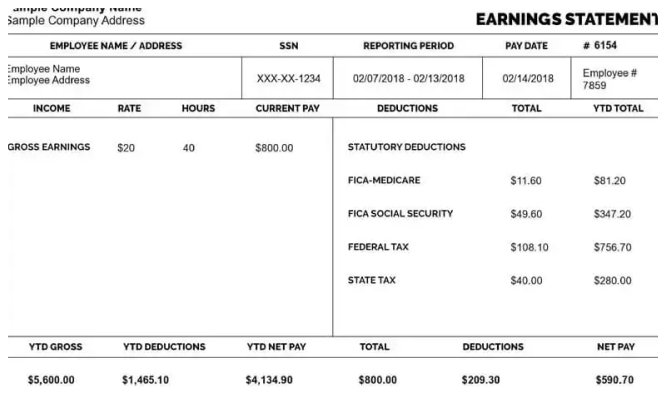

Paystubs serve as a critical document for both employers and employees in the healthcare sector. They provide a clear breakdown of earnings, deductions, and net pay, which helps employees understand their compensation and ensures compliance with labour laws. For healthcare professionals working irregular shifts, such as nurses and technicians, paystubs also document overtime pay, shift differentials, and bonuses.

Using a pay stub generator ensures consistency and accuracy in these documents. By automating calculations, the tool minimizes the risk of human error and creates a reliable record for tax purposes, loan applications, and employee disputes.

2. Choose a Paystub Generator Designed for Healthcare Needs

Not all paystub generators are created equal. For the healthcare industry, it’s important to choose a tool that accommodates specific needs such as:

- Overtime and Shift Differentials: Healthcare professionals often work overtime or night shifts, which require additional pay calculations. Ensure the paystub generator supports these features.

- Multiple Payment Types: From salaried doctors to hourly staff and contracted specialists, healthcare organizations employ various compensation models. Choose a paystub generator that handles diverse payment structures.

- Compliance Features: Look for a tool that adheres to federal and state labor laws to avoid penalties and legal issues.

3. Ensure Data Accuracy Before Generating Paystubs

The output of a paystub generator is only as accurate as the data input. To maintain accuracy:

- Verify Employee Details: Ensure names, job titles, and tax information are correct.

- Double-Check Hours Worked: For hourly employees, confirm the total hours worked, including overtime and on-call hours.

- Review Benefits and Deductions: Healthcare employees often have complex benefits packages, including retirement contributions, health insurance, and union dues. Make sure these deductions are calculated correctly.

4. Train Payroll Staff on the Tool

Introducing a paystub generator can streamline payroll processes, but only if your payroll team knows how to use it effectively. Offer training sessions to:

- Familiarize staff with the software’s features and interface.

- Teach best practices for inputting and reviewing data.

- Address common errors and how to resolve them.

By equipping your payroll team with the necessary skills, you can maximize the tool’s potential and avoid costly mistakes.

5. Maintain Employee Confidentiality

Healthcare organizations handle sensitive information daily, and payroll data is no exception. Protect employee confidentiality by:

- Using Secure Software: Choose a paystub generator with robust encryption and security features to safeguard data.

- Restricting Access: Limit access to payroll systems to authorized personnel only.

- Regularly Updating Security Protocols: Stay ahead of potential threats by keeping software updated and conducting regular security audits.

6. Customize Paystubs for Transparency

Transparency builds trust between employers and employees. Customize paystubs to include detailed information such as:

- Earnings Breakdown: Clearly separate regular hours, overtime, and bonuses.

- Deductions: Itemize deductions for taxes, insurance, and retirement contributions.

- Accrued Benefits: Include details about paid time off, sick leave, and vacation days.

Customized paystubs help employees understand their pay and reduce questions or disputes.

7. Stay Compliant with Healthcare Regulations

The healthcare industry is heavily regulated, and payroll processes must align with both labor laws and industry-specific requirements. When using a paystub generator:

- Adhere to Labor Laws: Ensure the paystub includes mandatory information such as gross pay, deductions, and net pay.

- Comply with State Requirements: Different states have unique paystub regulations, so customize templates accordingly.

- Document Everything: Keep copies of all generated paystubs for at least three years to comply with recordkeeping requirements.

8. Leverage Automation for Efficiency

One of the biggest advantages of using a paystub generator is automation. Automating repetitive tasks like calculations and formatting saves time and reduces errors. This efficiency is especially valuable in healthcare, where payroll teams often manage large and diverse workforces.

Additionally, automation allows payroll staff to focus on higher-value tasks, such as addressing employee concerns or analyzing compensation trends.

9. Regularly Update Software

To ensure optimal performance, regularly update your paystub generator software. Updates often include:

- New Features: Access to improved functionalities.

- Compliance Updates: Adjustments to meet changes in labor laws.

- Security Enhancements: Better protection against cyber threats.

By keeping your software current, you’ll maintain efficiency and compliance.

10. Provide Digital Access to Paystubs

In today’s digital world, employees appreciate easy access to their paystubs. Many paystub generators allow organizations to:

- Email Paystubs: Send paystubs directly to employees’ inboxes.

- Offer Online Portals: Create a secure platform where employees can log in and view their pay history.

- Support Mobile Access: Ensure compatibility with mobile devices for on-the-go access.

Digital access not only improves convenience but also reduces paper waste, aligning with sustainability goals.

11. Seek Employee Feedback

Finally, involve your employees in the process by seeking their feedback on the paystub system. Regular surveys or one-on-one discussions can reveal:

- Areas for Improvement: Identify features employees find confusing or lacking.

- Preferences: Understand whether employees prefer digital or printed paystubs.

- Trust Issues: Address concerns about accuracy or transparency promptly.

By incorporating feedback, you demonstrate a commitment to employee satisfaction and continuous improvement.

Conclusion

A free paystub generator can revolutionize payroll management in the healthcare industry, offering accuracy, efficiency, and compliance. By following these best practices, healthcare organizations can ensure seamless payroll processes while fostering trust and transparency with their employees. Whether managing a large hospital or a small clinic, investing in a reliable paystub generator is a smart move that benefits both employers and employees alike.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs