In today’s fast-paced world, independent contractors, freelancers, and gig workers are an essential part of the workforce. From delivery drivers to graphic designers, independent contractors enjoy the flexibility of setting their schedules and working on a variety of projects. However, with this freedom comes the challenge of managing finances, especially when it comes to documenting income and taxes. One powerful tool that can help independent contractors stay organized and maintain accurate financial records is the free paycheck stub creator.

In this blog, we’ll explore how a free paycheck stub creator can be a game-changer for independent contractors, helping them stay organized, save time, and simplify the financial management process. We’ll also delve into why paycheck stubs are important for contractors, how they can use a paycheck stub creator, and the benefits of having accurate, professional pay stubs.

What is a Paycheck Stub, and Why Do Independent Contractors Need One?

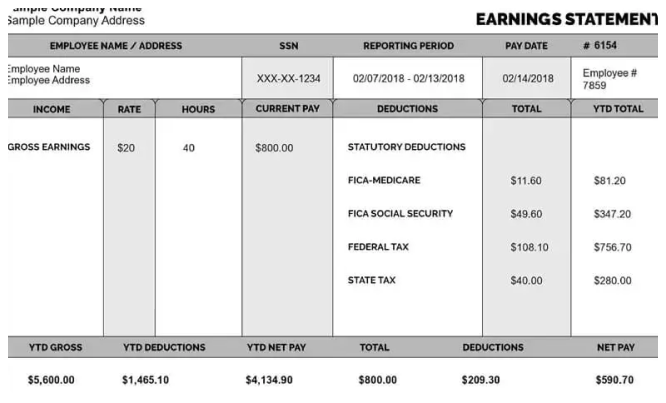

A paycheck stub, often referred to as a pay stub or pay slip, is a document that outlines the details of an individual’s earnings for a specific pay period. For employees, paycheck stubs are typically provided by their employer and include information like hours worked, wage rates, deductions (taxes, insurance, etc.), and the net pay they will receive.

For independent contractors, paycheck stubs are just as important, even though they don’t have an employer providing them. Contractors are responsible for their own income reporting and tax filings, and a well-documented paycheck stub can help keep everything in order.

Some key details typically included on a paycheck stub are:

- Gross Income: The total earnings before any deductions.

- Deductions: This may include taxes, insurance, retirement contributions, or other voluntary deductions.

- Net Income: The amount the contractor actually takes home after all deductions.

Independent contractors need these details for several reasons:

- Tax Filing: Contractors are responsible for their own taxes, including self-employment tax. A paycheck stub helps them track income and expenses for tax filing.

- Loan and Lease Applications: Many contractors need proof of income when applying for loans or leases. A professional paycheck stub can serve as documentation for these applications.

- Organization: Keeping track of earnings and deductions regularly helps contractors stay organized and avoid confusion during tax season.

- Professionalism: Providing clients with professional-looking pay stubs builds credibility and trust.

The Benefits of Using a Free Paycheck Stub Creator

Independent contractors often face the challenge of managing their finances while juggling multiple clients and projects. A free paycheck stub creator can simplify this process in several ways:

1. Saving Time and Effort

One of the biggest advantages of using a free paycheck stub creator is the time it saves. Instead of manually calculating earnings, deductions, and taxes for each job, a paycheck stub creator automates much of this work. Contractors can enter their income information, and the tool will generate a professional-looking paycheck stub in minutes. This saves contractors from hours of manual calculation and formatting.

2. Accurate and Professional Results

A free paycheck stub creator ensures that the results are accurate and professional. These tools are typically designed to follow standard formats and include all the necessary details. For contractors who may not be familiar with accounting or tax procedures, using a paycheck stub creator helps avoid errors that could impact their finances. Whether the contractor is just starting out or has years of experience, the professionalism of a well-designed paycheck stub can help build trust with clients.

3. Tracking Income Easily

Freelancers often work for multiple clients at once, making it challenging to keep track of individual earnings. A paycheck stub creator allows contractors to keep detailed records of their earnings over time. By generating a paycheck stub for each job or project, contractors can stay on top of how much they’ve earned and how much they still owe. This makes it easier to track payments, follow up with clients if needed, and stay organized for tax purposes.

4. Simplifying Tax Preparation

Independent contractors are responsible for paying self-employment taxes, which can be confusing for many. A paycheck stub creator makes this process easier by providing clear documentation of earnings and deductions. When it’s time to file taxes, contractors can simply refer to their pay stubs to calculate their total income, estimate taxes owed, and ensure they’re not missing any important deductions. Many free paycheck stub creators even have built-in tax calculation features, helping contractors estimate their tax liabilities based on their earnings.

5. Improved Financial Planning

By using a paycheck stub creator regularly, contractors can track their income and expenses more accurately. This can help them plan their finances, set aside money for taxes, and build a budget. Having clear records of how much they’ve earned each month gives contractors a better understanding of their cash flow and can help them make informed decisions about savings, investments, and future expenses.

6. Easy to Share with Clients or Lenders

As mentioned earlier, independent contractors often need to provide proof of income for various purposes, such as applying for loans, leases, or even certain contracts. A professional-looking paycheck stub can help with this. Many free paycheck stub creators allow contractors to download and print pay stubs in a format that’s easy to share with clients, lenders, or other institutions. This can improve the chances of getting approved for loans or contracts, as it shows the contractor is organized and professional.

7. Customizable Features

Many free paycheck stub creators offer customizable templates. This is particularly useful for contractors who want to include specific information on their pay stubs, such as additional deductions, reimbursements, or special project details. The ability to tailor the paycheck stub to fit their unique needs ensures contractors can accurately document their work and earnings in a format that makes sense for them.

How to Use a Free Paycheck Stub Creator

Using a free paycheck creator is easy, and most tools are user-friendly. Here’s a step-by-step guide to help independent contractors get started:

- Select a Tool: Choose a free paycheck stub creator that fits your needs. Many online platforms offer this service with basic functionality for free.

- Enter Your Information: Input your personal and business details, including your name, address, and business name (if applicable). You’ll also need to enter your earnings for the relevant pay period.

- Add Income and Deductions: Enter details like the gross income for each job or project, and any deductions (taxes, insurance, etc.). Some tools may also let you add overtime, bonuses, or reimbursements.

- Generate the Stub: Once all the necessary information is entered, the tool will automatically generate a paycheck stub. Review it to ensure all the information is correct.

- Download or Print: After confirming the details, you can download the paycheck stub as a PDF or print it out to share with clients or save for your records.

Popular Free Paycheck Stub Creators for Independent Contractors

While there are many options available, here are a few popular free paycheck stub creators that independent contractors often use:

- Paycheck Stub Online: This tool allows you to create professional pay stubs for free, offering customization options for income and deductions.

- Stub Generator: A simple and free online tool that generates paycheck stubs with all the essential information.

- W-2 Generator: In addition to creating pay stubs, this tool can also generate W-2 forms, making it a great option for contractors who want to manage their taxes in one place.

- QuickBooks Pay Stub Generator: QuickBooks offers a free paycheck stub generator for contractors who are also using QuickBooks for accounting.

Conclusion

For independent contractors, staying organized is essential for financial success. A free paycheck stub creator is a tool that can help contractors manage their income, track earnings, and simplify the tax process. By using these tools regularly, contractors can save time, improve professionalism, and maintain accurate financial records that are essential for tax preparation, loan applications, and long-term financial planning.

Whether you’re a seasoned freelancer or just starting your contracting journey, using a free paycheck stub creator is an investment in your business’s financial health. It ensures you stay on top of your income, reduces stress during tax season, and provides a professional image that can impress clients and lenders alike.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons