In today’s fast-paced world, managing remote teams is more common than ever. As businesses shift towards flexible, online environments, managing payroll has become one of the essential tasks that companies need to handle effectively. For remote teams, this process can sometimes become complicated, especially when dealing with diverse locations, varying pay schedules, and different work arrangements. One solution that is gaining traction is using a free paycheck creator for payroll management. This tool offers convenience, accuracy, and ease, making it an ideal solution for small businesses, freelancers, and remote teams.

If you’re managing a remote team and looking for a better way to handle payroll, here’s why you should consider using a free payroll check maker.

What is a Free Payroll Check Maker?

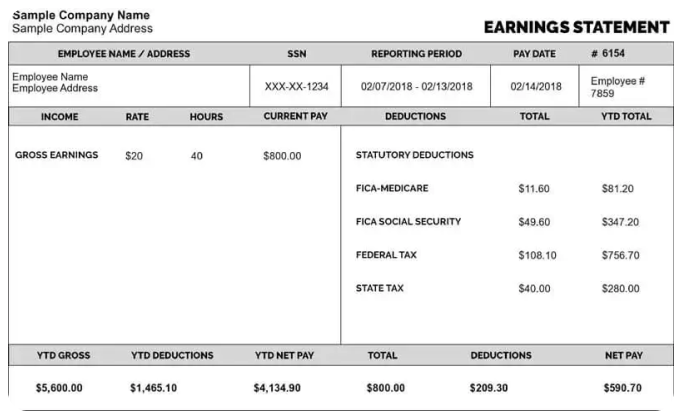

A free paycheck creator is an online tool designed to help business owners or managers create and print paychecks for employees. With just a few details, such as employee name, pay rate, hours worked, and deductions, the software will automatically generate a paycheck with all the necessary details, including tax information, net pay, and any benefits or deductions.

Most free paycheck creators are accessible through cloud-based platforms, meaning you can use them anytime and from anywhere, which is ideal for teams working remotely across different locations.

1. Ease of Use

One of the major advantages of using a free paycheck creator is its simplicity. Traditional payroll systems can be cumbersome and may require you to use specialized software or hire professionals to manage the payroll. For a small business or a remote team with fewer employees, this can be an expensive and time-consuming process.

Free paycheck creators are typically designed to be user-friendly, even for those with no accounting or payroll experience. The platforms generally have an intuitive interface with easy-to-follow instructions. All you need to do is input the necessary details such as the number of hours worked, overtime, tax rates, and any deductions. The software then generates the paycheck automatically.

For businesses without an HR department or finance team, this is a huge time-saver. As a business owner or manager, you can create and issue paychecks without relying on complicated software or external help.

2. Cost-Effective Solution

Managing payroll is an ongoing expense, especially if you’re using third-party services to handle it. Professional payroll services can cost a lot of money, especially when dealing with remote teams scattered across different time zones or countries. These costs add up quickly, which can take a significant chunk out of your business’s budget.

By using a free paycheck creator, you can save money while still ensuring that your employees get paid accurately and on time. While there are some premium options that offer additional features, many free paycheck creators offer all the essential features needed to handle payroll for remote teams. This is a great way to reduce overhead costs while maintaining accuracy in payroll.

3. Accuracy and Compliance

Ensuring payroll is accurate is essential for keeping your employees happy and avoiding legal issues. Miscalculations, missed payments, or incorrect tax deductions can lead to dissatisfaction among employees and even legal penalties for the company.

A free payroll check maker helps minimize human error by automating much of the payroll process. Many of these tools are updated regularly to comply with the latest tax laws, including federal, state, and local taxes, which is especially helpful for businesses operating across multiple states.

These tools often come with built-in features that calculate the correct deductions for taxes, insurance, and other benefits. This level of automation reduces the likelihood of errors, saving you time and ensuring compliance with government regulations.

4. Time-Saving Automation

When managing remote teams, time is one of your most valuable resources. Payroll can take up a significant chunk of your workweek, especially when you’re managing multiple employees or contractors.

Using a free paycheck creator automates the calculations and generation of paychecks, which means you can spend less time on administrative tasks and more time focusing on the growth and development of your business. The software typically allows you to save employee details, making it easy to generate paychecks for future payroll periods without re-entering the same information.

Additionally, many paycheck creators allow you to set up recurring payroll schedules. This means you won’t have to manually calculate or enter pay information every pay period. Once you input the initial details, the software can handle the rest, which is especially useful for remote teams working on consistent hourly rates or salaries.

5. Accessibility and Flexibility for Remote Teams

One of the biggest challenges when managing remote teams is the ability to access payroll data easily. Traditional payroll methods might require you to print checks, sign them, and then mail them out, which can delay payments for remote workers located in different cities or countries.

With a free paycheck creator, you can access your payroll system from anywhere. These tools are often cloud-based, which means you can generate paychecks and access payroll records from any device with internet access. This flexibility is crucial for remote teams working in various locations. It also allows managers to stay on top of payroll, even when they are traveling or working remotely themselves.

Furthermore, some tools offer features like direct deposit, which means you can pay your remote team members faster without needing to deal with physical checks. This is an added benefit for ensuring that employees get paid on time, regardless of where they are located.

6. Customization Options

Every business is different, and so are its payroll needs. A free payroll check maker gives you the ability to customize paychecks to suit the specific needs of your business and employees. Whether your remote team members are salaried, hourly, or receive commissions, you can input various pay structures and generate paychecks accordingly.

These tools also allow for the addition of specific deductions or bonuses that might be unique to your team. For example, if you offer health insurance or retirement contributions, the paycheck creator can automatically deduct the correct amounts. This level of customization is perfect for small businesses or startups that may not have a dedicated payroll system in place but still need to manage complex payrolls.

7. Secure and Confidential

Managing payroll involves sensitive information, including employee wages, Social Security numbers, and tax data. As a business owner, protecting this information is crucial to maintaining trust and avoiding legal issues.

Many free paycheck creators offer encryption and secure data storage, ensuring that employee information remains private and protected. These platforms often comply with data protection regulations like GDPR or CCPA, which adds an extra layer of security. By using these tools, you can rest assured that your employees’ personal and financial information is safeguarded.

8. Reports and Record-Keeping

One of the often-overlooked advantages of using a free paycheck creator is the ability to generate and store reports. Many paycheck creators allow you to download and save detailed reports of payroll for each pay period, which is essential for bookkeeping and tax filing.

These reports can be easily accessed and reviewed at any time, making it simpler to prepare for tax season or audits. You can also keep a record of previous paychecks, which can be helpful in resolving any discrepancies or addressing employee questions.

9. Multi-State and International Support

For remote teams that work across different states or even countries, managing varying tax laws and pay rates can be complicated. Many free paycheck creators support multi-state and international payroll, meaning the software will automatically apply the correct tax rates and deductions based on the employee’s location.

This is especially beneficial for remote teams working in different states in the USA, as each state has different income tax rates. With a payroll check maker, you don’t have to manually calculate these differences – the software does it for you.

10. Boosting Employee Satisfaction

Finally, the accuracy and timeliness of payroll play a crucial role in employee satisfaction. Remote workers, just like any other employees, rely on getting paid on time for their work. By using a free paycheck creator, you ensure that employees receive their paychecks accurately and on schedule. Happy employees are more likely to be engaged, productive, and loyal, which is essential for maintaining a positive company culture, especially when working remotely.

Conclusion

Managing payroll for remote teams can be complex, but it doesn’t have to be. A free paycheck creator simplifies the entire process by automating calculations, ensuring compliance, and offering the flexibility needed for remote workforces. It saves you time, reduces errors, and keeps your employees happy by ensuring they are paid accurately and on time.

For small businesses, freelancers, or startups, a free payroll check maker is an essential tool that allows you to focus on growing your business while handling payroll efficiently. With its ease of use, cost-effectiveness, and robust features, it’s an option worth considering for any business managing remote teams.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons