As a small business owner, managing payroll can be a daunting task, especially if you’re working with a limited budget and staff. Payroll is a crucial part of running your business smoothly, ensuring your employees are paid on time and accurately. Fortunately, technology has made it easier to manage payroll with tools like free paycheck makers. These free tools can simplify the process of creating pay stubs, calculating wages, and handling tax deductions, without breaking the bank. In this blog, we’ll walk you through how to use free paycheck creators effectively and the benefits they can bring to your small business.

What is a Paycheck Maker?

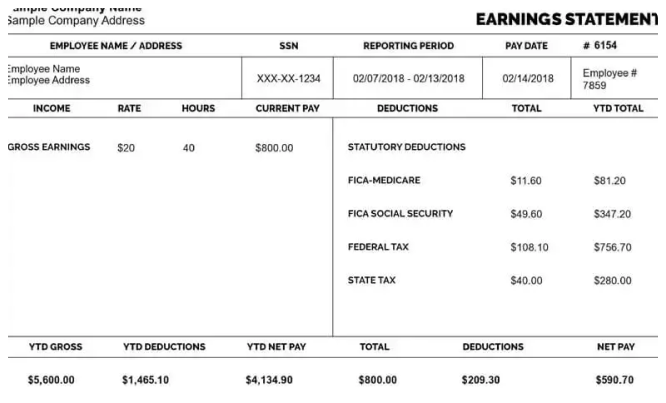

A paycheck maker is a tool that helps businesses create pay stubs for their employees. Pay stubs are documents that outline an employee’s earnings for a specific pay period, including wages, tax deductions, benefits, and other important information like overtime or bonuses.

For small businesses, using a paycheck maker is an efficient way to ensure that pay stubs are accurate and timely, helping you maintain compliance with tax laws and keep employees satisfied. These tools allow you to quickly generate pay stubs and avoid the hassle of manually calculating each employee’s wages.

Why Should Small Business Owners Use a Free Paycheck Maker?

Small business owners typically wear many hats, and payroll is just one of many responsibilities. While larger businesses may have dedicated payroll departments or software, small businesses often lack the resources for that. This is where a free paycheck maker can be a game-changer. Here’s why:

1. Cost-Effective Solution

As a small business, keeping costs down is essential. Many paid payroll services can be expensive, especially if you’re just getting started or have a limited number of employees. Free paycheck makers offer an affordable solution, allowing you to generate pay stubs without the need for pricey software or hiring an accountant.

2. Time-Saving

With a free paycheck maker, you can create pay stubs in minutes, saving you valuable time that could be better spent focusing on growing your business. Many free paycheck makers come with automated calculations for tax deductions, overtime pay, and other variables, reducing the time it would take to calculate each paycheck manually.

3. Accuracy

Using a free paycheck maker can help you avoid common payroll mistakes, such as miscalculating hours worked, incorrect tax deductions, or forgetting to include bonuses or commissions. By entering your employee’s data into the tool, you can be confident that your pay stubs will be accurate and error-free.

4. Tax Compliance

Staying compliant with federal, state, and local tax laws is critical to avoid penalties. A free paycheck maker typically includes automatic tax calculations, ensuring that the appropriate federal and state taxes, as well as Social Security and Medicare contributions, are deducted correctly. This reduces the risk of errors that could lead to costly penalties.

5. Employee Satisfaction

Employees appreciate receiving clear and accurate pay stubs that break down their earnings, deductions, and other benefits. A free paycheck maker ensures that you can deliver professional pay stubs that employees can easily understand and trust.

6. Easy Record-Keeping

Pay stubs are an essential part of your business’s financial record-keeping. Many free paycheck makers allow you to store pay stubs digitally, making it easy to access and manage them whenever you need them. This can be especially helpful during tax season or if you’re ever audited.

How to Use a Free Paycheck Maker for Payroll

Using a free paycheck maker for payroll is a simple process, and most tools are designed to be user-friendly. Here’s a step-by-step guide to help you get started:

Step 1: Choose a Reliable Free Paycheck Maker

There are several free paycheck makers available online, but it’s important to choose one that is reliable, accurate, and easy to use. Look for tools that include features like automatic tax calculations, direct deposit options, and customizable pay stubs. Some popular free paycheck makers include:

- PayStubCreator

- 123PayStubs

- W-2 Mate

- QuickBooks Payroll (free version)

Before you start using any paycheck maker, make sure to read reviews and check that the tool meets your business needs.

Step 2: Gather Employee Information

To create accurate pay stubs, you’ll need to gather all the relevant information about your employees. This includes:

- Employee Name

- Address

- Social Security Number (SSN)

- Hours Worked (for hourly employees)

- Hourly Rate or Salary

- Overtime (if applicable)

- Bonuses or Commissions (if applicable)

- Deductions (such as health insurance, retirement contributions, or taxes)

Having all this information at hand will ensure that you can quickly input it into the paycheck maker.

Step 3: Input Data Into the Paycheck Maker

Once you’ve selected a free paycheck maker, simply input the gathered information into the tool. Most tools will prompt you to enter the employee’s hours worked, pay rate, deductions, and any other relevant details. Many free paycheck makers have built-in calculators that automatically calculate things like taxes, overtime, and deductions once you enter the necessary data.

Some tools even allow you to choose the frequency of the pay (e.g., weekly, bi-weekly, monthly) and adjust for any holiday pay or paid time off (PTO).

Step 4: Review and Generate the Pay Stub

Once all the data has been entered, review the pay stub to ensure everything is accurate. Double-check the calculations for taxes, deductions, and the employee’s gross and net pay. Pay particular attention to overtime hours or bonuses, as these can sometimes be overlooked.

When you’re satisfied with the information, click the option to generate the pay stub. You can usually download the pay stub in a PDF format, which you can then print or email to your employee.

Step 5: Distribute Pay Stubs

After generating the pay stubs, you can distribute them to your employees. Some free paycheck makers allow you to send pay stubs directly to employees via email, while others provide printable PDFs that you can hand out. It’s essential to make sure that your employees receive their pay stubs in a timely manner, as this helps maintain transparency and trust.

Step 6: Store the Pay Stubs

Most free paycheck makers will allow you to store pay stubs digitally, making it easy to keep track of your payroll records. You can save these records for future reference or tax purposes. It’s a good practice to store these documents securely, either in a cloud-based service or encrypted on your computer, to ensure that you have access to them if needed.

Tips for Small Business Owners When Using a Free Paycheck Maker

- Stay Organized: Keep detailed records of employee information, working hours, and pay history. This will make it easier when using a paycheck maker and help ensure that you can track and verify your payroll.

- Review Local Tax Laws: Payroll taxes can vary by state or locality. Ensure that the free paycheck maker you choose supports the tax rates in your state to avoid mistakes.

- Track Paid Time Off (PTO): If your employees have paid time off, make sure that your paycheck maker allows you to easily account for this.

- Avoid Overworking Yourself: While using a paycheck maker saves time, it’s important not to neglect other aspects of your business. If payroll becomes too complex or time-consuming, consider upgrading to a paid solution or outsourcing payroll.

Conclusion

Managing payroll as a small business owner can be overwhelming, but it doesn’t have to be. A free paycheck maker can help simplify the payroll process, saving you time, reducing the risk of errors, and ensuring compliance with tax laws. By using these tools, you can provide your employees with accurate pay stubs, streamline your record-keeping, and focus more on growing your business.

So, if you’re looking for an easy and affordable way to handle payroll, consider giving a free paycheck maker a try. It’s a small investment of your time that can make a big difference in the efficiency and accuracy of your payroll process.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons