In the world of payroll management, ensuring that employees are paid correctly for overtime and holiday hours is crucial. Getting it wrong can lead to employee dissatisfaction, legal issues, and costly penalties. Fortunately, using a check stubs maker can simplify the entire process, providing an efficient, accurate, and transparent way to manage overtime and holiday pay.

For businesses of all sizes, managing payroll can be a daunting task, especially when dealing with complex pay scenarios like overtime and holiday pay. These additional pay components often involve specific rules and regulations that must be followed. In this blog, we’ll explore how a check stubs maker can help you manage overtime and holiday pay effectively, ensuring compliance with labor laws while keeping employees happy.

What is a Check Stubs Maker?

Before diving into how a check stubs maker can help with overtime and holiday pay, it’s essential to understand what a check stub maker is and how it works.

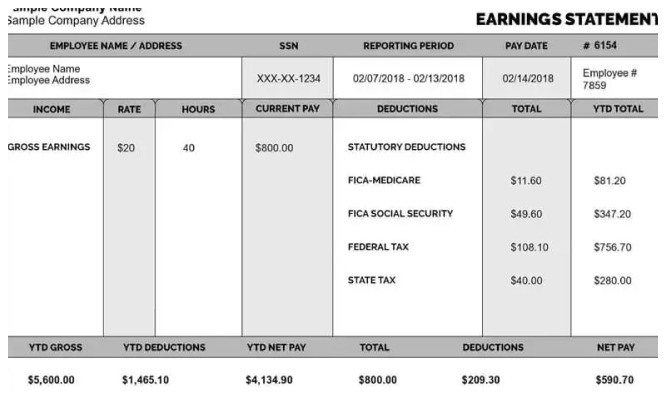

A check stubs maker is an online tool or software that helps businesses generate pay stubs for employees. These pay stubs contain important details, such as the employee’s gross pay, deductions, taxes, and net pay. The tool automates the process, ensuring accuracy and saving time.

By inputting relevant payroll information—such as the hours worked, hourly wage, and any additional pay factors—employers can use a check stubs maker to create professional pay stubs. This automation eliminates manual calculations, reducing the risk of errors and ensuring compliance with tax laws and labor regulations.

How Overtime and Holiday Pay Are Calculated

Before we get into the benefits of using a check stubs maker, it’s important to understand how overtime and holiday pay are calculated, so you can better appreciate the role of the check stub maker in simplifying the process.

1. Overtime Pay

Overtime pay applies to employees who work more than the standard hours of work (typically 40 hours per week in the U.S.). The Fair Labor Standards Act (FLSA) mandates that non-exempt employees be paid overtime at a rate of one and a half times their regular hourly rate for any hours worked beyond 40 hours per week.

For example, if an employee normally makes $15 per hour, they would receive $22.50 per hour for overtime hours.

Here’s how overtime pay is typically calculated:

- Regular pay: $15/hour

- Overtime pay: $15 × 1.5 = $22.50/hour

- Overtime hours worked: 10 hours

- Overtime pay: 10 hours × $22.50 = $225

2. Holiday Pay

Holiday pay refers to the additional pay given to employees who work on designated holidays. While not all businesses are required to offer holiday pay, many do, especially in industries like retail, healthcare, and hospitality. Some businesses pay employees a higher rate for working on holidays, while others offer time off with pay.

Holiday pay calculations vary depending on the employer’s policies and labor laws. For example, some companies pay employees double their regular hourly rate for working on holidays, while others pay time-and-a-half (1.5 times the regular hourly rate).

Here’s an example of holiday pay calculation:

- Regular pay: $15/hour

- Holiday pay: $15 × 2 = $30/hour

- Holiday hours worked: 8 hours

- Holiday pay: 8 hours × $30 = $240

How a Check Stub Maker Can Help Manage Overtime and Holiday Pay

Now that we understand how overtime and holiday pay are calculated, let’s explore how a check stubs maker can streamline this process and ensure accuracy.

1. Automating Calculations

The primary benefit of using a check stubs maker is automation. Manual payroll calculations, particularly for overtime and holiday pay, can be error-prone and time-consuming. With a check stubs maker, the tool automatically calculates overtime and holiday pay based on the inputs provided.

For example, when an employee works overtime, you simply need to enter their regular hourly rate and the number of overtime hours worked. The tool will automatically calculate the overtime pay and incorporate it into the pay stub. This eliminates the need for complex calculations and reduces the risk of mistakes.

Similarly, when an employee works on a holiday, you can input the holiday pay rate (such as double time or time-and-a-half) and the number of hours worked. The check stubs maker will calculate the holiday pay and include it in the pay stub, ensuring that employees are paid accurately and on time.

2. Compliance with Labor Laws

Overtime and holiday pay are subject to various labor laws and regulations, which can vary depending on the state, industry, and employee classification. Employers must stay compliant with these regulations to avoid costly fines and lawsuits.

A check stubs maker ensures compliance by calculating overtime and holiday pay based on the relevant laws. The tool typically comes with built-in features that adjust pay rates according to the specific rules governing overtime and holiday pay in the employer’s jurisdiction.

For example, if the state requires double-time pay for certain holidays, the check stubs maker will automatically apply the correct pay rate for employees working on those holidays. This ensures that your business stays compliant with labor laws and that employees are paid correctly for overtime and holiday hours.

3. Easy Tracking of Overtime and Holiday Hours

Managing overtime and holiday hours can be tricky, especially for businesses with large teams or employees working irregular hours. Keeping track of overtime and holiday hours manually can lead to confusion and errors.

A check stubs maker makes it easy to track overtime and holiday hours by allowing you to input the exact number of hours worked. The tool records this information and incorporates it into the employee’s pay stub. With this digital record, it’s easy to reference past pay stubs and see how many overtime and holiday hours an employee has worked over a specific period. This feature ensures that employees are not underpaid or overpaid for overtime and holiday hours.

4. Generating Professional and Transparent Pay Stubs

Transparency is key when managing payroll, particularly for overtime and holiday pay. Employees need to understand how their pay is calculated, including any overtime or holiday pay they are entitled to. A check stubs maker generates professional, easy-to-read pay stubs that clearly outline the breakdown of regular pay, overtime pay, and holiday pay.

Each pay stub will include detailed information, such as:

- Regular hours worked and pay

- Overtime hours worked and overtime pay rate

- Holiday hours worked and holiday pay rate

- Total deductions and net pay

By providing employees with clear, itemized pay stubs, a check stubs maker ensures that employees can easily verify their pay and understand how overtime and holiday pay are calculated. This transparency can improve employee satisfaction and reduce confusion or disputes.

5. Record Keeping and Reporting

Accurate record keeping is essential for both employers and employees. For employers, it’s important to maintain records of overtime and holiday pay for tax purposes, audits, and financial planning. For employees, having access to a history of overtime and holiday pay helps with personal record keeping, tax filings, and loan applications.

A check stubs maker stores pay stubs digitally, making it easy to access and review past records. This feature eliminates the need for paper-based storage, which can be prone to damage, loss, or theft. Instead, pay stubs are stored securely in the cloud or on your business’s computer system, ready to be accessed at any time.

Additionally, many check stubs makers offer reporting features that allow employers to generate reports on overtime and holiday pay. These reports can be useful for tracking labor costs, budgeting, and ensuring compliance with labor laws.

6. Employee Self-Service

In today’s digital world, employees appreciate the ability to access their pay stubs at any time, from anywhere. Many check stubs makers offer employee self-service portals where employees can log in and view their pay stubs online. This feature is especially useful for remote workers, part-time employees, and those who work irregular hours.

Through the self-service portal, employees can easily access their overtime and holiday pay details. They can check their pay stubs, verify the number of overtime or holiday hours worked, and see the corresponding pay. This reduces the need for employees to contact HR or payroll departments for information, saving time and improving efficiency.

Conclusion

Managing overtime and holiday pay doesn’t have to be complicated or time-consuming. By switching to a check stubs maker, employers can automate the process, ensure compliance with labor laws, and provide employees with transparent, accurate pay stubs. The tool simplifies calculations, reduces errors, and saves valuable time for both employers and employees.

If you’re still relying on manual payroll systems or outdated methods, it’s time to make the switch to a check stubs maker. With its numerous benefits, including automation, accuracy, compliance, and ease of use, a check stubs maker is an invaluable tool for businesses of all sizes. It will help you manage overtime and holiday pay with ease, keeping both your business and your employees happy.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown