When it comes to managing payroll, accuracy, efficiency, and convenience are key. Whether you’re a business owner, a freelancer, or someone managing a small team, ensuring that your employees get their pay on time and with the correct details is crucial. A free paycheck creator offers an excellent solution for generating paychecks quickly and without hassle. But a common question that arises is, “Can I save and print paychecks generated by the free paycheck creator?”

The answer is yes! Most free paycheck creator tools not only allow you to generate paychecks but also give you the option to save and print them. Let’s take a deeper look into how this works, the benefits of saving and printing paychecks, and how it can make managing payroll easier and more efficient.

What is a Free Paycheck Creator?

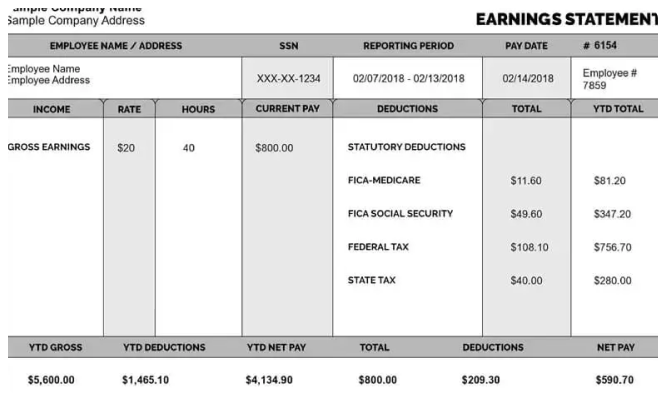

A free paycheck creator is an online or software-based tool that helps business owners and individuals generate accurate paychecks for their employees. This tool automates the payroll process, calculating wages, taxes, and deductions, and provides a pay stub for employees. By using a paycheck creator, businesses can save time and avoid the errors that come with manual payroll calculations.

These tools are especially useful for small businesses, freelancers, or self-employed individuals, as they provide an affordable solution to managing payroll. Many of these free paycheck creators allow users to input hours worked, employee information, and pay rates. The tool then generates a paycheck with detailed information, including gross pay, taxes, deductions, and net pay.

Saving Paychecks with a Free Paycheck Creator

One of the significant advantages of using a free paycheck creator is the ability to save paychecks for future reference. Once a paycheck is generated, the creator will typically offer an option to save the paycheck as a PDF file or another format of your choosing. This is beneficial for a few reasons:

1. Record-Keeping and Organization

Keeping accurate records is essential for any business. Having a saved copy of each paycheck ensures that you can easily refer back to previous payments. This is particularly important for tax purposes, audits, or even resolving any disputes with employees about their pay. Storing paychecks digitally eliminates the need for physical storage, which can take up valuable space and be difficult to manage.

2. Easy Access to Pay Stubs

If you or your employees need a copy of a pay stub for loan applications, tax filings, or other purposes, having the paycheck saved means that it’s easy to retrieve at any time. Simply open the saved file, and you have instant access to the pay information you need. No more searching through piles of paperwork or worrying about losing physical copies.

3. Backup for Payroll Records

Sometimes, mistakes happen. Perhaps a paycheck was incorrectly generated, or there was a clerical error. By saving the paychecks in a digital format, you ensure that you always have a backup in case something needs to be corrected or verified later on.

4. Tax Filing

When it’s time to file taxes, having a saved record of all paychecks can help you compile accurate figures. This will help in the preparation of tax returns, ensuring that you report wages, taxes withheld, and deductions correctly. You can use the saved paychecks to confirm your records and prevent mistakes.

Printing Paychecks from a Free Paycheck Creator

Printing paychecks is another essential feature offered by most free paycheck creators. When you generate a paycheck using the tool, it typically creates a printable format (like a PDF) that you can easily print and distribute to your employees. Here are some of the benefits of printing paychecks:

1. Convenient for Physical Distribution

While digital pay stubs are convenient, there are still businesses and employees who prefer physical paychecks. Printing paychecks allows you to hand out paper copies to employees, especially if they don’t have access to email or prefer to receive their pay information in physical form. It’s also a great option for businesses that have employees working on-site, allowing them to receive their paychecks in person.

2. Professional Appearance

Printed paychecks have a more professional appearance than handwritten pay stubs. This can help establish trust with employees, showing them that their pay is being handled in an organized and reliable way. Paychecks generated by a free paycheck creator often come with a pre-formatted template that includes all the necessary details like company name, employee information, pay period, and taxes, giving a polished, official look.

3. Legal and Tax Compliance

Printing paychecks and pay stubs helps businesses comply with local, state, and federal regulations regarding payroll documentation. In some states, businesses are required to provide employees with written pay stubs that show detailed information about their pay and deductions. Printing paychecks ensures that your business is meeting these legal obligations, and it helps employees keep accurate records of their earnings and taxes for future reference.

4. Ease of Distributing Payment

If you’re running a business where employees do not have direct deposit or prefer paper checks, printing paychecks is essential for distributing wages. The paycheck creator tool simplifies this process by offering an easy way to print out checks that can be signed and handed over to employees, streamlining the payment process.

How Does a Free Paycheck Creator Make Payroll More Efficient?

By offering features like paycheck saving and printing, a free paycheck creator significantly improves payroll efficiency. Here’s how it benefits businesses, freelancers, and employers:

1. Saves Time

With a free paycheck creator, generating paychecks is a quick and straightforward process. There’s no need for manual calculations, and the paycheck is generated in just a few steps. This saves time that would otherwise be spent on payroll tasks, allowing you to focus on running your business. Saving and printing paychecks is equally fast, making the overall payroll process much more efficient.

2. Ensures Accuracy

The paycheck creator tool automatically calculates all relevant payroll information, including hours worked, taxes, deductions, and overtime. This reduces the chances of human error and ensures that employees are paid the correct amount every time. By saving and printing accurate paychecks, you eliminate the possibility of miscommunication or confusion with employees about their pay.

3. Streamlines Employee Management

For employers, having access to saved paychecks makes employee management easier. You can track pay history, monitor payroll expenses, and ensure consistency in payments. Employees also benefit from having quick access to their pay stubs, reducing the time they spend requesting paycheck information. It improves communication and reduces payroll-related queries.

4. Cost-Effective Solution

Using a free paycheck creator is a cost-effective way to manage payroll. Traditional payroll methods, such as outsourcing to payroll services or hiring in-house payroll specialists, can be expensive. A free paycheck creator is an affordable alternative, especially for small businesses, freelancers, or startups that need to keep their expenses low.

Conclusion

In conclusion, the ability to save and print paychecks generated by a paycheck creator provides significant advantages to businesses of all sizes. Whether you’re running a small business, working as a freelancer, or managing a team, these tools help automate payroll tasks, ensuring accuracy, compliance, and efficiency. By saving paychecks, you have a secure digital record for future reference, while printing paychecks gives you a professional and legally compliant way to distribute payments.

The free paycheck creator eliminates manual payroll processes, saving time and reducing errors, while also offering an affordable solution for businesses looking to streamline their payroll system. Whether you need to save pay stubs for tax purposes, print checks for physical distribution, or simply keep organized payroll records, these tools are invaluable for efficient and accurate payroll management.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important