In today’s fast-paced world, managing payroll can be overwhelming, especially for businesses that employ workers across various employment types. Whether you’re a small business owner, a freelancer, or a manager at a large company, finding an efficient way to manage payroll is essential. One tool that has gained traction in recent years is the free paycheck creator. But, many wonder: Can a free paycheck creator be used for different types of employment, such as full-time, part-time, or contract workers?

The answer is yes, and in this blog, we’ll explore how a free paycheck creator can cater to various employment types, its benefits, and why it’s becoming a popular choice for employers and workers alike. We will also dive into the importance of accurate payroll management and how using the right tools can streamline the process for both businesses and employees.

What is a Free Paycheck Creator?

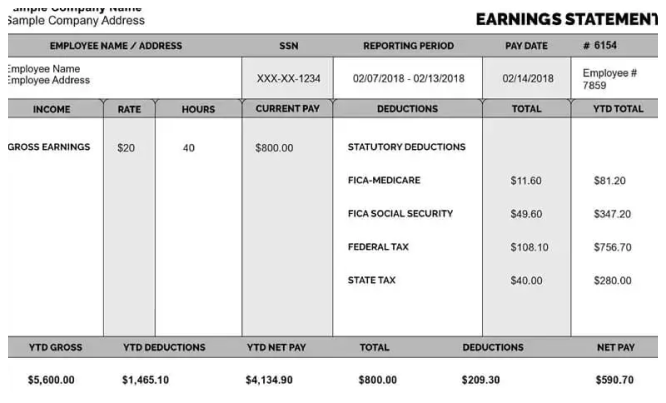

A free paycheck creator is an online tool that allows employers or independent workers to create pay stubs for employees. These pay stubs serve as an official record of earnings, taxes withheld, deductions, and net pay. With a paycheck creator, you can easily generate detailed pay stubs without needing to be a payroll expert.

Many free paycheck creators offer customizable templates to ensure that every paycheck accurately reflects the employee’s pay and deductions. Some tools also integrate with payroll systems and tax calculators, simplifying the process further. Most importantly, a free paycheck creator can save businesses time, reduce errors, and ensure employees get the correct pay on time.

Can a Free Paycheck Creator Be Used for Full-Time, Part-Time, and Contract Workers?

The short answer is yes, and here’s why:

1. Full-Time Employees

Full-time employees work a set number of hours, usually 40 hours per week, and are often entitled to benefits such as health insurance, paid time off (PTO), and retirement plans. These workers typically receive a salary or hourly wages, depending on the nature of their job.

When using a free paycheck creator for full-time employees, employers can easily input the following information:

- Salary or hourly rate

- Number of hours worked (for hourly employees)

- Overtime pay, if applicable

- Deductions (taxes, insurance, etc.)

- Bonuses or other additional earnings

A free paycheck creator helps ensure that all of these factors are accurately calculated and reflected in the pay stub. It can also include deductions like federal and state taxes, Social Security, and Medicare, making it ideal for full-time workers who rely on regular payroll.

2. Part-Time Employees

Part-time employees work fewer hours than full-time employees, often working less than 30-35 hours per week. They may or may not be eligible for benefits depending on the employer’s policies.

For part-time employees, a free paycheck creator works similarly to the full-time model but allows more flexibility for varying hours worked. Here’s what can be managed:

- Hourly rates or fixed pay

- Total hours worked for the pay period

- Overtime pay, if applicable (especially if part-time workers work beyond their scheduled hours)

- Deductions based on income and applicable tax rates

The beauty of using a free paycheck creator is that it allows businesses to easily track and calculate hours worked for part-time employees, reducing the risk of errors or missed payments.

3. Contract Workers

Contract workers, also known as independent contractors, are typically self-employed and work on a project-by-project basis. They aren’t entitled to the same benefits as full-time employees, and their pay is often based on the contract terms they’ve agreed upon.

Contract workers can use a free paycheck creator to generate pay stubs as well, but with a few important differences:

- Payment type: Contractors are usually paid by the project or hour. The paycheck creator allows the entry of a fixed amount or an hourly rate for the specific work completed.

- Tax considerations: Unlike employees, contractors are responsible for their own taxes. The paycheck creator will help outline the gross income but will not typically include tax withholdings. Instead, contractors will need to set aside the appropriate percentage for self-employment taxes.

- Deductions: Contractors may not have benefits or deductions like employees do, but they might have specific tax-related deductions to account for, which can be input into the paycheck creator.

Using a paycheck creator helps contractors maintain accurate records of their payments, which is essential for tax reporting and financial management. By having detailed pay stubs, contractors can also keep track of their earnings for personal use or when applying for loans or credit.

Benefits of Using a Free Paycheck Creator

Regardless of the employment type, a free paycheck creator offers numerous benefits for both employers and employees. Here’s why more people are turning to this tool for payroll management:

1. Accuracy

Calculating pay manually can lead to mistakes, especially when working with multiple employees. A paycheck creator automatically calculates wages, taxes, and deductions, ensuring accuracy and reducing errors. This is particularly important when managing a diverse workforce with different pay rates and benefits.

2. Time-Saving

Payroll can be time-consuming, particularly if you have a large workforce or deal with various types of employment. A paycheck creator simplifies the process, allowing you to quickly generate pay stubs without spending hours on calculations. This is especially beneficial for small business owners, freelancers, or managers who need to streamline operations.

3. Compliance

For employers, staying compliant with tax laws and labor regulations is essential. A paycheck creator helps ensure that the proper taxes are deducted and that employees receive accurate records of their pay. This helps businesses avoid penalties and legal complications that can arise from improper payroll processing.

4. Convenience

Most free paycheck creators are cloud-based, meaning you can access them from anywhere, at any time. Whether you’re a remote worker, a business owner on the go, or a contractor working from multiple locations, you can generate pay stubs whenever you need them.

5. Record-Keeping

Accurate records are essential for both employers and employees. A paycheck creator allows you to easily store pay stubs electronically, making them readily accessible for future reference. This is especially important for contractors and employees who may need these records for tax filing, loan applications, or disputes.

Best Practices for Using a Free Paycheck Creator

To make the most of your free paycheck creator, follow these best practices:

- Keep Detailed Records: Always ensure you’re inputting the correct hours worked, wages, and deductions. Accurate records help maintain payroll consistency and prevent potential disputes.

- Review Pay Stubs: Employees should review their pay stubs regularly to ensure that everything is correct. If discrepancies arise, it’s easier to address them sooner rather than later.

- Stay Updated on Tax Changes: Tax rates and labor laws can change, so make sure your paycheck creator is updated regularly. This ensures compliance and accuracy.

- Use for All Employment Types: Whether you’re handling full-time, part-time, or contract workers, a paycheck creator can be customized to meet the specific needs of each employee type.

Conclusion

A free paycheck creator is a powerful tool that can streamline payroll for various types of employment, including full-time, part-time, and contract workers. It ensures accuracy, saves time, and provides convenience for both employers and employees. By using this tool, businesses can simplify payroll processing, remain compliant with tax laws, and provide their workers with reliable pay stubs.

For businesses of all sizes and industries, adopting a paycheck creator can lead to smoother operations, fewer mistakes, and happier employees. Whether you’re a manager overseeing a team of full-time staff or a contractor managing your work, a free paycheck creator can make managing your pay and taxes a lot easier. So, if you haven’t already, consider implementing this tool today and take the stress out of payroll.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important