In the retail industry, clear and accurate pay stubs are essential for maintaining trust between employers and employees. Whether you run a small retail business or manage a large chain, ensuring your employees understand how their pay is calculated is key to a positive working relationship. This transparency not only helps with employee satisfaction but also ensures that your business remains compliant with labor laws.

One of the most efficient ways to create clear and professional pay stubs is by using a paystub creator. This tool can help you generate pay stubs quickly, accurately, and in a format that’s easy for retail employees to understand. In this blog, we’ll explore the importance of transparent pay stubs, how a paystub creator can streamline the process, and best practices for creating pay stubs that meet your business needs and keep employees informed.

What is a Paystub Creator?

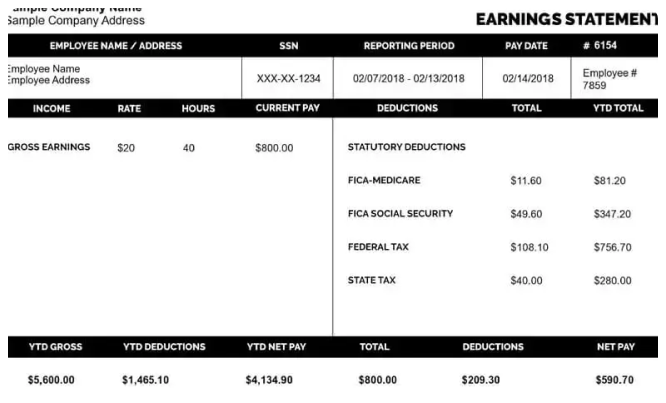

A paystub creator is an online tool or software that allows businesses to generate pay stubs for their employees. Pay stubs typically include a detailed breakdown of an employee’s earnings for a specific pay period, as well as deductions for taxes, benefits, and other items. By inputting basic information, such as hours worked, pay rate, and deductions, a paystub creator automatically calculates earnings, taxes, and net pay, then generates a pay stub that can be downloaded, printed, or shared electronically with employees.

For retail businesses, where many employees work hourly and may have variable shifts, using a paystub creator ensures that each employee’s pay is accurately calculated, transparent, and easy to understand. This is especially important in retail, where pay structures often involve hourly wages, overtime pay, tips, and commissions.

Why Transparent Pay Stubs Matter in Retail

Transparent pay stubs are crucial in any industry, but they hold particular importance in retail. Retail employees often work variable hours, earn commissions, and may be entitled to overtime pay, all of which can complicate pay calculations. Clear and transparent pay stubs allow employees to easily understand how their pay is calculated, which builds trust and reduces potential misunderstandings or disputes.

Here are a few reasons why transparent pay stubs are essential for retail businesses:

1. Employee Trust and Satisfaction

Employees are more likely to feel valued and respected when they understand how their pay is determined. Transparent pay stubs help prevent confusion about earnings, taxes, and deductions. When employees have access to clear, detailed pay stubs, they can easily track their wages and understand any discrepancies or changes in their pay.

Retail businesses that provide transparent pay stubs show employees that they care about their compensation and are committed to fairness. This can lead to higher employee morale, increased retention rates, and improved job satisfaction.

2. Compliance with Labor Laws

Retail employers are required by law to provide accurate pay stubs to their employees. In many states, employees must be given a detailed breakdown of their pay, including hours worked, hourly rates, deductions, and net pay. By using a paystub creator, employers can ensure that pay stubs meet legal requirements and avoid penalties or legal issues related to incorrect or incomplete pay information.

3. Simplified Tax Reporting

For both employees and employers, having accurate and transparent pay stubs simplifies tax reporting. Employees can use their pay stubs to report income and deductions during tax season. Additionally, employers can use the pay stubs as a record of payments made to employees, which helps in filing taxes and maintaining financial records for the business.

How a Paystub Creator Simplifies the Process

A paystub creator takes the guesswork and manual calculations out of the payroll process, making it easier for business owners to provide accurate, transparent pay stubs. Below are the key ways a paystub creator simplifies the process of generating pay stubs for retail employees.

1. Automatic Calculations

The most significant benefit of using a paystub creator is its ability to automatically calculate earnings, taxes, and deductions based on the information you input. Whether you have hourly employees, salaried employees, or those earning commissions or tips, the paystub creator can calculate gross pay, net pay, tax withholdings, and deductions automatically.

This automation reduces the chances of human error and ensures that all calculations are accurate. Retail business owners can be confident that the pay stubs generated are correct and up to date, especially when it comes to tax rates and benefit deductions.

2. Customization Options

A good paystub creator allows for customization, so you can tailor each pay stub to reflect the unique needs of your business and employees. For example:

- Overtime Pay: Many retail employees work overtime, and it’s crucial to show how overtime pay is calculated on their pay stubs. A paystub creator can allow you to enter regular hours worked, as well as overtime hours, and calculate the appropriate pay based on the overtime rate.

- Commissions and Bonuses: If your retail employees earn commissions or bonuses, the paystub creator can include these additional earnings on their pay stubs. By clearly showing these extras, you can ensure transparency and accuracy in payment.

- Deductions: Your paystub creator can also include any deductions, such as healthcare benefits, retirement contributions, or union dues. With customizable fields, you can ensure that all deductions are accurately tracked and clearly displayed for employees.

3. Easily Accessible and Shareable

Most paystub creators offer the ability to generate digital pay stubs that can be shared with employees electronically. This feature makes it easy for retail businesses to distribute pay stubs to employees, especially those who work irregular hours or on weekends. Employees can receive their pay stubs directly via email, download them from a secure portal, or even access them through an employee app.

This digital distribution saves time and effort compared to handing out paper pay stubs manually. It also provides employees with easy access to their pay stubs whenever they need them, which is particularly helpful if they have questions about their pay or need the information for tax filing.

4. Detailed Breakdown

A well-designed paystub creator ensures that pay stubs provide a detailed, transparent breakdown of an employee’s pay. Retail employees will see a clear division of:

- Gross pay (total earnings before deductions)

- Deductions (taxes, benefits, etc.)

- Net pay (take-home pay)

- Hours worked (for hourly employees)

- Commission or bonus earnings (if applicable)

- Overtime pay (if applicable)

This transparency helps employees understand exactly how their pay is calculated and allows them to spot any discrepancies quickly.

5. Record-Keeping and Reporting

A paystub creator makes it easy to store and track pay stubs over time. Both employers and employees can access historical pay stubs, which are useful for tracking earnings, deductions, and taxes throughout the year. For business owners, having a digital record of all pay stubs makes it easy to maintain payroll history for tax reporting, audits, or employee inquiries.

Best Practices for Using a Paystub Creator in Retail

To get the most out of your paystub creator, here are some best practices for retail businesses:

1. Ensure Accurate Data Input

Always double-check the data you input into the paystub creator, such as hours worked, overtime, and commissions. Accurate data entry is crucial for ensuring that the pay stubs are correct.

2. Update Tax Information Regularly

Tax rates and deductions can change over time, so it’s essential to keep your paystub creator updated with the latest tax information. This will ensure that the pay stubs are accurate and reflect current tax laws.

3. Communicate with Employees

While paystub creators make generating pay stubs easier, it’s important to communicate with your employees about how to read their pay stubs. Ensure they understand the breakdown of earnings, deductions, and taxes. Clear communication fosters transparency and reduces misunderstandings.

4. Store Pay Stubs Securely

Ensure that pay stubs are stored securely, either digitally or physically. Many paystub creators offer secure cloud storage, so you can easily access and share pay stubs when needed.

Conclusion

Creating transparent, accurate pay stubs for retail employees doesn’t have to be difficult. A paystub creator simplifies the process by automating calculations, providing customizable options, and ensuring clear, transparent pay stubs. By using this tool, retail employers can ensure that employees understand their pay, trust the accuracy of their earnings, and feel confident that they are being compensated fairly.

Whether you’re running a small retail shop or managing a large retail operation, a free paystub creator can save time, reduce errors, and improve communication with your employees. Embrace this technology to streamline your payroll process and ensure that your retail business remains transparent, compliant, and efficient.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown