Managing international payroll can be a complex task for businesses with a global workforce. From dealing with different currencies and tax regulations to ensuring timely salary payments, payroll management requires accuracy and efficiency. A free paycheck creator can simplify this process, making it easier for companies to manage payments for international employees while staying compliant with regulations.

In this guide, we will explore the challenges of international payroll and how a free paycheck creator can help streamline payroll management for businesses operating in multiple countries.

Understanding International Payroll Challenges

Before we dive into the benefits of using a free paycheck creator, let’s explore some of the common challenges companies face when handling international payroll:

1. Currency Exchange Rates

One of the biggest challenges of managing international payroll is dealing with multiple currencies. Exchange rates fluctuate constantly, which can impact the amount employees receive when converted to their local currency.

2. Tax Compliance and Regulations

Every country has different tax laws and labor regulations. Businesses must comply with these laws to avoid penalties and legal issues. This includes understanding tax deductions, social security contributions, and reporting requirements.

3. Payment Methods and Banking Differences

International employees may not have access to the same banking systems as domestic workers. Some countries rely on wire transfers, while others prefer digital payment platforms. Ensuring timely and secure payments is crucial.

4. Time Zone Differences

Coordinating payroll across multiple time zones can be tricky, especially when ensuring that payments are processed and received on time.

5. Employee Classification

Companies must correctly classify employees as full-time, part-time, or independent contractors to comply with tax and labor laws. Misclassification can lead to legal and financial consequences.

How a Free Paycheck Creator Can Help

A free paycheck creator can simplify the process of managing international payroll by automating calculations and ensuring compliance with tax regulations. Here’s how it can help:

1. Automated Payroll Processing

A free paycheck creator can calculate wages, tax deductions, and other payroll-related figures automatically. This reduces the risk of human error and ensures that employees receive accurate payments.

2. Multi-Currency Support

Many paycheck creators allow businesses to generate paychecks in different currencies. This makes it easier to manage payroll for employees working in various countries.

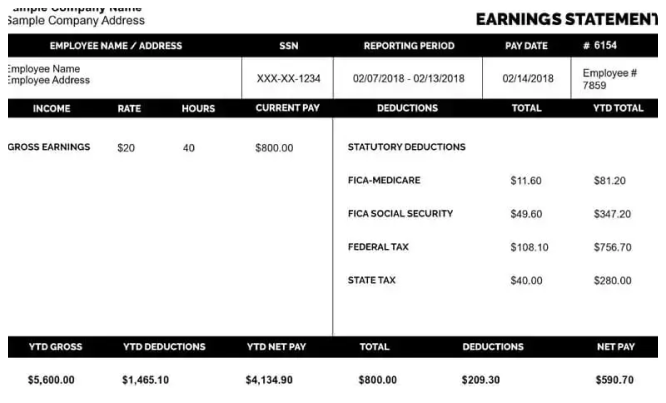

3. Customizable Paycheck Templates

A free paycheck creator provides customizable templates that include important details such as employee name, pay period, earnings, deductions, and employer information. This ensures that each paycheck meets local requirements.

4. Tax Compliance Assistance

A paycheck creator helps businesses apply the correct tax deductions based on local tax laws. This minimizes the risk of non-compliance and ensures that businesses meet regulatory requirements.

5. Faster Payroll Processing

Instead of manually calculating payroll, businesses can use a free paycheck creator to generate pay stubs instantly. This saves time and ensures that employees are paid on time, regardless of location.

6. Digital Access and Record Keeping

A free paycheck creator allows businesses to store payroll records digitally. This makes it easy to access past pay stubs for tax reporting and employee inquiries.

Steps to Manage International Payroll with a Free Paycheck Creator

Now that we understand the benefits, let’s look at how to use a free paycheck creator for international payroll management.

Step 1: Gather Employee Information

Collect essential details for each employee, including:

- Full name

- Job title

- Pay rate

- Tax identification number (if applicable)

- Payment method (bank transfer, digital wallet, etc.)

Step 2: Determine Payment Schedule

Decide whether you will pay employees weekly, bi-weekly, or monthly. Make sure the schedule aligns with local labor laws and employee expectations.

Step 3: Input Payroll Data into the Paycheck Creator

Use the free paycheck creator to enter employee details, including:

- Gross salary

- Overtime pay (if applicable)

- Bonuses and deductions

- Tax withholdings

Step 4: Generate Paychecks

Once all data is entered, generate paychecks for employees. The tool will automatically calculate net pay after taxes and deductions.

Step 5: Distribute Paychecks

Send digital pay stubs to employees or print them for physical distribution. Ensure employees receive their payments through their preferred banking method.

Step 6: Keep Payroll Records

Maintain records of all pay stubs for future reference. This is important for tax reporting and compliance.

Best Practices for Managing International Payroll

To make international payroll management more efficient, follow these best practices:

1. Use Payroll Software Alongside a Free Paycheck Creator

While a free paycheck creator is a great tool, integrating it with payroll software can further streamline payroll processing.

2. Stay Updated on Tax Laws

Laws and regulations change frequently. Regularly check for updates to ensure compliance with local tax laws.

3. Provide Transparent Payroll Information

Clearly communicate payroll policies with international employees. Make sure they understand how their salary is calculated and when they will be paid.

4. Ensure Secure Payment Methods

Use reliable and secure payment systems to transfer salaries to international employees. This helps avoid delays and transaction issues.

5. Regularly Review Payroll Processes

Assess your payroll system periodically to identify areas for improvement. This can help enhance efficiency and reduce errors.

Conclusion

Managing international payroll doesn’t have to be overwhelming. A free paycheck creator simplifies the process by automating calculations, ensuring tax compliance, and generating accurate pay stubs. By following the right steps and best practices, businesses can ensure smooth payroll operations for their international workforce.

Whether you’re a small business expanding globally or a company managing remote employees, using a free paycheck creator can save time and help you stay organized. Start using one today and experience the benefits of hassle-free international payroll management!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do