Managing payroll is an essential yet time-consuming task for any business. Whether you are a small business owner, an HR manager, or an entrepreneur managing a startup, ensuring that your employees are paid accurately and on time is crucial for maintaining morale and keeping your operations running smoothly. One tool that can make this process easier and more efficient is a free paycheck creator.

As we move into 2025, businesses are increasingly looking for cost-effective solutions to manage payroll without compromising on accuracy. The good news is that you don’t have to invest in expensive payroll software to handle paycheck creation. With a free paycheck creator, businesses of all sizes can streamline the payroll process, reduce errors, and save time and money.

In this blog, we’ll discuss how a paycheck creator can benefit your business, highlighting key features and advantages that can make payroll management easier. Let’s take a look at why adopting a paycheck creator tool in 2025 is a smart move for any business.

1. Streamline Payroll Processing

One of the most significant benefits of using a free paycheck creator is the ability to streamline payroll processing. Payroll can be a complicated task, especially for businesses that have multiple employees with different pay rates, benefits, and deductions. Manually calculating wages, taxes, overtime, and deductions can be time-consuming and prone to errors.

A paycheck creator simplifies this process by automating many of these calculations. With just a few inputs—such as the number of hours worked, hourly rates, and deduction types—the paycheck creator can generate accurate paychecks in minutes. This automation saves you time and reduces the risk of human error.

For businesses that operate on tight schedules, this time-saving benefit can help you allocate resources to other essential tasks rather than spending hours on payroll every month.

2. Ensure Accuracy and Compliance

Tax calculations, deductions, and benefits are integral to any payroll process. A small mistake in calculating taxes, for example, can lead to serious consequences such as fines, audits, or compliance issues with the IRS. One of the key advantages of using a paycheck creator is that it helps ensure accuracy and compliance with tax laws and labor regulations.

Most free paycheck creator tools automatically update their systems to reflect changes in federal and state tax rates, ensuring that you are always in compliance with current laws. These tools will calculate the necessary federal, state, and local taxes based on the employee’s location, as well as any deductions for benefits, retirement plans, and insurance.

By using a paycheck creator, you are less likely to make mistakes that could result in costly fines or penalties. The automatic calculation of taxes and deductions ensures that both the business and employees are protected from any potential payroll-related compliance issues.

3. Save Money on Payroll Software

Traditional payroll software can be expensive, especially for small businesses or startups that are trying to keep costs low. Many full-featured payroll solutions require monthly subscriptions or annual fees, which can quickly add up.

A free paycheck creator provides a cost-effective alternative to expensive payroll software. Many free paycheck creator tools offer essential payroll functionalities, such as paycheck generation, tax calculations, and deductions, without charging a fee. This allows small businesses, freelancers, and self-employed individuals to manage payroll without a large financial investment.

By opting for a free paycheck creator, your business can save money that would otherwise go toward costly payroll software. This saved capital can be reinvested into other areas of your business, such as marketing, inventory, or employee development.

4. Improve Employee Satisfaction

Employees appreciate timely and accurate paychecks. If payroll is delayed or there are mistakes on their pay stubs, employees may feel frustrated or even lose trust in their employer. A paycheck creator can help you avoid these issues by generating paychecks that are accurate and on time.

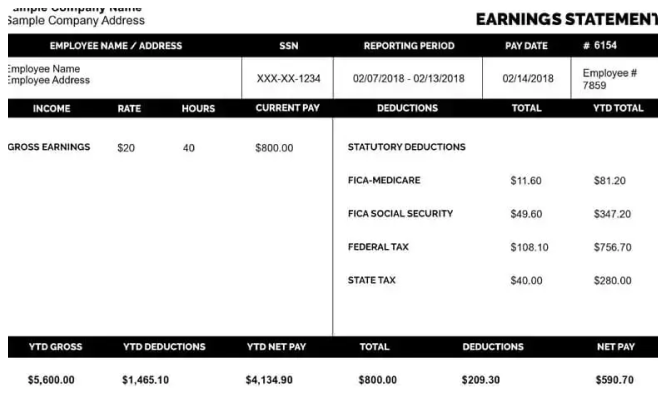

The transparency provided by paycheck creators is also crucial in fostering good employee relations. Pay stubs created through paycheck generators typically include a breakdown of earnings, taxes, deductions, and other important details, helping employees better understand how their pay is calculated.

Additionally, offering a quick and easy way for employees to access their pay stubs and paycheck information can lead to higher job satisfaction. Many paycheck creators provide employees with online access to their pay stubs, allowing them to view and download their pay information whenever they need it. This level of transparency can go a long way in building employee trust and satisfaction.

5. Increase Payroll Efficiency

Efficient payroll management is vital for any business, regardless of size. A free paycheck creator tool can increase payroll efficiency by automating several time-consuming tasks. With a paycheck creator, you can quickly calculate wages, generate pay stubs, and ensure that all necessary deductions are included.

For businesses with many employees, a paycheck creator can significantly speed up the payroll process. Instead of manually entering data for each employee, you can input the relevant information into the tool, and it will automatically calculate and generate pay stubs. This means you can process payroll much faster and with fewer manual steps, leading to overall increased efficiency.

Furthermore, paycheck creators often come with features such as payroll templates and easy-to-use interfaces that make it easier to track employee hours, calculate overtime, and manage deductions. This efficiency not only saves time but also reduces the likelihood of mistakes that can occur when manually handling payroll.

6. Customizable Pay Stubs

A free paycheck creator gives you the flexibility to create customized pay stubs that reflect your business’s unique needs. Most paycheck creator tools allow you to personalize the layout, including the ability to add your business logo, payment terms, and employee-specific information. Customizing pay stubs helps create a professional appearance and enhances the overall image of your business.

Moreover, some tools allow you to include additional fields, such as commission or bonus payments, making it easier to account for variable compensation structures. Customizable pay stubs are especially useful for businesses with diverse employee roles or non-traditional pay structures, such as freelancers, contractors, or part-time employees.

Having well-designed, professional pay stubs can also help in situations where you need to prove payments for tax purposes, loans, or legal matters. They provide a clear and official record of the payments made to employees.

7. Easily Track Payroll Records

Tracking payroll records is essential for both compliance and record-keeping purposes. By using a free paycheck creator, you can maintain accurate and organized payroll records. Many paycheck creators offer the option to store previous pay stubs, making it easy to access historical payroll information when needed.

For businesses that are required to keep payroll records for a certain number of years (such as for tax purposes), having these records readily available can save time and prevent potential legal issues. You can also share these records with employees or auditors, if necessary, ensuring that all parties have access to the same information.

8. Scalability as Your Business Grows

As your business grows, so does your payroll complexity. Managing payroll for a few employees is easy, but as you hire more staff, the process becomes more complicated. A free paycheck creator can scale with your business. While the free versions of many paycheck creators are ideal for small businesses or startups, many tools offer paid upgrades that provide more advanced features as your business grows.

These paid features might include direct deposit integration, tax filing services, and access to HR tools for managing employee benefits and time off. Whether you stay with the free version or decide to upgrade as your business expands, a paycheck creator can evolve with your needs.

Conclusion

In 2025, businesses need tools that simplify tasks, improve efficiency, and save money. A free paycheck creator is one of the best solutions for businesses looking to manage payroll with ease. By automating calculations, ensuring accuracy, saving money on software, and improving employee satisfaction, a paycheck creator can benefit your business in many ways.

Whether you’re a small business owner, freelancer, or HR manager, adopting a paycheck creator tool will save you time and effort while keeping your payroll operations smooth and compliant. The best part is that these tools are often free to use, providing a cost-effective solution for businesses of all sizes.

Consider implementing a paycheck creator in your business today to take control of your payroll process and set yourself up for success in the years to come!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?

Access Your Pay Information Using eStub in 2025