Managing payroll and employee payments can be a complex task for any business, big or small. One essential tool that can simplify this process is a check stub maker. If you’re a business owner or manager, understanding how a check stub maker works and the benefits it offers can help streamline your operations and maintain professionalism. In this blog, we’ll cover everything you need to know about check stub makers, how they can benefit your business, and tips for choosing the right one.

What is a Check Stub Maker?

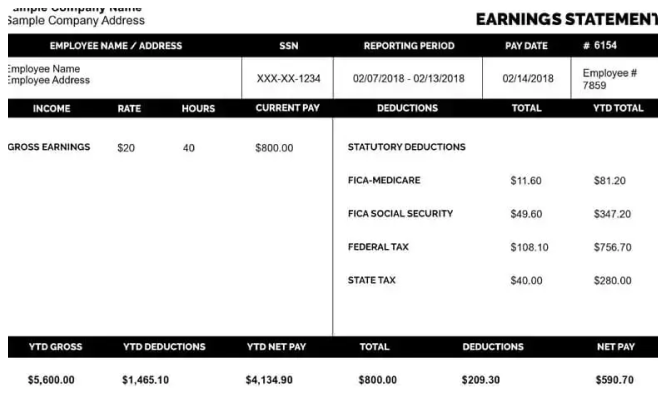

A check stub maker is an online tool or software that allows businesses to create pay stubs easily. Pay stubs are documents that detail an employee’s earnings, taxes withheld, and other deductions for a specific pay period. These stubs serve as an official record of payment and are essential for both employees and employers.

Using a check stub maker ensures that pay stubs are accurate, professional-looking, and compliant with legal standards. This is especially important for businesses that want to maintain a good relationship with their employees and ensure proper record-keeping for tax purposes.

Why Your Business Needs a Check Stub Maker

1. Accuracy in Calculations

One of the biggest challenges in payroll management is ensuring that calculations are correct. Manual calculations can lead to mistakes, resulting in employee dissatisfaction or tax complications. A check stub maker automates these calculations, ensuring that gross pay, deductions, and net pay are accurate every time.

2. Time Efficiency

Creating pay stubs manually can be time-consuming. A check stub maker speeds up the process, allowing you to generate pay stubs quickly without spending hours on paperwork. This efficiency can save valuable time for both you and your employees, enabling you to focus on other essential business tasks.

3. Professional Appearance

A well-designed pay stub reflects professionalism. When employees receive clear, organized, and professional pay stubs, it enhances their trust in your business. A check stub maker allows you to customize the design of your pay stubs, adding your company logo and using consistent branding elements.

4. Improved Record Keeping

Keeping track of employee payments is crucial for any business. Pay stubs generated through a check stub maker serve as official records of payment. This can be invaluable during tax season or if you face an audit. Having organized records makes it easier to access information when needed.

5. Compliance with Tax Laws

Tax regulations can be complex and vary by state. A reliable check stub maker stays updated with current tax laws, helping you remain compliant. This reduces the risk of errors that could lead to penalties or legal issues down the line.

How to Choose the Right Check Stub Maker

With various options available, choosing the right check stub maker for your business can be challenging. Here are some key factors to consider:

1. User-Friendly Interface

A check stub maker should be easy to navigate, even for those who are not tech-savvy. Look for a tool with a simple layout and clear instructions to help you create pay stubs without hassle.

2. Features and Customization

Consider what features you need in a check stub maker. Look for options that allow customization, such as adding your logo, changing colors, and selecting different templates. Other helpful features may include automatic calculations, secure storage, and cloud access.

3. Cost

Check stub makers vary in price, from free options to subscription-based services. Assess your budget and determine which features are essential for your business. Sometimes, investing in a paid service may offer better features and support.

4. Customer Support

Reliable customer support is crucial when using any software. If you encounter issues or have questions, ensure that the check stub maker provides multiple support options, such as live chat, email, or phone assistance.

5. Security Features

Since you’ll be handling sensitive employee information, security should be a top priority. Choose a check stub maker that offers encryption and secure data storage to protect your business and employees’ information.

Getting Started with a Check Stub Maker

Once you’ve chosen a check stub maker, follow these steps to get started:

Step 1: Sign Up for an Account

Most check stub makers require you to create an account. This usually involves providing your email address, creating a password, and possibly entering your business details.

Step 2: Familiarize Yourself with the Dashboard

Take some time to explore the dashboard of the check stub maker. Familiarize yourself with the features and layout, which will make it easier to create pay stubs later.

Step 3: Enter Employee Information

To generate a pay stub, you’ll need to input relevant information about the employee, including their name, address, and pay rate. If applicable, add their employee ID or Social Security number.

Step 4: Specify Pay Period and Hours Worked

Enter the pay period for which you are generating the pay stub. This includes the start and end dates, along with the total hours worked during that period.

Step 5: Add Earnings and Deductions

Input the gross pay and any deductions that apply, such as federal and state taxes, Social Security, Medicare, and retirement contributions. Many check stub makers will automatically calculate these figures based on the information you provide.

Step 6: Review and Customize

Before finalizing the pay stub, review all the entered information for accuracy. Customize the design by adding your logo and choosing colors that reflect your brand.

Step 7: Generate and Download the Pay Stub

Once you’re satisfied with the information and design, generate the pay stub. You can typically download it as a PDF or print it directly.

Step 8: Save and Distribute

Save copies of the generated pay stubs for your records. Distribute the pay stubs to your employees, either by email or through physical copies.

Common Mistakes to Avoid

1. Neglecting Accuracy

Double-check all entered information to ensure accuracy. Mistakes in calculations or employee details can lead to serious issues down the line.

2. Ignoring Deductions

Ensure that all relevant deductions are accounted for in each pay stub. Missing deductions can lead to complications for both you and your employees.

3. Not Saving Copies

Always save copies of generated pay stubs for your records. This will be helpful during tax season and in case of audits or inquiries.

4. Using Outdated Software

Ensure that the check stub maker you choose is updated regularly to comply with current tax laws and regulations. Using outdated software can lead to compliance issues.

5. Overcomplicating Design

While customization is beneficial, avoid making pay stubs too complicated. A clean and simple layout is usually the most effective and professional.

Benefits of Using a Check Stub Maker for Small Businesses

For small business owners, the benefits of using a check stub maker are particularly significant:

1. Cost-Effectiveness

Many check stub makers offer affordable options tailored for small businesses. This means you can maintain professionalism without breaking the bank.

2. Flexibility

As a small business, you may have varying payment schedules or multiple contractors. A check stub maker provides the flexibility to create pay stubs for different pay structures easily.

3. Scalability

As your business grows, so will your payroll needs. A check stub maker can scale with you, allowing you to generate pay stubs for more employees or contractors without needing to switch software.

4. Better Employee Satisfaction

Providing employees with clear, professional pay stubs enhances their trust in your business. Happy employees are often more productive, contributing to a positive work environment.

Conclusion

A check stubs maker is a valuable tool for businesses looking to simplify payroll management. With benefits such as accuracy, time efficiency, and professional appearance, using a check stub maker can significantly improve your financial operations.

By choosing the right check stub maker for your needs and following best practices for generating pay stubs, you can streamline your payroll process and maintain compliance with tax regulations. Whether you’re a small business owner or managing a larger team, implementing a check stub maker can enhance your business’s professionalism and efficiency, ultimately leading to greater success.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown