Managing payroll can be overwhelming, especially for small businesses, nonprofits, and freelancers. A free paycheck creator simplifies this process, ensuring accurate payments, tax compliance, and proper record-keeping. This guide will help you understand how to use a paycheck creator effectively and maximize its benefits.

Why Use a Free Paycheck Creator?

A free paycheck creator automates calculations, saving time and reducing errors. Here’s why it’s a game-changer:

- Saves Time – No need for manual calculations.

- Ensures Accuracy – Minimizes errors in taxes and deductions.

- Cost-Effective – Ideal for businesses and freelancers on a budget.

- Easy Record-Keeping – Generates pay stubs for compliance and financial tracking.

Key Features of a Free Paycheck Creator

A good paycheck creator offers:

- Automatic Tax Calculations – Calculates federal, state, and local taxes.

- Customizable Pay Stubs – Allows adding earnings, deductions, and benefits.

- Employee and Contractor Payment Options – Supports different work classifications.

- Printable and Digital Paychecks – Provides flexible distribution options.

- Secure Data Storage – Ensures safe and accessible payroll records.

How to Use a Free Paycheck Creator Effectively

Step 1: Gather Employee Information

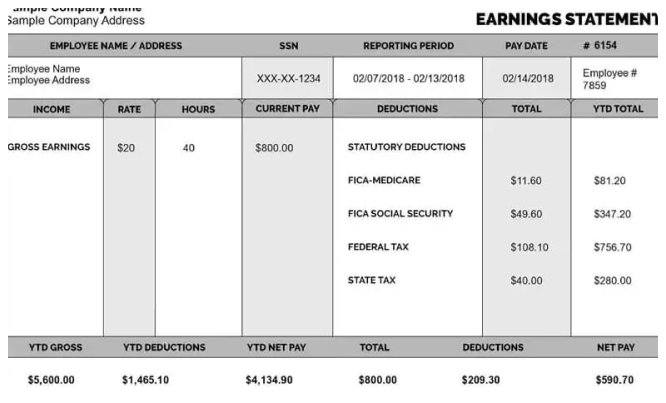

Before using a paycheck creator, collect essential details:

- Employee’s full name and Social Security Number (SSN)

- Tax withholding details (W-4 form)

- Pay rate and hours worked

- Any additional deductions or bonuses

Step 2: Choose a Reliable Free Paycheck Creator

Look for a tool that fits your needs, such as:

- Payroll4Free – Free for businesses with up to 25 employees.

- Check Stub Maker – Ideal for freelancers and small businesses.

- PaycheckCity – Offers tax calculators for accurate paychecks.

Step 3: Input Payroll Details

Enter the required details, including:

- Employee classification (full-time, part-time, contractor)

- Gross earnings (hourly wage/salary)

- Tax withholdings and deductions

- Payment frequency (weekly, bi-weekly, monthly)

Step 4: Generate and Review the Paycheck

Before finalizing:

- Double-check tax calculations.

- Ensure deductions and benefits are accurate.

- Preview the pay stub for errors.

Step 5: Print or Distribute Paychecks

Once verified, distribute the paycheck:

- Print – For physical record-keeping.

- Email – Digital delivery for convenience.

- Direct Deposit Support – Some tools integrate with banking services.

Common Mistakes to Avoid

1. Incorrect Tax Withholding

Use a paycheck creator that updates tax rates automatically.

2. Failing to Classify Workers Correctly

Misclassifying employees as independent contractors can lead to compliance issues.

3. Not Keeping Payroll Records

Store pay stubs and payroll records for tax and audit purposes.

4. Ignoring Overtime Pay Rules

Ensure compliance with federal and state labor laws regarding overtime wages.

Benefits of Using a Free Paycheck Creator

- Improves Payroll Accuracy – Reduces human errors.

- Ensures Compliance – Keeps up with payroll regulations.

- Enhances Transparency – Employees understand their earnings and deductions.

- Simplifies Financial Management – Helps with budgeting and tax preparation.

Final Thoughts

A free paycheck creator is a valuable tool for businesses, freelancers, and nonprofits. It simplifies payroll management, ensures compliance, and saves time. By following the steps outlined above, you can effectively generate accurate paychecks while avoiding common payroll mistakes. Explore different free paycheck creators today and streamline your payroll process effortlessly.