Nurses are the backbone of the healthcare industry, working tirelessly to provide patient care. However, managing nurse payroll can be complex due to varying shift schedules, overtime, and additional benefits. Ensuring accurate and timely payments is essential for maintaining staff satisfaction and operational efficiency. A free payroll check maker simplifies this process by automating calculations, reducing errors, and ensuring compliance with labor laws.

In this blog, we will discuss the importance of efficient nurse payroll management, the benefits of using a free payroll check maker, and how it can streamline payroll processing for healthcare facilities.

Challenges in Nurse Payroll Management

1. Irregular Work Hours and Overtime

Nurses often work:

- Rotating shifts (day, evening, and night)

- Overtime due to staff shortages

- Double shifts or on-call hours

Manually tracking these variations can be challenging, leading to payroll errors. A free payroll check maker automates these calculations, ensuring nurses receive accurate pay.

2. Compliance with Labor Laws and Tax Deductions

Healthcare employers must comply with:

- Federal and state labor laws

- Overtime pay regulations

- Tax withholding and deductions

A payroll check maker automatically calculates and includes necessary deductions, reducing legal risks.

3. Payroll Processing Efficiency

Manual payroll processing is time-consuming and prone to mistakes. Errors in nurse payroll can cause:

- Delayed payments

- Incorrect tax withholdings

- Employee dissatisfaction

Using a free payroll check maker streamlines this process, ensuring timely and accurate payments.

Benefits of Using a Free Payroll Check Maker for Nurse Payroll

1. Automation of Payroll Calculations

A free payroll check maker automatically calculates:

- Base pay

- Overtime pay

- Shift differentials

- Tax deductions

This eliminates the risk of human error and ensures precision in salary calculations.

2. Time and Cost Savings

By automating payroll, healthcare facilities save time and reduce administrative costs. Payroll software eliminates the need for manual data entry, allowing HR teams to focus on other essential tasks.

3. Accuracy and Transparency

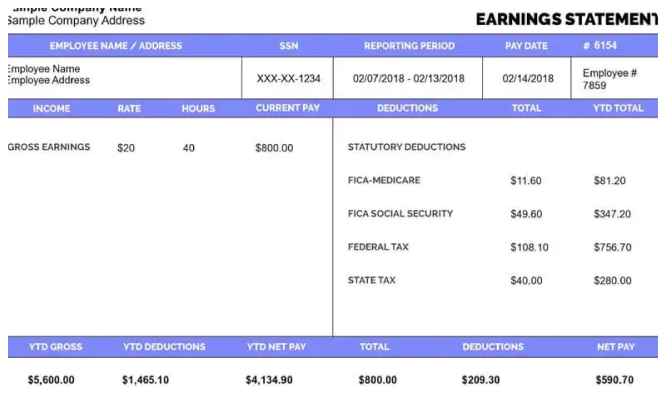

Nurses can access their payroll details, ensuring they are paid correctly for each shift. A free payroll check maker provides clear breakdowns of earnings, deductions, and net pay.

4. Easy Tax Filing and Compliance

Accurate payroll records simplify tax filing for both employers and employees. The software generates detailed pay stubs that include all necessary tax information.

5. Secure Digital Payroll Management

A free payroll check maker allows for secure digital payroll processing, reducing paperwork and ensuring compliance with data protection laws.

How to Use a Free Payroll Check Maker for Nurse Payroll

Step 1: Choose a Reliable Payroll Check Maker

Select a free payroll check maker that supports healthcare payroll needs, including shift differentials and overtime calculations.

Step 2: Input Nurse Payroll Data

Enter essential details such as:

- Employee name and designation

- Work hours and overtime

- Tax details and deductions

Step 3: Generate Payroll Checks

The software calculates earnings and deductions automatically, creating accurate payroll checks for each nurse.

Step 4: Distribute Payroll Checks

Payroll checks can be printed or distributed digitally, ensuring quick and hassle-free payments.

Step 5: Maintain Payroll Records

Store payroll records securely for tax filing, audits, and future reference.

Conclusion

Efficient nurse payroll management is crucial for healthcare facilities. A free payroll check maker simplifies the process by automating calculations, ensuring compliance, and reducing errors. By adopting payroll automation, healthcare providers can improve operational efficiency and keep their nursing staff satisfied with accurate and timely payments. If you’re managing nurse payroll manually, it’s time to switch to a free payroll check maker for a seamless and stress-free payroll process.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?