As an IT professional, keeping track of your earnings is crucial for managing your finances, planning for taxes, and ensuring that you’re being paid correctly. Whether you’re working as a freelancer, contractor, or full-time employee, a paystub template can be an invaluable tool to streamline the process. It’s a simple yet powerful solution that helps you track your income, deductions, and tax contributions accurately.

In this blog, we’ll explore how IT professionals can use a paystub template to track their earnings, and why it’s important for efficient financial management.

What Is a Paystub Template?

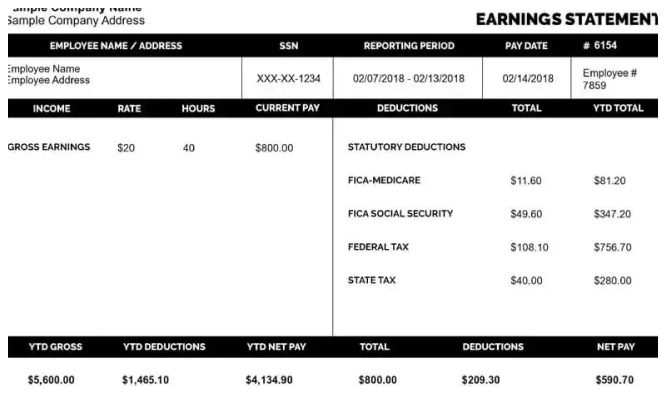

A paystub template is a document that breaks down your earnings, deductions, and other important payroll information. It typically includes details like your gross income, net pay, taxes withheld, and any other deductions, such as health insurance or retirement contributions. Paystub templates can be customized and generated easily, providing a clear and professional record of your income.

For IT professionals, especially those working as freelancers or contractors, having access to a paystub template can simplify tracking earnings across multiple projects or clients. It ensures that you maintain an organized record for budgeting, tax filing, and future financial planning.

Why IT Professionals Need a Paystub Template

Whether you are a software developer, network engineer, IT consultant, or any other IT professional, keeping track of your income is essential. Let’s dive into why a paystub template is particularly useful for those in the IT industry:

1. Accurate Record Keeping

In IT, professionals often work on different projects or have multiple clients at once, especially if they’re freelancing or contracting. With so many different sources of income, it can be easy to lose track of payments, especially if they are irregular or if clients have different billing schedules. A paystub template helps keep everything organized in one place.

You can create a pay stub for each project or client, which clearly outlines the income for that particular job. This makes it easy to reference later when reconciling your payments or preparing for tax season. Accurate record-keeping can save you from financial confusion and potential errors down the line.

2. Tracking Deductions

A paystub template doesn’t just track earnings. It also provides a detailed breakdown of deductions. If you are employed in-house, deductions may include income taxes, retirement contributions, and health insurance premiums. For freelancers or contractors, you may have additional expenses such as business-related deductions or self-employment taxes.

The template allows you to see all of this in one document, so you know exactly how much of your income is going to taxes, insurance, and savings. Keeping an eye on these deductions is key for tax planning and understanding how much money you are actually bringing home.

3. Simplifying Tax Filing

Taxes can be a headache for IT professionals, especially those who are self-employed or working with multiple clients. A paystub template can make tax season a lot easier. With all of your income and deductions listed, you’ll have everything you need to file your taxes accurately.

For freelancers and contractors, this is particularly helpful, as you need to report your income and calculate your self-employment taxes. Using a paystub template allows you to track both your gross income (before taxes) and your net income (after taxes), making the process of filing your tax return much simpler.

4. Avoiding Payment Discrepancies

If you’re working as an IT contractor or freelancer, you may experience occasional discrepancies with clients regarding the amount they owe. A paystub template provides a clear and detailed breakdown of what you have earned and when the payment was made.

In case of a payment dispute, a paystub serves as proof of the agreed-upon terms, which helps resolve the issue quickly. You can also use the template to outline any overtime or additional work that was done, ensuring that your client understands the full scope of your contribution.

5. Better Financial Planning

For IT professionals, financial planning is crucial, especially if you’re a freelancer or working on multiple short-term projects. A paystub template not only provides an immediate snapshot of your earnings but also helps you plan for the future.

By regularly generating pay stubs, you can track your income over time and identify trends. This can help you make informed decisions about saving, investing, and budgeting. You can also use the pay stubs to predict future income and ensure you’re meeting your financial goals.

6. Professionalism and Client Trust

If you’re an IT freelancer or contractor, presenting a professional image is vital for attracting and retaining clients. Using a paystub template shows clients that you’re organized, serious about your work, and transparent in your dealings. It helps establish trust, as clients can clearly see how much they owe you and when payments are due.

Additionally, providing a pay stub gives clients confidence that you’re managing your finances responsibly, making them more likely to continue working with you or refer you to others.

7. Easier Loan Applications

IT professionals who work as freelancers may need to apply for loans or mortgages at some point. Traditional lenders typically require proof of income when reviewing loan applications. A paystub template provides an easy-to-read and professional way of showcasing your earnings.

Since freelancers don’t have the consistent paychecks that full-time employees enjoy, a paystub can act as proof of your financial reliability. Whether you’re applying for a personal loan or a mortgage, having a pay stub to demonstrate your income can help strengthen your application.

8. Transparency for All Parties

A paystub template ensures transparency in your payments. As an IT professional, you might be paid hourly, per project, or on a retainer. Whatever your payment structure, a pay stub provides a clear breakdown for both you and your client. It can list the number of hours worked, the hourly rate, the total project fee, and any applicable deductions or bonuses.

This transparency can foster better relationships with clients by ensuring there are no misunderstandings about compensation. You and your clients can both reference the pay stub to make sure everything is accurate and agreed upon.

How to Use a Paystub Template Effectively

Using a paystub template is simple. Here’s a quick guide on how to use it effectively:

-

Choose a Reliable Paystub Generator: Start by selecting a paystub template that suits your needs. There are plenty of free and paid options online, so choose one that allows you to customize details like hourly rates, deductions, and project-specific information.

-

Enter Your Earnings Details: Fill in the details of your income, whether hourly or project-based. Be sure to include any bonuses, overtime, or tips that might apply to your work.

-

Track Deductions: Include deductions like taxes, retirement savings, or any other expenses. Some paystub templates automatically calculate taxes, but make sure everything is accurate.

-

Save and Print: Once you’ve entered all the information, save and print the pay stub for your records. You can also send it directly to clients as part of your invoicing process.

-

Keep a Record: Maintain a record of all pay stubs for future reference, especially when preparing for taxes or applying for loans.

Conclusion

For IT professionals, whether you’re a contractor, freelancer, or full-time employee, managing your earnings is crucial for financial stability. A paystub template can help you organize your income, track deductions, simplify tax preparation, and maintain professionalism in your work.

By regularly generating pay stubs, you gain better control over your finances and ensure transparency with clients. With all of your earnings and deductions documented, you can focus more on your work and less on the complexities of managing your income.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?