Property maintenance workers are essential to the upkeep of residential and commercial properties. These workers handle everything from routine repairs to emergency fixes, ensuring the property remains in excellent condition. As the number of maintenance staff grows, managing their payroll can become a challenge. That’s where tools like a free paycheck creator can make a significant difference.

A free paycheck creator is a simple tool that helps employers easily generate paychecks and pay stubs for their employees. It automates many payroll tasks, helping business owners and payroll managers save time and reduce the risk of errors. In industries like property maintenance, where employees often work varying hours, overtime, and on-call shifts, a free paycheck creator ensures that every worker is paid accurately and on time.

In this blog, we will explore how a free paycheck creator can streamline payroll for property maintenance workers, increase accuracy, and ensure compliance with labor laws, all while saving businesses time and money.

What Is a Paycheck Creator?

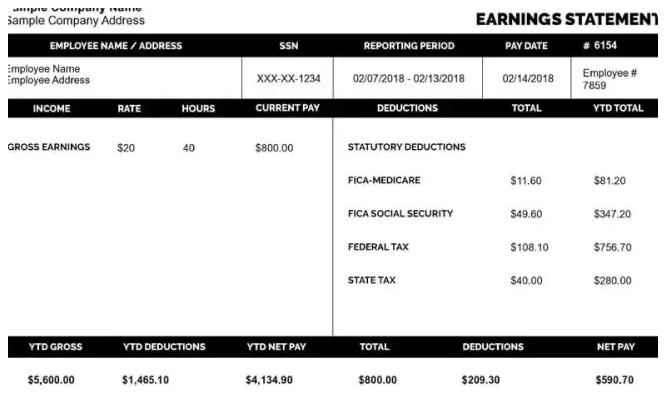

A paycheck creator is an online tool that generates paychecks and pay stubs for employees. By entering payroll information—such as hours worked, hourly wage, deductions, and bonuses—users can easily generate the necessary documents. These documents include detailed information such as gross pay, net pay, tax deductions, and overtime.

For property maintenance companies, using a free paycheck creator simplifies payroll management, enabling businesses to focus more on operations and less on manual calculations.

Why Property Maintenance Workers Need Accurate Payroll

Property maintenance workers often have complex pay structures. Some workers may be hourly, while others could be salaried. Additionally, overtime pay, on-call shifts, bonuses for emergency repairs, and holiday pay can all be part of their compensation. Ensuring accurate payroll is crucial for several reasons:

- Fair Compensation: Workers deserve to be paid correctly for their time, including overtime and any additional shifts worked.

- Compliance with Labor Laws: Property maintenance workers, like all employees, are entitled to certain protections under labor laws. For instance, overtime rules dictate that workers should be paid 1.5 times their normal wage for any hours worked beyond 40 hours a week.

- Employee Morale: Timely and accurate payments help maintain positive employee morale and reduce turnover rates. Workers are more likely to stay with a company that treats them fairly and handles their payroll correctly.

How a Free Paycheck Creator Can Help Property Maintenance Companies

1. Automated Payroll Calculations

One of the main advantages of using a free paycheck creator is automation. A paycheck creator takes the hassle out of payroll calculations. By entering the number of hours worked, hourly rates, and other compensation details, the tool automatically calculates the gross and net pay, as well as any deductions for taxes, insurance, or benefits.

This eliminates the risk of human error in manual calculations and reduces the time spent preparing paychecks. For property maintenance companies, which often have a mix of hourly and salaried employees, this can be a game-changer, ensuring every paycheck is accurate and reliable.

2. Customization for Different Pay Structures

In the property maintenance industry, workers may have varying pay structures. Some employees might be paid hourly, while others may receive a flat salary. Additionally, workers may earn overtime pay for working more than 40 hours per week, or they may receive special allowances for emergency repairs.

A free paycheck creator allows payroll managers to customize paychecks according to each worker’s pay structure. The tool can accommodate different wage rates for regular hours, overtime, and special shifts. Customization ensures that all employees are paid fairly and according to the work they perform.

3. Accurate Tax Calculations and Deductions

Property maintenance companies must adhere to federal and state tax regulations, and failing to comply can result in penalties. For workers, the proper calculation of deductions—such as Social Security, Medicare, and income tax—is crucial to ensure that they are paying the correct amount.

A free paycheck creator helps by automatically calculating the required deductions for each employee. Most paycheck creators include the latest tax rates for federal and state taxes, and they adjust the calculations according to the worker’s income and tax filing status. This helps ensure that the company stays compliant with tax laws and that employees’ paychecks reflect the correct deductions.

4. Reducing Payroll Processing Time

For businesses that manage multiple maintenance workers, especially across different job sites, payroll processing can take hours, especially if done manually. Using a free paycheck creator significantly reduces this time by automating the process.

Rather than spending hours manually calculating wages, bonuses, overtime, and deductions, property maintenance managers can generate paychecks in minutes. The time saved can be redirected toward other important tasks, such as managing maintenance projects, communicating with clients, or growing the business.

5. Simplified Record Keeping and Reporting

For businesses in the property maintenance industry, maintaining accurate payroll records is essential for tax purposes, audits, and employee inquiries. Using a free paycheck creator helps streamline record-keeping.

Most paycheck creators allow you to save and store pay stubs digitally. This feature makes it easy to access and review past pay stubs when needed. Whether you’re preparing for tax season or need a record for an employee, you can easily find and print out pay stubs at any time.

Additionally, some paycheck creators generate payroll reports that give business owners an overview of payroll expenses, tax liabilities, and other important data. These reports are helpful for budgeting and financial planning.

6. Employee Transparency

Providing employees with detailed pay stubs is essential for maintaining trust and transparency. A paycheck creator automatically generates pay stubs that outline all aspects of the employee’s pay, including hourly rates, hours worked, overtime, deductions, and net pay.

By giving property maintenance workers clear and easy-to-read pay stubs, businesses can avoid confusion or disputes regarding pay. This also helps employees keep track of their earnings and deductions, which is important when filing taxes or applying for loans.

7. Cost-Effective Solution

Small businesses, including property maintenance companies, often operate on tight budgets. Payroll software and services can be expensive, especially for those with only a few employees.

A free paycheck creator provides a cost-effective alternative to expensive payroll systems. These tools are often free or come at a very low cost, making them an excellent solution for small and medium-sized property maintenance companies. By using a free paycheck creator, businesses can keep payroll costs down while still ensuring accuracy and efficiency.

8. Time and Attendance Integration

Some free paycheck creators also allow for integration with time and attendance tracking systems. For property maintenance companies, where workers may clock in and out at various job sites, having a time-tracking system integrated with the paycheck creator can simplify the payroll process even further.

By linking time cards directly with payroll data, the paycheck creator can automatically calculate the total hours worked by each employee. This reduces the chance of errors that can occur when hours are manually inputted and ensures that employees are paid for every hour worked.

How to Implement a Free Paycheck Creator for Property Maintenance Workers

Implementing a free paycheck creator in your property maintenance business is simple. Here’s how you can get started:

-

Select a Free Paycheck Creator: Research online tools and choose one that suits your business needs. Look for a tool that supports multiple pay rates, tax calculations, and easy customization for your employees.

-

Input Employee Information: Enter the necessary information for each employee, such as their hourly rate, hours worked, and any deductions. Make sure all data is accurate to avoid errors in the paychecks.

-

Generate Paychecks: Once the data is entered, generate paychecks for each employee. Review the pay stubs to ensure everything is correct before distributing them to your workers.

-

Store Pay Stubs Digitally: Save the generated pay stubs for future reference and reporting. Keep these records organized for easy access when needed.

-

Review and Update: Regularly review and update your payroll data to ensure it stays current with tax laws, employee changes, and pay structure modifications.

Conclusion

Managing payroll for property maintenance workers doesn’t have to be complicated or time-consuming. A free paycheck creator can streamline the process by automating calculations, reducing errors, and ensuring compliance with tax laws. It offers property maintenance businesses a cost-effective way to manage payroll while maintaining accuracy, transparency, and employee satisfaction.

By incorporating a free paycheck creator, property maintenance companies can save time, reduce costs, and ensure that every worker is paid correctly and on time. This helps create a positive work environment, which is crucial for retaining top talent and maintaining the efficiency of the business.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?