Running a law firm involves a variety of complex tasks, from managing client relationships to ensuring that all legal paperwork is in order. One of the most crucial aspects of a law firm’s operation is payroll management. Payroll for law firms can be particularly tricky due to varying employee roles, salary structures, and the need to ensure compliance with legal regulations. A simple mistake in payroll can lead to legal complications, employee dissatisfaction, and financial penalties.

This is where using a free payroll check maker can simplify the payroll process. By incorporating this tool into your payroll system, law firms can save time, reduce errors, and improve the overall efficiency of payroll management. Let’s dive into how law firms can benefit from using a free payroll check maker and the ways it can improve payroll management.

What Is a Payroll Check Maker?

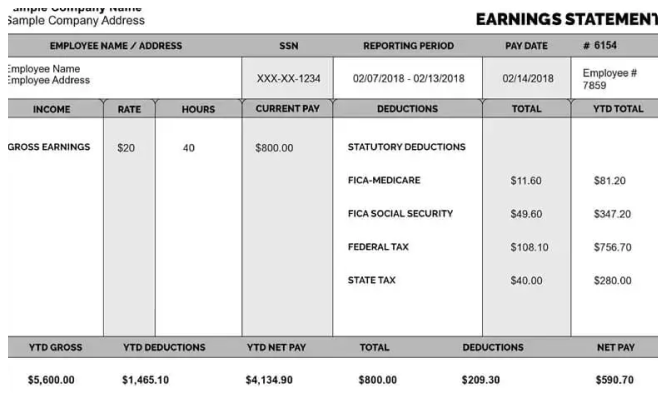

A payroll check maker is an online tool or software that allows businesses to generate payroll checks for employees. It simplifies the process by automating key elements of payroll, such as calculating gross wages, taxes, deductions, and net pay. With a free payroll check maker, law firms can create professional, accurate paychecks quickly and easily, without needing extensive payroll knowledge or a dedicated payroll team.

Most payroll check makers allow for customization, ensuring that the payroll checks meet the unique needs of your law firm. Additionally, these tools often include automatic calculations for taxes, overtime, and deductions, further streamlining the process.

Why Law Firms Need a Payroll Check Maker

Managing payroll in a law firm can be more complex than it seems. Here are some of the reasons law firms should consider using a free payroll check maker:

1. Varied Compensation Structures

In law firms, compensation structures can vary greatly depending on the role. Attorneys might receive a salary, while paralegals or administrative staff may be hourly employees. Some law firms may also employ temporary staff or contractors, all of whom require different pay structures. Managing these various compensation models can be tricky without a streamlined system.

A payroll check maker can handle these variations efficiently. It allows for the customization of pay rates and ensures that each employee, regardless of their role, is paid correctly. Whether it’s an attorney with a fixed salary or an hourly clerk, a payroll check maker helps ensure that all payments are accurate and timely.

2. Compliance with Legal Requirements

Law firms are bound by various legal and tax regulations, both federal and state. Payroll mistakes, such as failing to withhold the correct amount of taxes or incorrectly classifying employees, can lead to costly fines and legal trouble. A free payroll check maker helps law firms stay compliant with these requirements by automatically calculating the correct tax withholdings and deductions.

Many payroll check makers also stay up-to-date with changes in tax laws, ensuring that law firms are following the most current regulations. This reduces the risk of errors, which can be particularly damaging in a legal environment.

3. Reducing Payroll Errors

Human error is inevitable, especially when dealing with complex calculations such as tax deductions, overtime, and benefit contributions. Even a minor mistake in payroll can lead to significant issues, including disgruntled employees and costly corrections.

By using a free payroll check maker, law firms can minimize errors by automating calculations and ensuring consistency. The software typically provides built-in error-checking features, reducing the likelihood of mistakes that could impact employee satisfaction and the firm’s bottom line.

4. Time Savings

Law firm partners and administrators are often focused on client work, case management, and business development. Spending valuable time on payroll can detract from more important tasks. By using a payroll check maker, payroll processing can be automated, freeing up time for lawyers and administrators to focus on their legal work.

The process of generating paychecks becomes quick and efficient with minimal input required, so there’s no need to spend hours manually calculating payroll details. A free payroll check maker simplifies payroll by generating the checks, calculating taxes, and ensuring all required deductions are applied.

5. Professional Appearance and Transparency

Providing employees with professional, clear paychecks is an essential part of running a law firm. A payroll check maker helps create paychecks that are easy to read, clear, and transparent. This gives employees confidence in the firm’s payroll practices and ensures that they can easily verify their wages and deductions.

In a law firm, transparency is important to maintain trust and morale among employees. By providing well-organized and accurate paychecks, you demonstrate to your team that the firm is handling payroll professionally.

How Law Firms Can Use a Free Payroll Check Maker

Let’s go over how law firms can implement and use a free payroll check maker for their payroll needs.

1. Choose a Payroll Check Maker Tool

The first step in using a payroll check maker is to select the right tool. There are many options available online, and many offer free versions for small businesses or law firms. When choosing a payroll check maker, consider the following features:

- Customization options: Ensure the tool allows you to add details relevant to your law firm, such as employee roles, compensation structure, and deductions.

- Tax calculation: The tool should automatically calculate federal, state, and local tax withholdings, as well as other deductions like retirement contributions or healthcare benefits.

- Employee profiles: Look for a tool that allows you to store employee information securely and easily access it when processing payroll.

- Integration with other tools: Some payroll check makers integrate with accounting or time-tracking software, making the payroll process even more efficient.

2. Enter Employee Information

Once you have chosen a payroll check maker, input all the necessary employee details. This will include names, roles, pay rates (hourly or salary), and tax information. For law firms, this may also include tracking billable hours for attorneys or recording overtime for administrative staff.

Some payroll check makers allow you to save employee profiles, making it easy to generate paychecks in the future without re-entering the same information.

3. Input Payroll Data

After employee information is entered, you will need to input the payroll data for the current pay period. This includes the number of hours worked (if applicable), any overtime, bonuses, or other earnings, and any deductions for benefits or taxes.

For salaried employees, the paycheck may remain the same from one period to the next, but for hourly workers or contractors, you’ll need to input their hours worked. Many payroll check makers allow you to import hours from time-tracking systems, further reducing the time needed for data entry.

4. Generate the Paycheck

After entering the necessary information, the payroll check maker will automatically generate the paychecks. The tool will calculate the gross earnings, tax deductions, and net pay, ensuring that everything is correct.

Paychecks can usually be printed directly from the system, or in some cases, the software will allow you to email them directly to employees. Having the option to email paychecks makes it easy to distribute them quickly and securely.

5. Distribute Paychecks to Employees

Once the paychecks are generated, the final step is distributing them to your employees. With a payroll check maker, law firms can easily print paychecks or send digital pay stubs to employees via email. This reduces the administrative burden of manually preparing paychecks and ensures that employees receive their pay on time.

Many payroll check makers also offer features that allow employees to access pay stubs and payment history online, adding an extra layer of convenience.

Additional Benefits of Using a Free Payroll Check Maker

-

Scalability: As your law firm grows, you can easily scale your payroll processes without needing to hire additional staff. Most payroll check makers are designed to handle businesses of all sizes, so whether you have five or fifty employees, the tool can accommodate your needs.

-

Cost-effective: For smaller law firms or solo practitioners, using a free payroll check maker can be a cost-effective alternative to hiring a payroll service or software. It’s a simple, no-cost solution that allows firms to handle payroll in-house without breaking the bank.

-

Employee Satisfaction: Consistently accurate and timely paychecks contribute to employee satisfaction. By using a payroll check maker, law firms can ensure that their employees are always paid correctly and on time, fostering a positive work environment.

Conclusion

For law firms, payroll management doesn’t have to be complicated or time-consuming. By using a free payroll check maker, law firms can simplify the payroll process, reduce errors, and ensure compliance with tax laws. These tools not only save time but also help maintain professionalism, transparency, and employee satisfaction.

Whether you’re a small law firm or a larger practice with multiple departments, a payroll check maker provides a cost-effective, efficient solution to managing payroll. By incorporating this tool into your payroll process, you can focus on what matters most—delivering exceptional legal services to your clients.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?