A check stub, also known as a paycheck stub or pay stub, is an essential document that provides detailed information about your earnings, deductions, and net pay. While it may seem confusing at first, learning how to read and understand your check stub can help you manage your finances better, catch errors, and ensure you’re being paid correctly.

In this guide, we’ll break down all the components of a check stub, explain what they mean, and show you how to interpret them like a pro.

What Is a Check Stub?

A check stub is a document that accompanies your paycheck or direct deposit and provides a detailed breakdown of your pay. It includes information about your wages, taxes, deductions, and net income. Whether you receive a physical or digital version, understanding how to read your check stub is important for keeping track of your earnings and financial planning.

Why Is It Important to Understand Your Check Stub?

Knowing how to read your check stub has several benefits:

- Ensures Accuracy: Helps you verify that you’re being paid the correct amount.

- Tracks Earnings and Deductions: Allows you to see how much money is taken out for taxes, insurance, and other deductions.

- Aids in Budgeting: Helps you manage your expenses by understanding your take-home pay.

- Useful for Tax Filing: Provides a record of your income and withholdings for tax purposes.

- Required for Loan and Rental Applications: Serves as proof of income when applying for credit, loans, or housing.

How to Read Your Check Stub

A typical check stub contains several sections. Here’s what each section means:

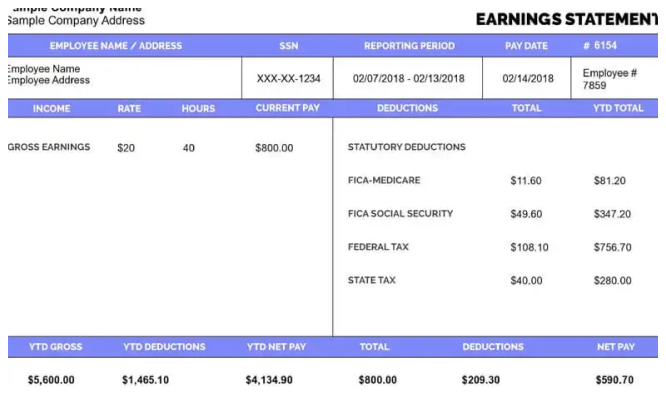

1. Employee and Employer Information

At the top of the check stub, you’ll usually find:

- Your name and address

- Your employer’s name and address

- Employee ID or Social Security Number (partially masked for security)

- Pay period dates (start and end date of the earnings period)

2. Gross Pay

Gross pay is the total amount you earned before any deductions are taken out. This amount depends on your salary, hourly wage, or commission earnings. If you’re an hourly worker, your gross pay is calculated by multiplying your hourly rate by the number of hours worked.

3. Taxes and Deductions

Several deductions are taken from your gross pay before you receive your final paycheck. Common deductions include:

- Federal Income Tax: A percentage of your earnings withheld based on your tax bracket and W-4 form.

- State Income Tax: If your state has income tax, it will be deducted from your pay.

- Social Security Tax: A 6.2% deduction required by law to fund Social Security benefits.

- Medicare Tax: A 1.45% deduction that helps fund Medicare benefits.

- Other Deductions: This may include health insurance, retirement contributions (401(k), IRA), union dues, or garnishments.

4. Net Pay (Take-Home Pay)

Net pay is the amount you actually receive after all deductions have been taken out. This is the money deposited into your bank account or issued as a paycheck.

5. Year-to-Date (YTD) Totals

The YTD section provides a cumulative summary of your earnings and deductions since the beginning of the year. This helps you track your income and taxes for the entire year.

Common Check Stub Terms Explained

Understanding the terminology on your check stub can help you read it with confidence. Here are some common terms and what they mean:

- Earnings: The amount you earned before deductions.

- Withholdings: The amount deducted for taxes and benefits.

- Net Pay: The final amount you take home after deductions.

- Pre-Tax Deductions: Amounts deducted before taxes, such as health insurance and retirement contributions.

- Post-Tax Deductions: Deductions taken after taxes, such as wage garnishments.

- FICA: Stands for Federal Insurance Contributions Act, which includes Social Security and Medicare taxes.

- Pay Period: The range of dates for which you are being paid.

How to Spot Errors on Your Check Stub

Mistakes on check stubs can happen. Here’s how to spot and fix them:

- Check Hours Worked: Make sure your recorded hours match what you actually worked.

- Verify Your Pay Rate: Ensure your hourly wage or salary is correct.

- Review Tax Withholdings: Compare deductions to your expected tax bracket.

- Look for Missing or Incorrect Deductions: If a deduction seems too high or too low, ask your employer.

- Compare YTD Totals: Ensure year-to-date earnings and deductions align with previous pay stubs.

If you find an error, notify your employer or payroll department immediately to get it corrected.

Digital vs. Paper Check Stubs

Many employers now provide electronic check stubs through payroll portals instead of paper copies. Both formats contain the same information, but digital versions are more convenient for record-keeping and easier to access anytime.

How to Use Your Check Stub for Financial Planning

Your check stub can be a valuable tool for managing your finances. Here’s how you can use it:

- Track Your Monthly Income: Helps you plan your budget based on actual take-home pay.

- Monitor Tax Withholding: Ensures enough taxes are deducted to avoid surprises during tax season.

- Save for Retirement: Check how much you contribute to retirement accounts and adjust if necessary.

- Review Health Insurance Costs: Understand how much is deducted for healthcare benefits.

Final Thoughts

A check stub is more than just a breakdown of your earnings—it’s a key financial document that helps you track income, verify deductions, and manage your finances. Learning how to read and understand your check stub can prevent paycheck errors, help with tax filing, and improve financial planning.

By paying attention to the details on your check stub, you can take control of your finances like a pro. The next time you receive your paycheck, take a few minutes to review your check stub and ensure everything is accurate. If you ever have questions, don’t hesitate to ask your employer or payroll provider for clarification.