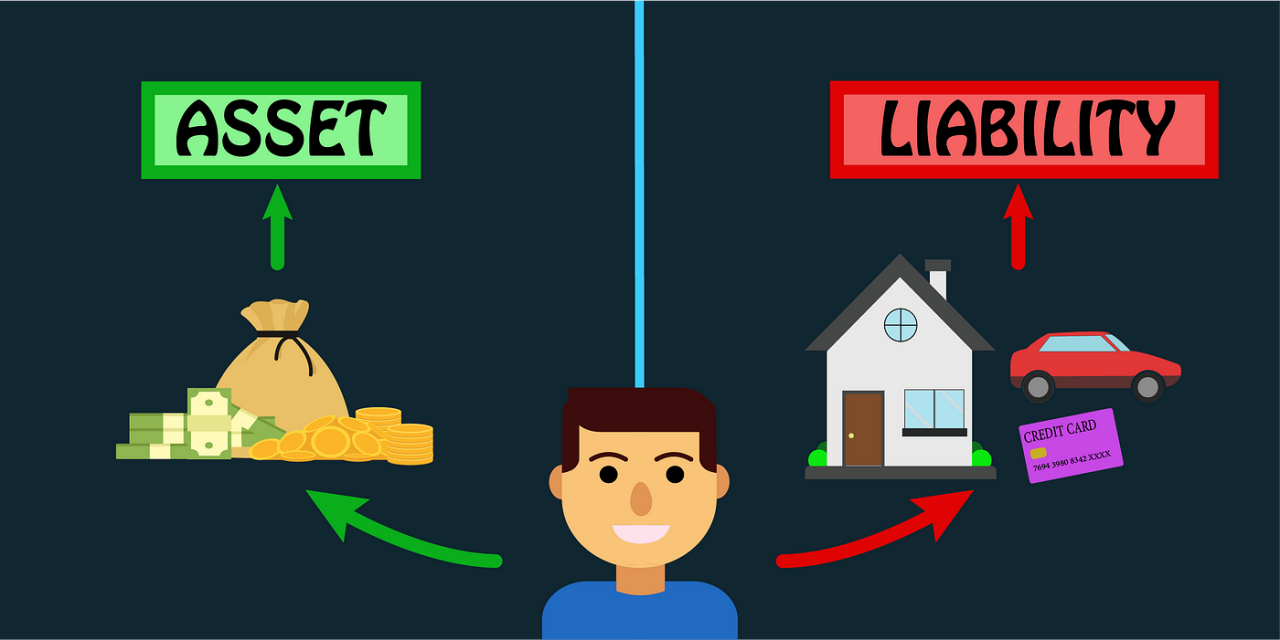

In the world of finance and economics, understanding the core concepts of assets and liabilities is fundamental. These terms are extensively used in accounting, investing, and business management. Knowing what they mean, however, is crucial for everyone, from individual investors to multinational corporations, as they form the basis for evaluating financial health and making informed decisions. This article aims to elucidate what assets and liabilities are, how they differ, and their implications within the broader framework of financial management.

Assets: A Detailed Overview

At its core, an asset is anything that provides value or future economic benefit to an individual or entity. Assets can be tangible or intangible, and they are further categorized into current assets and non-current assets.

Current Assets

Current assets are short-term assets expected to be converted into cash or used up within one year. They are crucial for maintaining day-to-day operations and ensuring liquidity. Examples of current assets include:

-

Cash and Cash Equivalents: The most liquid form of asset that can be readily used for transactions.

-

Accounts Receivable: Money owed to a company by its customers for goods or services delivered.

-

Inventory: Raw materials, work-in-progress, and finished goods that a company intends to sell.

-

Marketable Securities: Short-term investments that can quickly be converted into cash.

In the Indian context, let’s consider a hypothetical company whose balance sheet includes Rs. 1,00,000 in cash, Rs. 2,00,000 in accounts receivable, and Rs. 3,00,000 in inventory. The total current assets would sum up to Rs. 6,00,000.

Non-current Assets

Non-current assets are long-term investments not expected to be converted into cash within a year. These include:

-

Property, Plant, and Equipment (PPE): Tangible assets like buildings and machinery used over many years.

-

Intangible Assets: Assets without physical form, such as patents and trademarks.

-

Long-term Investments: Should include any business investments meant for maintaining growth over a prolonged period, not liquidation.

Liabilities: An In-depth Explanation

Liabilities are financial obligations that an entity owes to outsiders. They represent debts, arising from past transactions, which need to be settled either in cash or through the transfer of other assets.

Current Liabilities

Current liabilities are obligations due within one year and are essential for funding operating costs and managing short-term debt. Typical current liabilities include:

-

Accounts Payable: Money a company owes its suppliers for goods or services purchased.

-

Short-term Debt: Loans and other borrowing expected to be settled within the year.

-

Accrued Expenses: Costs that have been incurred but not yet paid, such as wages and taxes.

Suppose the same hypothetical company has Rs. 2,50,000 in accounts payable, Rs. 50,000 in short-term debt, and Rs. 1,00,000 in accrued expenses. The total current liabilities would be Rs. 4,00,000.

Non-current Liabilities

Non-current liabilities are debts or obligations not due within one year, including:

-

Long-term Debt: Loans and financial obligations that are due after one year.

-

Deferred Tax Liabilities: Taxes that are assessed but not yet payable.

The Balance Sheet: Assets vs. Liabilities

The Balance Sheet is a financial statement that encapsulates an entity’s assets, liabilities, and equity at a specific point in time. This equation, expressed as Assets = Liabilities + Equity, forms the foundation of double-entry bookkeeping.

The differential between assets and liabilities determines the entity’s equity or net worth. Using the above data, the hypothetical company’s balance sheet can be framed as follows:

-

Total Assets: Rs. 6,00,000 (current assets) + Rs. 10,00,000 (assuming non-current assets) = Rs. 16,00,000

-

Total Liabilities: Rs. 4,00,000 (current liabilities) + Rs. 3,00,000 (assuming non-current liabilities) = Rs. 7,00,000

Thus, Equity = Assets (Rs. 16,00,000) – Liabilities (Rs. 7,00,000) = Rs. 9,00,000.

Understanding this equation is pivotal for assessing an entity’s financial leverage, solvency, and risk.

Implications in Financial Management

For businesses and investors, comprehending assets and liabilities aids in evaluating operational efficiency, liquidity, and financial stability. Managers use these metrics to make strategic decisions regarding investment, financing, and tax planning. Investors focus on these elements to gauge an entity’s intrinsic value and future profitability potential.

Disclaimer

This article is intended for informational purposes only. All details mentioned are hypothetical, and the reader must thoroughly assess all the pros and cons before engaging in the Indian financial market. Adequate due diligence and consultation with financial advisors are advisable for investment decisions.

Summary

Assets and liabilities are pivotal in understanding an entity’s financial health. Assets are resources with potential future benefits, categorized into current and non-current types, while liabilities are obligations due to outsiders, similarly divided into current and non-current. The balance sheet equates assets to the sum of liabilities and equity, showcasing an organization’s financial stability. In the Indian context, evaluating these components is essential for informed decision-making. However, potential investors and financial analysts must scrutinize all aspects carefully before engaging in financial transactions or investments.