When it comes to safe and secure investment options, few choices match the reliability of a Fixed Deposit (FD). For decades, fixed deposits have remained a go-to financial instrument for Indian investors seeking guaranteed returns without exposure to market volatility.

In this guide, I’ll explain what a fixed deposit is, how it works, its benefits, and how you can use it to grow your wealth smartly. With years of experience in finance content creation and market analysis, I aim to make this information simple, factual, and actionable.

What is a Fixed Deposit?

A Fixed Deposit is a financial product offered by banks and NBFCs, where you deposit a lump sum amount for a fixed tenure at a predetermined interest rate. The interest does not fluctuate and is guaranteed throughout the investment period.

You can select the tenure based on your needs—from 7 days to 10 years, and at the end of the term, you receive your original amount along with interest.

This predictability makes FDs one of the most preferred investment options for salaried professionals, retirees, and conservative investors.

How Fixed Deposits Work

Here’s a simple breakdown of how fixed deposits work:

-

You invest a lump sum for a chosen tenure.

-

The bank offers a fixed rate of interest.

-

Interest can be paid monthly, quarterly, annually, or at maturity.

-

At the end of the term, the principal + interest is credited back to you.

Most banks in 2025 are offering interest rates between 6% to 7.5%, while some private and small finance banks offer even more.

Key Benefits of Fixed Deposits

-

Capital Protection

Your principal amount remains safe. Unlike stocks or mutual funds, FDs do not depend on market performance. -

Guaranteed Returns

The interest rate is fixed when you invest. No surprises, no losses. -

Flexible Tenure

Choose any duration as per your financial goals—from short-term savings to long-term wealth creation. -

Loan Facility

Need urgent funds? Most banks offer loans against FD up to 90% of your deposit value. -

Senior Citizen Advantage

Individuals above 60 years of age receive 0.25% to 0.50% higher interest rates. -

Tax-Saving Option

You can invest in 5-year Tax Saver FDs and claim deductions under Section 80C (up to ₹1.5 lakh annually).

Taxation on Fixed Deposits

Interest earned from FDs is taxable as per your income tax slab. If the annual interest exceeds ₹40,000 (₹50,000 for senior citizens), TDS at 10% is deducted automatically by the bank.

To avoid TDS (if your total income is non-taxable), submit Form 15G or 15H to your bank at the start of the financial year.

Types of Fixed Deposits

| Type | Description |

|---|---|

| Regular FD | Standard FD with fixed interest for a fixed tenure. |

| Cumulative FD | Interest is compounded and paid at maturity. Best for long-term saving. |

| Non-Cumulative FD | Interest paid monthly, quarterly, or yearly. Ideal for regular income. |

| Tax-Saver FD | 5-year lock-in with tax benefits under 80C. |

| Senior Citizen FD | Special FDs with higher interest for individuals aged 60+. |

Tips to Maximize Returns from Your FD

-

Compare rates from different banks and NBFCs before investing.

-

Ladder your investments – spread across multiple FDs with different tenures.

-

Reinvest maturity proceeds instead of withdrawing.

-

Avoid breaking your FD early to save on penalties and reduced interest.

-

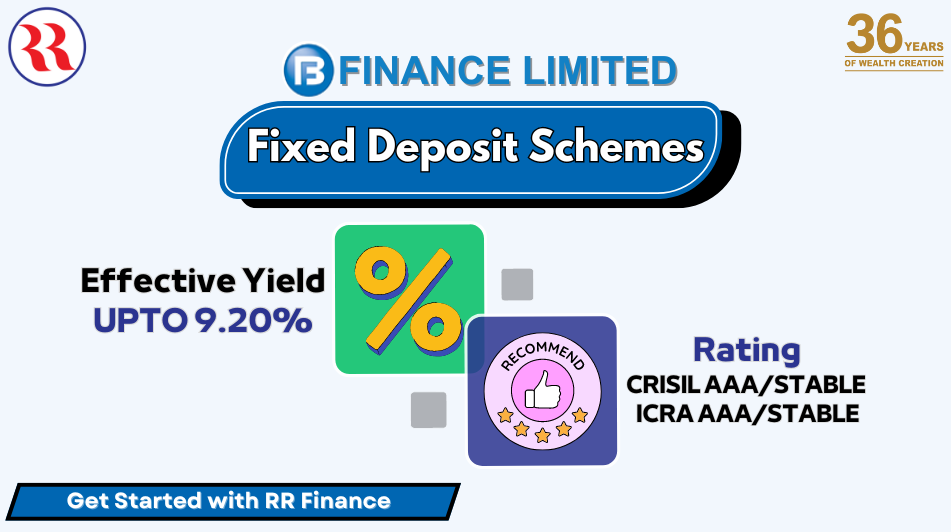

Invest in a mix of bank and corporate FDs (only those with AAA ratings) for better returns with managed risk.

My Recommendation as a Finance Professional

As someone deeply involved in financial content and digital marketing for leading platforms like rrfinance.com, I always advise clients to balance safety with returns.

FDs are best suited for:

-

Emergency funds

-

Short-term financial goals (within 1–3 years)

-

Conservative investors

-

Senior citizens or retirees

-

Portfolio diversification

For younger or risk-tolerant investors, FDs should be part of a broader portfolio that includes mutual funds, equities, or real estate.

Final Thoughts

In today’s unpredictable market environment, a Fixed Deposit continues to be a smart, no-stress investment option. Whether you’re just starting your financial journey or looking for stable returns post-retirement, an FD can offer peace of mind and dependable growth.

As always, choose a trusted bank or NBFC, check the interest rate and credit rating (if corporate FD), and align your FD strategy with your personal financial goals.