Are you struggling to stay on top of your weekly budget? Do you find yourself overspending and regretting it later? If so, investing in a budgeting planner could be the solution you need to take control of your finances and achieve your weekly budget goals. But with so many options available on the market, how do you choose the best budgeting planner for your needs? In this article, we will guide you through the process of selecting the right budgeting planner to help you manage your finances effectively.

Understanding the Importance of a Budgeting Planner

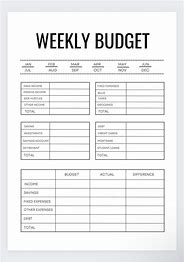

Before we dive into the tips for choosing the best budgeting planner, let’s first understand why having a budgeting planner is essential for achieving your weekly budget goals. A budgeting planner is a tool that allows you to track your income, expenses, and savings in an organized manner. By using a budgeting planner, you can easily identify where your money is going, set realistic financial goals, and monitor your progress towards achieving them.

Factors to Consider When Choosing a Budgeting Planner

When selecting a budgeting planner, there are several factors to consider to ensure that it meets your specific needs and preferences:

-

Budgeting Features: Look for a budgeting planner that offers a wide range of budgeting features, such as expense tracking, goal setting, and customizable categories. This will help you tailor the planner to suit your unique financial situation.

-

Ease of Use: Choose a budgeting planner that is user-friendly and intuitive to navigate. You want a planner that makes it easy for you to input your financial data and generate reports without any hassle.

-

Mobile Accessibility: Consider a budgeting planner that offers mobile accessibility so that you can track your finances on the go. This feature is especially useful for those who lead busy lifestyles and need to manage their finances while away from their computer.

-

Budgeting Templates: Opt for a budgeting planner that provides pre-designed templates for budgeting, saving you time and effort in setting up your budgeting system.

-

Affordability: Determine your budget for a planner and choose one that fits within your price range. Remember, investing in a budgeting planner is a wise decision for your financial health, so consider it an investment rather than an expense.

Choosing the Right Budgeting Planner for You

Now that you know what to look for in a budgeting planner, how do you choose the best one for your weekly budget goals? Here are a few tips to help you make an informed decision:

-

Research: Take the time to research different budgeting planners available in the market. Visit websites like My Budget Breeze to explore their range of budgeting planners and read customer reviews to get a better idea of their features and functionalities.

-

Trial Period: Look for budgeting planners that offer a free trial period so you can test out the software before committing to a purchase. This will help you determine if the planner meets your needs and is easy to use.

-

Customer Support: Choose a budgeting planner that offers excellent customer support in case you run into any issues or have questions about using the software. Having reliable customer support can make a significant difference in your overall experience with the planner.

-

Customization Options: Select a budgeting planner that allows you to customize the categories, tags, and labels to align with your financial goals and preferences. The more customizable the planner is, the better suited it will be to your specific needs.

Conclusion

In conclusion, choosing the best budgeting planner for your weekly budget goals requires careful consideration of your individual needs and preferences. By understanding the importance of a budgeting planner, considering key factors such as budgeting features, ease of use, and affordability, and following the tips provided, you can select a budgeting planner that will help you stay on track with your finances and achieve your weekly budget goals effectively. Remember, investing in a quality budgeting planner is an investment in your financial future. So, take the time to choose wisely and watch your financial health improve day by day.