Retail businesses thrive on keeping things organized and efficient, whether it’s managing inventory, serving customers, or handling payroll. One key aspect of this organization is creating accurate and timely paystubs for employees. Paystubs, also known as check stubs, are essential documents that provide a detailed breakdown of an employee’s earnings and deductions. In this blog, we’ll explore the importance of creating paystubs for retail employees and guide you through how to use a check stub maker to streamline this process.

Why Are Paystubs Important for Retail Employees?

Paystubs serve multiple purposes, making them vital for both employers and employees in the retail sector. Here are some key reasons why paystubs matter:

1. Transparency of Earnings

Retail employees often work varied shifts, take on overtime hours, or earn commission-based pay. This makes it essential for them to understand exactly how their wages are calculated. Paystubs provide a clear and detailed record of gross earnings, taxes, and any other deductions, ensuring that employees can see exactly what they are being paid for.

For instance, if an employee works extra hours during a busy sale period, their paystub will break down those additional earnings. Transparency in earnings builds trust and reduces the chances of disputes or misunderstandings over pay.

2. Proof of Income

Retail employees may need proof of income when applying for loans, renting an apartment, or even securing a credit card. Paystubs are typically the go-to document for proving income. A check stub maker ensures that every retail employee receives accurate, professional-looking paystubs that they can use as verification when needed.

Without proper paystubs, employees may face challenges when trying to provide proof of income, which can delay important life decisions such as securing housing or making significant purchases.

3. Tax Reporting and Compliance

Accurate paystubs are crucial when it comes to tax reporting. Both employees and employers rely on these documents to track income, withholdings, and deductions throughout the year. At tax time, retail employees can use their paystubs to verify the information on their W-2 forms and file their taxes with confidence.

For employers, issuing correct paystubs helps ensure compliance with state and federal labor laws. Many states require businesses to provide paystubs to their employees, and failure to do so can result in legal penalties. Using a reliable check stub maker ensures that you meet these legal obligations while avoiding costly mistakes.

4. Tracking Deductions and Benefits

Retail employees often have a variety of deductions that appear on their paystubs, including taxes, health insurance premiums, retirement contributions, and more. Paystubs make it easy for employees to track these deductions and verify that they are accurate.

For example, an employee may want to check that the correct amount is being deducted for health insurance or that their contributions to a 401(k) are in line with their selected benefits plan. If there is ever an issue with deductions, paystubs provide the necessary documentation to resolve it.

How to Create Paystubs for Retail Employees

Now that we understand why paystubs are important, let’s walk through the steps to create them efficiently and accurately. A check stub maker can be an invaluable tool for retail businesses, helping them streamline payroll and reduce errors. Follow this simple guide to create paystubs for your retail employees:

1. Gather Employee Information

Before creating paystubs, you’ll need to gather all relevant employee information. This includes:

- Full name and address of the employee

- Social Security number or Employee Identification Number (EIN)

- Job title and department

- Pay rate (hourly or salary)

- Number of hours worked during the pay period

- Any overtime or bonuses earned

Having this information ready ensures that your paystubs are accurate and complete. A check stub maker typically has fields where you can easily input this data to create professional-looking paystubs quickly.

2. Calculate Gross Pay

Gross pay refers to the total amount of money an employee earns before any deductions are made. To calculate gross pay for an hourly retail employee, multiply the number of hours worked by the hourly wage. Don’t forget to add any additional earnings such as overtime, commissions, or bonuses.

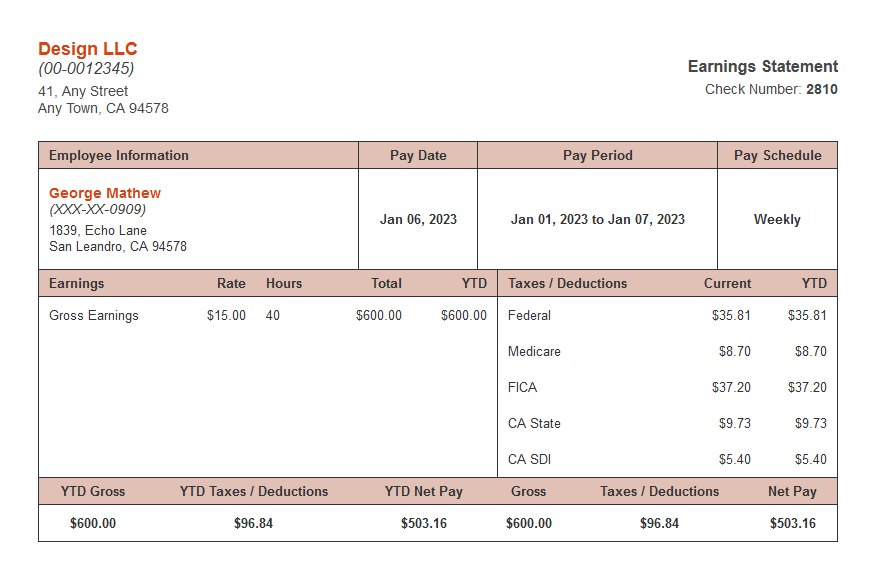

For example, if an employee works 40 hours at $15 per hour, their gross pay would be: 40 hours x $15/hour = $600.

If they worked 5 hours of overtime at time-and-a-half pay (1.5x their regular hourly rate), you would add: 5 hours x ($15/hour x 1.5) = $112.50.

So, their total gross pay would be: $600 + $112.50 = $712.50.

3. Account for Deductions

Once you have the gross pay, it’s time to account for deductions. Common deductions for retail employees include:

- Federal income tax

- State and local income taxes (if applicable)

- Social Security and Medicare taxes (FICA)

- Health insurance premiums

- Retirement contributions (e.g., 401(k))

- Wage garnishments (if applicable)

A check stub maker typically has pre-built formulas for calculating these deductions based on the latest tax rates. All you need to do is input the relevant information, and the software will handle the rest.

4. Calculate Net Pay

Net pay, also known as “take-home pay,” is the amount an employee receives after all deductions have been made. This is the amount that is deposited into the employee’s bank account or given via check.

To calculate net pay, subtract all deductions from the gross pay. For example, if an employee’s gross pay is $712.50 and their total deductions amount to $150, their net pay would be: $712.50 – $150 = $562.50.

5. Include Additional Information

Besides earnings and deductions, paystubs should also include additional information such as:

- Pay period start and end dates

- Date of payment (when the employee will receive their wages)

- Employer’s name and contact information

- Year-to-date earnings and deductions (optional but recommended)

Including this information helps employees track their earnings over time and provides clarity on when they can expect their pay.

6. Use a Check Stub Maker

Now that you’ve gathered all the necessary information and performed the calculations, it’s time to create the actual paystubs. A check stub maker is an efficient tool that simplifies this process. Here’s why it’s beneficial:

- Accuracy: A check stub maker automatically calculates earnings and deductions based on the data you input, reducing the chance of human error.

- Efficiency: You can generate paystubs in minutes, even for a large number of employees. This is especially useful for retail businesses with rotating staff or seasonal hires.

- Professionalism: A check stub maker produces professional-looking paystubs that include all the necessary details, which helps build trust with employees.

7. Deliver Paystubs to Employees

Once you’ve created the paystubs, it’s important to deliver them to your employees promptly. You can either provide physical copies or distribute them electronically. Many modern check stub makers allow you to download or email paystubs directly to your employees, saving time and resources.

It’s a good idea to keep a record of all paystubs for both your employees and your business. These records are helpful for tax reporting, audits, and resolving any payroll disputes.

Best Practices for Creating Paystubs

To ensure that your paystubs are accurate and compliant, follow these best practices:

1. Double-Check Your Data

Before finalizing any paystub, double-check that all employee information, earnings, and deductions are correct. Errors on paystubs can lead to confusion, delays in payment, or even legal issues.

2. Stay Updated on Tax Laws

Tax laws and regulations can change frequently, so it’s important to stay updated on the latest rates and requirements. A good check stub maker will automatically update these rates for you, ensuring that your deductions are accurate.

3. Provide Clear and Detailed Paystubs

Make sure your paystubs are easy to read and understand. Employees should be able to see at a glance how much they earned, what was deducted, and what their net pay is. The more transparent the paystub, the less likely it is that employees will have questions or concerns about their pay.

4. Use a Reliable Check Stub Maker

Not all check stub makers are created equal. Choose one that is reliable, easy to use, and compliant with legal requirements. A good check stub maker will save you time, reduce errors, and ensure that your payroll process runs smoothly.

Conclusion

Creating paystubs for retail employees is a critical task that requires attention to detail and accuracy. Using a check stub maker can simplify the process, ensuring that your employees receive clear, accurate, and professional pay stubs every pay period. By following the steps outlined in this guide, retail employers can streamline payroll, build trust with their staff, and stay compliant with tax and labour laws. Remember, a well-organized payroll system not only keeps your employees happy but also helps your business run more smoothly.