When it comes to construction work, paying employees correctly and on time is one of the most important aspects of maintaining a good working relationship with your crew. One of the key tools in ensuring this is the check stub. But what exactly is a check stub, and why is it so important for construction workers?

In this blog, we’ll explore the role of check stubs in the construction industry, why they matter, and how both employers and workers can ensure that pay records are accurate. We’ll also dive into the various components of a check stub, common mistakes to watch out for, and best practices to keep everything in check. Let’s get started!

What is a Check Stub?

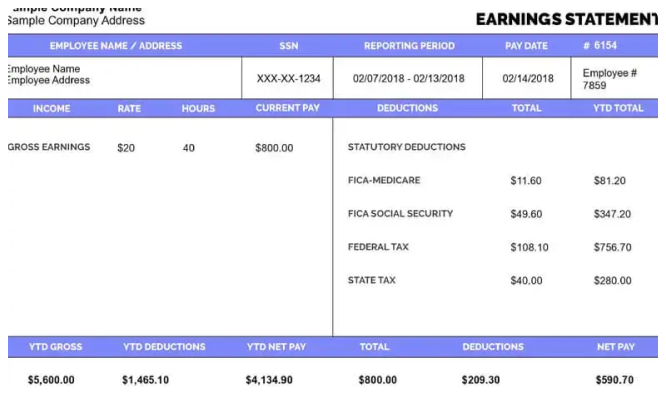

A check stub is a document that provides a detailed breakdown of an employee’s earnings, deductions, and net pay. This document is typically issued with every paycheck and serves as a receipt for the wages paid. For construction workers, who may work on different job sites or have varying pay rates depending on the project, having an accurate and clear check stub is crucial for both financial record-keeping and tax purposes.

Why Check Stubs Matter for Construction Workers

- Proof of Earnings Check stubs provide workers with proof of income. Whether you need to apply for a loan, rent an apartment, or even prove your income for government benefits, a check stub is often required as proof of how much you earn.

- Tax Compliance Construction workers need to report their earnings to the IRS at the end of the year. Having accurate check stubs ensures that workers can correctly file their taxes and avoid any potential penalties for underreporting income or missing deductions.

- Deductions and Benefits Construction workers may have various deductions from their paychecks, such as taxes, health insurance, retirement contributions, union dues, or other benefits. A clear check stub will show the worker exactly what has been deducted, helping them understand their net pay and how their benefits are being handled.

- Time and Pay Transparency Construction workers often have fluctuating work hours depending on the project. A check stub will typically show regular hours worked, overtime, holiday pay, and any bonuses earned. This ensures transparency between the worker and the employer and minimizes disputes over pay.

- Budgeting and Financial Planning With detailed pay records, construction workers can better plan their finances. Knowing exactly how much they’ve earned, including overtime or bonuses, allows for smarter budgeting and saving.

Key Components of a Check Stub

Check stubs come with different formats, but most will include the following key details:

- Employee Information This typically includes the worker’s name, employee ID, and sometimes the job title or department.

- Employer Information The employer’s name, address, and contact information are also included. This ensures that both parties know where the payment comes from and can reach out in case of any discrepancies.

- Pay Period The check stub should clearly show the pay period, which is the specific range of dates the worker was paid for. For example, a worker may be paid for the two-week period from September 1st to September 15th.

- Hours Worked For hourly workers, the check stub should display the total hours worked during the pay period. If there was overtime, it should also show how many overtime hours were worked and the pay rate for those hours.

- Gross Pay Gross pay is the total earnings before any deductions, including wages for regular hours, overtime, bonuses, or commissions.

- Deductions Deductions are amounts taken from the worker’s gross pay for taxes, insurance, retirement plans, union fees, or other benefits. It’s essential to review these deductions for accuracy.

- Net Pay Net pay is the final amount the worker takes home after all deductions have been subtracted from the gross pay. This is the actual paycheck amount.

- Employer Contributions In some cases, employers will also contribute to benefits like health insurance, 401(k) retirement plans, or taxes (such as Social Security and Medicare). These contributions may be listed separately on the check stub.

- Year-to-Date (YTD) Totals A good check stub will show the total earnings and deductions for the year up to that point. This helps workers track their progress toward annual goals and keep an eye on tax-related matters.

How to Ensure Accurate Pay Records for Construction Workers

Ensuring accurate pay records starts with both the employer and the employee being diligent about tracking and reviewing information. Here’s how to ensure your check stubs are accurate:

1. Use Reliable Payroll Software

For construction businesses, the easiest way to keep track of payroll is by using reliable payroll software or services. These tools are designed to calculate wages, taxes, and deductions automatically, reducing the chances of human error. Many payroll systems also offer direct deposit and digital check stubs, making it easy to distribute pay records to workers quickly.

2. Review Work Hours Carefully

Construction workers often work irregular hours due to varying project timelines, weather, and other factors. It’s essential that both employers and employees carefully track the hours worked. Employers should use a time-tracking system or timesheets to ensure that all hours worked, including overtime or holiday pay, are correctly documented.

3. Double-Check Deductions

Deductions such as taxes, insurance, and retirement contributions must be accurate. Employers should review the applicable federal, state, and local tax rates, as well as any benefits or deductions that apply to the worker. Construction workers should also be vigilant about these deductions to ensure that they are being correctly withheld.

4. Handle Overtime Pay Properly

In the construction industry, workers often put in extra hours, which means overtime pay may apply. Under the Fair Labor Standards Act (FLSA), most non-exempt workers are entitled to overtime pay for hours worked over 40 in a week. This pay must be at least 1.5 times the employee’s regular hourly rate. Ensure that overtime hours are accurately reflected in the check stub.

5. Ensure Clear and Transparent Pay Stubs

Both employers and employees should review check stubs to ensure that the information is clear and transparent. The pay stub should list all deductions, pay rates, and hours worked so there are no misunderstandings about how much is being paid.

6. Communicate Any Changes

If a construction worker’s pay rate, benefits, or deductions change, the employer should inform the worker immediately. This ensures that both parties are on the same page and that future check stubs reflect any changes accurately.

Common Mistakes to Avoid

Here are some common mistakes related to check stubs that both employers and employees should watch out for:

- Incorrect Hourly Rates Sometimes, workers may be paid incorrectly if the hourly rate is not properly recorded or if the wrong rate is applied to overtime hours.

- Missing Deductions A common issue is forgetting to include certain deductions, such as union fees or retirement contributions. This can result in underpayment or discrepancies.

- Failure to Account for Overtime If overtime hours are not correctly tracked, the worker may not receive the proper compensation for those extra hours worked.

- Not Including Year-to-Date Totals Without year-to-date totals, workers may have trouble tracking their cumulative earnings, which can lead to confusion come tax season.

- Incorrect Address or Contact Information It’s important to ensure that both the employer’s and employee’s information is up-to-date on the check stub, including the correct mailing address.

Best Practices for Construction Workers

- Keep a Copy of Your Check Stubs Construction workers should keep a copy of every check stub they receive, either in digital or paper format. These documents are important for budgeting, taxes, and legal purposes.

- Regularly Review Your Pay Workers should review each check stub as soon as they receive it to ensure that all hours, pay rates, and deductions are correct. If there’s an error, it’s easier to resolve it sooner rather than later.

- Ask Questions if Needed If there’s something unclear on the check stub, such as a deduction or overtime calculation, workers should feel comfortable asking their employer for clarification.

Conclusion

Free Check stubs are an essential part of the payroll process, particularly in the construction industry where pay can vary based on job site location, hours worked, and overtime. By ensuring that check stubs are accurate and complete, both employers and workers can avoid confusion, ensure proper tax reporting, and maintain financial transparency. Whether you are an employer or a construction worker, paying attention to the details on your check stub is a key step toward a smooth and successful working relationship.

By following the best practices outlined in this blog, you can ensure that both pay and records are in order. Remember: accurate pay records are not just a matter of financial responsibility; they are also a matter of trust and fairness in the workplace.