Managing payroll can be a daunting task for small businesses, freelancers, or even large companies. Keeping track of employee wages, deductions, taxes, and overtime requires accuracy and attention to detail. Errors can lead to unhappy employees, legal issues, or tax penalties. That’s why using a paystub creator can make a significant difference.

In this blog, we’ll explore how a paystub creator can simplify your payroll process, why it’s essential for businesses of all sizes, and how to choose the right one for your needs. By the end, you’ll have a clear understanding of how this tool can save you time and improve your payroll accuracy.

What is a Paystub Creator?

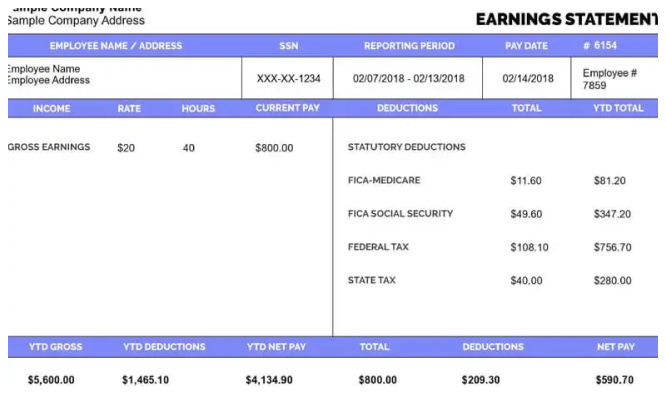

A paystub creator is an online tool or software that generates accurate and professional paystubs for employees or contractors. These paystubs detail earnings, deductions, taxes, and net pay, providing a transparent breakdown of payment information.

Many paystub creators allow users to customize templates, ensuring that your paystubs comply with state and federal requirements while reflecting your company’s branding. Whether you’re a business owner or a freelancer, having detailed paystubs improves financial clarity and fosters trust.

Why Should You Use a Paystub Creator?

- Accuracy

Manually calculating wages, taxes, and deductions increases the risk of errors. A paystub creator automates these calculations, ensuring precise results. Employees can rely on the information provided, and you can avoid potential disputes or compliance issues. - Time-Saving

Generating paystubs manually or using outdated methods can be time-consuming. A paystub creator streamlines the process, allowing you to create multiple paystubs in minutes. - Compliance

Payroll laws and tax regulations vary across states in the U.S. A paystub creator often includes features that align with local, state, and federal requirements, helping you remain compliant. - Professionalism

A well-designed paystub shows your commitment to transparency and professionalism. It enhances your company’s credibility and ensures employees have the documentation they need for financial or legal purposes.

Who Needs a Paystub Creator?

Small Business Owners

Running a small business often means wearing multiple hats, including managing payroll. A paystub creator simplifies this task, allowing you to focus on growing your business instead of getting bogged down in payroll details.

Freelancers and Gig Workers

Freelancers and gig workers may not receive traditional paystubs from clients. Creating your own paystub can provide proof of income for tax purposes, loan applications, or financial planning.

HR Professionals

HR departments in larger organizations handle payroll for dozens or hundreds of employees. A paystub creator helps streamline this process, reducing manual errors and increasing efficiency.

Contractors

Independent contractors often need paystubs for tax filing or proof of income. A paystub creator enables them to maintain accurate financial records.

Key Features to Look for in a Paystub Creator

- Customization Options

Look for a tool that allows you to customize templates to include your company’s logo, contact information, and other branding details. - Tax Compliance

The ideal paystub creator should handle federal, state, and local taxes, ensuring all deductions are accurate. - Ease of Use

A user-friendly interface is crucial. The tool should be intuitive, even for users with little technical expertise. - Affordability

Many paystub creators are affordable or even free, making them accessible to small businesses and freelancers. Compare pricing and features to find the best fit for your budget. - Instant Generation

A good paystub creator generates documents instantly, allowing you to meet tight deadlines. - Security

Payroll data is sensitive. Ensure the paystub creator uses encryption and other security measures to protect your information.

How a Paystub Creator Streamlines Payroll

1. Automated Calculations

Manual payroll calculations can be tedious and error-prone. A paystub creator automates the process, accurately calculating gross pay, deductions, and net pay based on input data.

2. Customizable Templates

You can tailor paystubs to fit your business needs. Include additional fields for overtime, bonuses, or commissions as needed.

3. Error Reduction

Automation significantly reduces the likelihood of errors. By eliminating manual entry, you avoid mistakes that could lead to financial discrepancies or compliance issues.

4. Accessibility

Most paystub creators are cloud-based, meaning you can access them anytime, anywhere. This flexibility is especially beneficial for remote businesses or freelancers.

5. Record-Keeping

Digital paystubs make it easy to maintain organized records. This is helpful for tax filing, audits, or employee disputes.

Benefits of Using a Paystub Creator

- Enhanced Employee Satisfaction

Employees appreciate clear and accurate paystubs. It builds trust and reduces confusion about earnings or deductions. - Better Financial Planning

Detailed paystubs help employees understand their earnings and deductions, aiding in personal financial planning. - Streamlined Tax Filing

With clear documentation, filing taxes becomes easier for both employers and employees. - Cost-Effectiveness

Many paystub creators are affordable and eliminate the need for expensive payroll software or outsourcing payroll tasks.

How to Choose the Right Paystub Creator

Step 1: Identify Your Needs

Determine the features you need based on the size of your business, the complexity of your payroll, and your budget.

Step 2: Research Options

Look for tools that offer a balance of affordability, functionality, and ease of use. Popular paystub creators in the U.S. include online platforms like Real Check Stubs, PayStubDirect, and StubCreator.

Step 3: Read Reviews

Check user reviews and testimonials to gauge the tool’s reliability and performance.

Step 4: Test the Tool

Many paystub creators offer free trials or demos. Test the tool to ensure it meets your requirements.

Common Mistakes to Avoid When Using a Paystub Creator

- Entering Incorrect Data

Double-check all input data, including wages, hours worked, and deductions, to ensure accuracy. - Ignoring Local Laws

Payroll regulations vary by state. Ensure the paystub creator complies with local laws to avoid penalties. - Not Keeping Records

Always save copies of pay stubs for your records. Digital tools often allow you to store documents securely in the cloud. - Choosing the Wrong Tool

Not all paystub creators are equal. Selecting one that doesn’t meet your needs can lead to inefficiencies.

Frequently Asked Questions

1. Are paystub creators legal?

Yes, paystub creators are legal and widely used in the U.S., as long as the information provided is accurate and complies with state and federal laws.

2. Can a paystub creator handle multiple employees?

Most paystub creators can handle payroll for multiple employees, making them ideal for businesses of all sizes.

3. Do I need technical skills to use a paystub creator?

No, most paystub creators are designed to be user-friendly, even for beginners.

4. Is a paystub creator suitable for freelancers?

Absolutely! Freelancers can use a paystub creator to generate professional documents for financial and tax purposes.

Conclusion

A free paystub creator is an invaluable tool for businesses, freelancers, and contractors looking to streamline payroll processes. It enhances accuracy, saves time, ensures compliance, and projects professionalism. With the right paystub creator, you can eliminate payroll stress and focus on what matters most—growing your business.

Take the time to research and choose a paystub creator that aligns with your specific needs. Whether you’re managing a small business or working as a freelancer, this tool will simplify your payroll process and set you up for long-term success.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season