As a small business owner, freelancer, or employer managing a team, payroll is one of the most crucial tasks you’ll face. Ensuring your employees are paid accurately and on time is vital for maintaining trust and keeping your business compliant with tax laws. However, payroll can be time-consuming and confusing, especially for those new to managing employees.

That’s where a free paycheck creator comes in. A free paycheck creator can help automate the payroll process, calculate taxes, manage deductions, and generate pay stubs, making your job much easier. But before you dive into using one for your team, it’s important to understand how they work, the features you should look for, and the potential challenges you might encounter.

In this blog, we will guide you through the essential things you need to know before using a free paycheck creator for your team. From understanding the tool’s capabilities to ensuring compliance, we’ll cover all the important aspects to help you make the best decision for your business.

1. Understand the Capabilities of a Free Paycheck Creator

Before using a free paycheck creator, it’s important to understand what it can and can’t do. These tools are typically designed to automate basic payroll functions, but they may not have the full range of features available in paid payroll software. Here’s what most free paycheck creators can help you with:

- Tax Calculation: A free paycheck creator can automatically calculate federal, state, and local taxes based on your employees’ wages, tax filing status, and exemptions.

- Deductions Management: It can help manage other payroll deductions, such as health insurance premiums, retirement contributions, and wage garnishments.

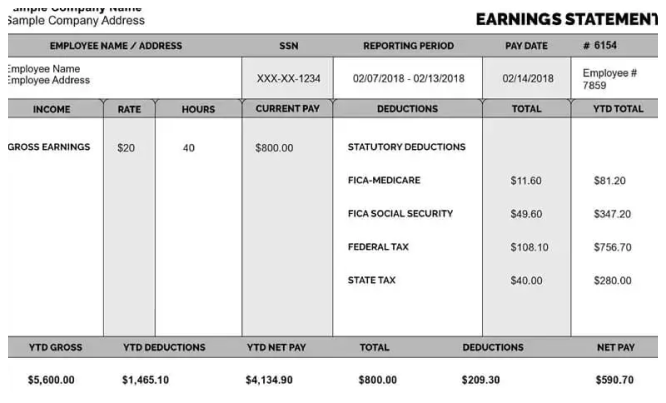

- Pay Stub Generation: The tool generates pay stubs that break down gross pay, net pay, taxes withheld, and deductions.

- Report Generation: Some free paycheck creators provide simple payroll reports that you can use for your records and tax filings.

While these are essential features, there may be limitations when it comes to handling complex payroll structures, multiple states, or specialized deductions. Make sure the tool aligns with your business’s specific payroll needs before you commit to using it.

2. Know the Limitations of Free Paycheck Creators

While a free paycheck creator can be a helpful tool, it’s essential to be aware of its limitations, especially if your business has more complex payroll needs. Here are some common limitations:

- Limited Features: Free paycheck creators often lack some of the advanced features offered by paid payroll software, such as year-end tax filing assistance, direct deposit, or full integration with accounting software.

- Employee Limits: Some free paycheck creators may limit the number of employees you can process. If your business grows, you may eventually need to switch to a paid solution to accommodate your expanding team.

- Limited Customer Support: Free tools might not offer the same level of customer support as paid tools. While some may offer help centers or FAQs, live customer support may be limited or unavailable.

Make sure to assess whether the free paycheck creator meets your business needs both now and in the future. If your business is likely to grow or has more complicated payroll requirements, you may want to consider upgrading to a paid solution later on.

3. Ensure Compliance with Tax Regulations

Payroll involves much more than paying employees — it also involves complying with federal, state, and local tax laws. When using a free paycheck creator, you need to be confident that the tool will help you meet your tax obligations. Here’s what you should keep in mind:

- Up-to-Date Tax Rates: Tax rates change regularly, and it’s crucial that your paycheck creator stays updated with the latest tax tables. Make sure the tool you choose automatically updates its rates so you don’t have to manually adjust them each year.

- State and Local Taxes: Different states and even local jurisdictions have varying tax rules. Ensure that the paycheck creator supports state and local tax calculations for all the areas where your employees live and work.

- Tax Filing: While a free paycheck creator will calculate taxes for you, it’s important to check whether the tool can also help with tax filing. Some tools provide reports that can help with quarterly or year-end tax filings, while others may not have this feature.

Before using a free paycheck creator, confirm that it aligns with all the applicable tax regulations in your area. You don’t want to risk penalties or fines due to tax miscalculations or missed deadlines.

4. Check the Tool’s Security Features

Since payroll involves handling sensitive employee data, security is an essential consideration. When using a free paycheck creator, you need to ensure that the tool keeps this data safe from unauthorized access or data breaches. Here are a few things to look for:

- Data Encryption: The tool should use encryption to protect sensitive information, such as employees’ Social Security numbers, bank account details, and wages.

- Password Protection: Ensure that the tool requires strong password protection to restrict access to payroll data.

- Backups: Check whether the tool offers automatic backups of payroll data in case of system failure or data loss.

When it comes to payroll, security is not something you want to take lightly. Be sure to choose a paycheck creator that provides strong security features to protect both your business and your employees.

5. Consider Employee Information Storage

An essential function of any paycheck creator is the ability to store employee information securely. This data is used to calculate pay and deductions, generate pay stubs, and ensure tax compliance. Before using a free paycheck creator, ensure that it offers secure storage for employee details, such as:

- Personal Information: Name, address, and Social Security number.

- Tax Information: W-4 forms, filing status, exemptions, and allowances.

- Employment Details: Job title, hourly rate or salary, and pay frequency.

Having a central place to store employee information helps streamline payroll and ensures that you always have accurate data for generating paychecks and tax filings. However, make sure that this data is protected through strong security measures to avoid breaches.

6. Look for Customization Options

Every business has different payroll needs, and a one-size-fits-all approach doesn’t always work. A free paycheck creator should offer a level of customization that allows you to tailor the tool to your specific needs. Look for the following customization options:

- Pay Period Frequency: Some employees may be paid weekly, while others may be paid bi-weekly or monthly. A good paycheck creator will allow you to choose the correct pay period for each employee.

- Deductions and Benefits: You should be able to set up specific deductions, such as health insurance premiums, retirement contributions, and other voluntary deductions that apply to certain employees.

- Bonuses and Overtime: If your employees receive bonuses or work overtime, you’ll want a tool that can accommodate these payments and calculate them correctly.

Customization features ensure that the free paycheck creator can handle the unique payroll structure of your business, reducing the likelihood of errors and improving overall accuracy.

7. Check for Ease of Use

A free paycheck creator should be easy to use, even for someone without a background in payroll. You don’t want to spend too much time trying to figure out how to use the tool. Look for these user-friendly features:

- Simple Interface: The tool should have an intuitive design with easy navigation so that you can quickly enter employee data and generate pay stubs without confusion.

- Step-by-Step Setup: Look for a paycheck creator that offers a guided setup process to help you input employee information and configure payroll settings.

- Automated Calculations: The tool should automate tax calculations, deductions, and pay stub generation to minimize the amount of manual work you need to do.

A tool that is easy to use will save you time and reduce the risk of mistakes. Look for a free paycheck creator that offers an interface that’s simple yet powerful enough to meet your business’s payroll needs.

8. Assess Customer Support Options

Although free paycheck creators are designed to be easy to use, there may be times when you need help. Customer support can be essential when you encounter a problem or have a question about using the tool. Consider the following:

- Help Resources: Look for a paycheck creator that offers a comprehensive help center or FAQ section to guide you through common issues.

- Email or Live Chat Support: Some free tools may offer email support, while others might have live chat options to assist you in real-time.

- Community Forums: Some paycheck creators offer forums where users can share tips, troubleshoot issues, and discuss best practices.

While free tools often don’t provide the same level of support as paid tools, it’s important to have access to some form of assistance when you need it.

9. Stay Prepared for Growth

As your business grows, your payroll needs will likely become more complex. While a free paycheck creator may work well for a small team or simple payroll structure, you should consider future growth. Here’s why:

- Employee Growth: If your team expands, you may need to process payroll for more employees. Some free tools have limits on the number of employees you can manage.

- Complex Payroll Needs: As your team grows, your payroll may involve more deductions, bonuses, or varying pay schedules. A free paycheck creator may not be able to handle these complexities.

Make sure that the tool you choose can accommodate your business’s future growth or that you have a plan for transitioning to a paid payroll solution if necessary.

Conclusion

Using a free paycheck creator can be an excellent way to streamline payroll processes and ensure that your employees are paid accurately and on time. However, before you start using one, it’s important to understand the tool’s capabilities, limitations, and security features. By assessing your business’s specific payroll needs and ensuring compliance with tax regulations, you can make an informed decision about whether a free paycheck creator is the right fit for your team.

Take the time to find a tool that meets your business’s needs now and in the future, and ensure it’s easy to use and secure. With the right free paycheck creator, you can simplify payroll and focus on growing your business.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease