Managing payroll for your employees is an essential task for every business, whether small or large. One of the best ways to ensure accurate and efficient payroll management is by using a check stub maker. These digital tools allow you to create professional, detailed pay stubs that can help both employers and employees stay organized, keep track of earnings, deductions, taxes, and much more. But how can you use a check stub maker effectively for different types of employees? This blog explores how to leverage this tool for various roles and industries to streamline payroll management.

What Is a Check Stub Maker?

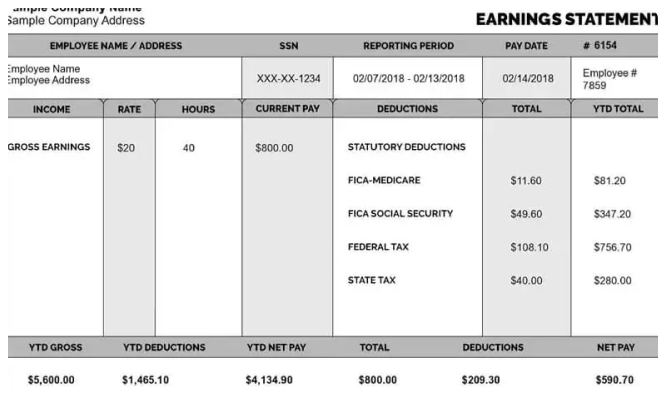

Before we dive into how to use a check stub maker, let’s first define what it is. A check stub maker is a digital tool that enables employers to create pay stubs for their employees. A pay stub (or paycheck stub) is a document that details the employee’s earnings, deductions, and other necessary payroll information for a specific pay period. A check stub maker is typically an online tool that allows you to input various details, such as hours worked, pay rates, taxes, deductions, and other benefits, to generate a professional pay stub.

Benefits of Using a Check Stub Maker

There are numerous advantages to using a check stub maker, especially for businesses of all sizes. These benefits include:

- Accuracy: With automated calculations for taxes, deductions, and overtime, a check stub maker reduces the risk of human error.

- Time-Saving: The process of creating a pay stub becomes quicker and more efficient, saving time for payroll departments.

- Professional Appearance: Check stubs created with a check stub maker look polished and professional, helping improve communication between employers and employees.

- Employee Transparency: Pay stubs allow employees to understand their earnings, deductions, and taxes, which helps build trust.

- Compliance: A well-made pay stub ensures your business complies with labor laws and provides employees with the proper documentation for tax filing or loan applications.

How Different Types of Employees Benefit from a Check Stub Maker

Now, let’s break down how you can use a check stub maker for different types of employees. Each role in your organization may have different needs, so it’s crucial to tailor the use of the check stub maker for those specific needs.

1. Hourly Employees

Hourly employees are paid based on the number of hours they work, making it essential to track their hours accurately. A check stub maker is particularly helpful for managing these workers because:

- Track Overtime: Many hourly employees work overtime, and a check stub maker can automatically calculate overtime pay according to labor laws.

- Accurate Hour Tracking: Employers can enter the exact number of hours worked, ensuring that employees are paid fairly for their time.

- Deductions: Hourly workers may have different tax and benefits deductions than salaried employees. A check stub maker helps break down these figures clearly.

With a check stub maker, you can generate pay stubs for hourly employees that show detailed hours worked, overtime pay, tax deductions, and other contributions like health insurance or retirement.

2. Salaried Employees

Salaried employees receive a fixed amount each pay period, which can make paystub creation a little more straightforward. However, salaried employees still require careful attention to ensure that their pay stubs are accurate. A check stub maker can:

- Ensure Consistent Pay: Even though salaried workers earn the same amount each pay period, it’s important to track any bonuses, commissions, or deductions. A check stub maker can include these figures on the pay stub.

- Track Benefits: Many salaried employees have benefits like healthcare or retirement contributions that need to be clearly shown on their pay stub.

- Track Leave or PTO: If a salaried employee takes time off, a check stub maker can reflect any deductions or adjustments made to their pay for vacation, sick leave, or personal time off (PTO).

Salaried employees benefit from a check stub maker by receiving a clear breakdown of their fixed salary, benefits, and any deductions or bonuses, ensuring transparency and clarity.

3. Freelancers and Contractors

Freelancers and contractors typically receive payments on a per-project or hourly basis rather than a regular salary. The pay stub for freelancers or contractors might look different compared to that of traditional employees, but a check stub maker is still an essential tool:

- Track Payments Per Project or Hour: Freelancers often bill based on hours worked or projects completed. A check stub maker can break down how many hours were worked or how much was earned per project, ensuring accurate payment.

- Manage Deductions: Although freelancers are responsible for their taxes, they may have certain business expenses or deductions that should be reflected on their pay stubs, such as payments toward a business account or health insurance.

- Show Total Earnings for Tax Purposes: Contractors can use pay stubs generated by a check stub maker for their tax filings, keeping accurate records of their earnings and deductions throughout the year.

Using a check stub maker, freelancers and contractors can ensure they have clear documentation of their earnings for tax filing and record-keeping.

4. Retail Workers

Retail workers often deal with varying work hours and tips, making accurate pay stubs even more important. A check stub maker can help retail businesses by:

- Managing Hourly Wages and Tips: Many retail workers earn tips in addition to their hourly wage. A check stub maker can break down both hourly earnings and tip income, showing a comprehensive view of total compensation.

- Track Commissions: If retail employees earn commissions, this can also be included on the pay stub to provide an accurate record of total earnings.

- Overtime Pay: Retail employees, especially during busy seasons, may work overtime. A check stub maker will calculate the additional overtime pay based on hours worked.

Using a check stub maker for retail workers ensures they have clear records of their base pay, tips, commissions, and overtime hours, which can also be useful for payroll auditing.

5. Healthcare Workers

Healthcare workers, such as nurses, doctors, and technicians, often work in complex environments with varying shifts, overtime, and bonuses. A check stub maker can help healthcare employers and employees by:

- Track Shifts: Healthcare workers often work in shifts that differ in length and timing. A check stub maker can help track these varying hours accurately.

- Show Bonuses and Allowances: Healthcare workers may receive bonuses for night shifts, holiday work, or other allowances. These can be clearly listed on their pay stubs.

- Include Deductions for Benefits: Healthcare workers frequently have health insurance, retirement contributions, and other benefits that should be included in the pay stub.

A check stub maker is an essential tool for healthcare employers, helping ensure that shift hours, bonuses, and deductions are all accurately reflected.

6. Hospitality Workers

The hospitality industry involves many part-time and hourly workers, as well as workers who rely on tips (like servers and bartenders). A check stub maker can be invaluable for hospitality employers because it:

- Calculates Tips: Many hospitality workers rely heavily on tips, and a check stub maker can itemize tip earnings alongside hourly wages.

- Track Overtime and Bonuses: Hospitality workers often work irregular hours and may be eligible for overtime or seasonal bonuses. These can be tracked easily with a check stub maker.

- Track Multiple Jobs: Many hospitality workers hold more than one job within a restaurant or hotel, and a check stub maker can be used to manage pay across different roles.

Hospitality businesses benefit from a check stub maker by providing workers with clear, detailed breakdowns of their wages and tips, helping to maintain transparency.

Conclusion: Why You Should Use a Check Stub Maker

No matter what type of employees you have, a check stub maker can help streamline payroll processes and ensure both employers and employees have accurate, easy-to-understand records. By using a check stub maker, businesses can avoid errors in pay, maintain clear records of hours worked, deductions, and benefits, and stay compliant with labor laws.

Whether you’re managing hourly workers, salaried employees, contractors, retail staff, healthcare professionals, or hospitality workers, a check stub maker is a must-have tool for ensuring that your payroll is efficient and accurate. For businesses in the USA, ensuring that employees have transparent, easy-to-read pay stubs is an essential part of maintaining a positive workplace environment and avoiding payroll disputes.

Start using a check stubs maker today to simplify payroll, improve accuracy, and keep your employees happy and informed.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown