A payroll stub template is a crucial document for businesses, employees, and freelancers. It provides a clear breakdown of earnings, deductions, and net pay, ensuring transparency in financial transactions. Whether you are an employer looking to streamline payroll processing or an employee wanting to verify your earnings, understanding what information a payroll stub template should include is essential.

In this guide, we will discuss the key components of a payroll stub template, why each element matters, and how using a well-structured template can benefit businesses and employees alike.

Why a Payroll Stub Template is Important

1. Ensures Payroll Accuracy

A well-structured payroll stub template reduces errors in salary calculations, deductions, and tax withholdings. Employers can avoid costly mistakes, and employees can verify their earnings.

2. Legal Compliance

Many states require employers to provide pay stubs with specific details. Using a payroll stub template helps businesses meet these legal requirements and avoid penalties.

3. Financial Transparency

Employees can see a detailed breakdown of their earnings, taxes, and deductions. This prevents misunderstandings and builds trust between employers and employees.

4. Simplifies Record-Keeping

Employers and employees can maintain organized payroll records for tax filing, audits, and financial planning.

Key Information a Payroll Stub Template Should Include

A payroll stub template should have the following essential sections:

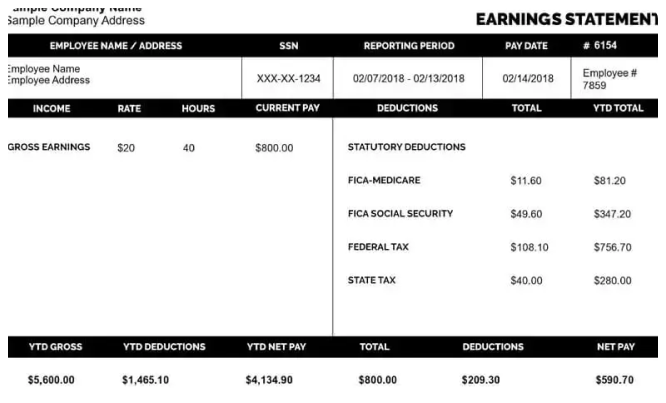

1. Employer Information

The employer’s details should be included for clarity and compliance purposes:

- Business Name

- Business Address

- Contact Details

- Employer Identification Number (EIN)

2. Employee Information

Every pay stub should clearly identify the employee:

- Full Name

- Employee ID (if applicable)

- Home Address

- Job Title

- Social Security Number (last 4 digits for security)

3. Pay Period & Payment Date

The pay stub should indicate the exact timeframe for which the wages are being paid:

- Start and End Date of the Pay Period

- Date of Payment

4. Gross Earnings

This section outlines the employee’s total earnings before any deductions:

- Regular Wages (Hourly or Salary-Based)

- Overtime Pay (if applicable)

- Bonuses or Commissions

- Holiday Pay

5. Deductions

A pay stub must include all deductions taken from the gross earnings:

a. Taxes Withheld

- Federal Income Tax

- State Income Tax

- Local Taxes (if applicable)

- Social Security Tax (FICA)

- Medicare Tax (FICA)

b. Voluntary Deductions

- Health Insurance Premiums

- Retirement Contributions (401k, IRA)

- Union Dues

- Life Insurance

6. Net Pay (Take-Home Pay)

After all deductions, the final amount paid to the employee is listed:

- Net Pay (Gross Earnings – Total Deductions)

- Payment Method (Direct Deposit, Check, or Cash)

7. Additional Notes (if necessary)

- Reimbursements (Travel, Office Supplies, etc.)

- Paid Time Off (PTO) or Sick Leave Details

- Year-to-Date (YTD) Earnings and Deductions

How to Use a Payroll Stub Template Effectively

Step 1: Choose a Payroll Stub Template

Many free and paid payroll stub templates are available online in formats like Excel, Word, and PDF. Choose a template that fits your business needs.

Step 2: Fill in Employer & Employee Information

Enter all relevant details accurately to ensure clarity and compliance.

Step 3: Input Earnings & Deductions

Calculate total gross earnings and subtract the necessary deductions.

Step 4: Review for Accuracy

Ensure all numbers are correct before finalizing the pay stub.

Step 5: Distribute the Pay Stub

Provide employees with their pay stubs via email, paper copies, or online payroll systems.

Free vs. Paid Payroll Stub Templates

| Feature | Free Payroll Stub Template | Paid Payroll Stub Template |

|---|---|---|

| Cost | Free | Subscription or One-Time Fee |

| Customization | Limited | Extensive |

| Automatic Calculations | No | Yes |

| Professional Appearance | Basic | Advanced |

| Best For | Small businesses, freelancers | Large businesses with complex payroll needs |

Conclusion

A payroll stub template is essential for businesses to ensure accurate payroll processing, legal compliance, and financial transparency. By including all necessary details such as employer information, employee details, earnings, deductions, and net pay, businesses can create professional and reliable pay stubs.

Whether you run a small business or work as a freelancer, using a well-structured payroll stub template will help you maintain organized financial records and avoid payroll disputes. Choose a template that best fits your needs and ensure accuracy before distributing pay stubs to employees.

By adopting a payroll stub template, businesses and employees can benefit from a clear, efficient, and legally compliant payroll process.