Why a Free Paystub Maker is Essential for Freelancers

In today’s evolving job market, more and more people are turning to freelancing and gig work as a way to earn money. Whether you’re a freelance writer, an Uber driver, a delivery person for DoorDash, or a web developer, one thing remains true: you need to manage your finances carefully. And one of the most…

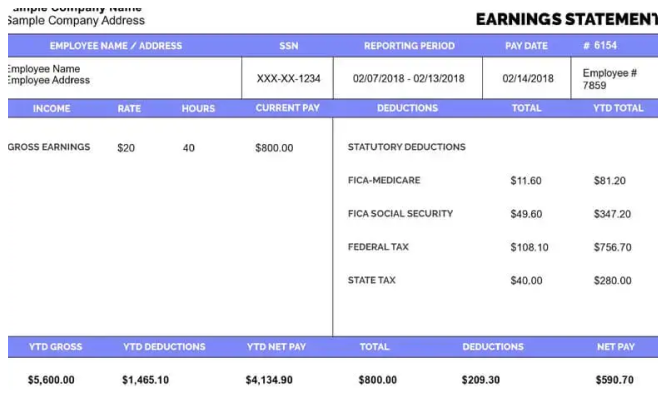

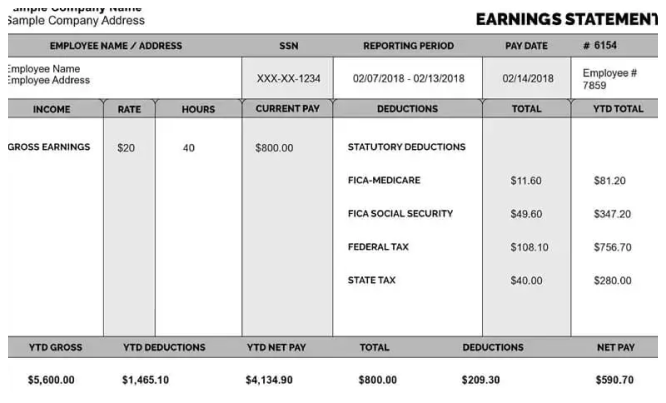

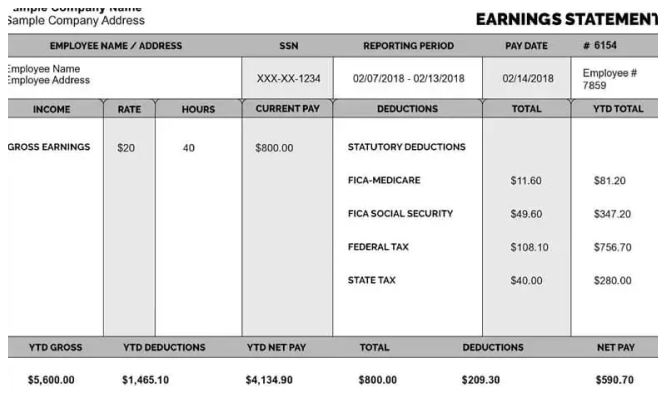

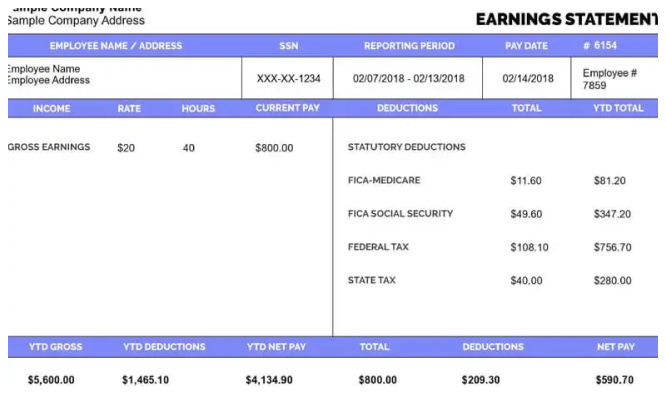

What You Need to Know Before Using a Free Paycheck Creator

As a small business owner, freelancer, or employer managing a team, payroll is one of the most crucial tasks you’ll face. Ensuring your employees are paid accurately and on time is vital for maintaining trust and keeping your business compliant with tax laws. However, payroll can be time-consuming and confusing, especially for those new to…

Are Check Stub Makers Secure? What You Need to Know

In today’s digital world, managing your finances efficiently is more important than ever. Whether you are an employee looking to keep track of your pay or a business owner needing to provide pay stubs for your employees, check stub makers can be a convenient tool to help with this task. These online tools can generate…

Streamline Your Payroll Process with Right Paystub Creator

Managing payroll can be a daunting task for small businesses, freelancers, or even large companies. Keeping track of employee wages, deductions, taxes, and overtime requires accuracy and attention to detail. Errors can lead to unhappy employees, legal issues, or tax penalties. That’s why using a paystub creator can make a significant difference. In this blog,…

Best Practices for Using a Paystub Generator in the Healthca

Accurate and efficient payroll management is essential in the fast-paced and highly regulated healthcare industry. Healthcare organizations, from hospitals to private practices, rely on streamlined payroll processes to ensure timely and precise employee payments. One tool that has emerged as a game-changer in this context is the paystub generator. With its ability to create detailed,…

How a Paystub Generator Can Help Retail Employees Track Tips

For retail employees, especially those working in the service industry like restaurants, bars, or hospitality, tips are a significant portion of their earnings. These tips can come from customers, and they play a huge role in the employee’s overall paycheck. However, it’s essential to accurately track and manage these tips to ensure proper deductions and…